Clear Data

Help

General information

Self-assessment

ou are a participating employer of a pension plan that makes

•

a deemed supply of the goods, services or intangible personal

You have to self-assess the provincial part of the HST in the

property to a pension entity and collects an amount of the

following circumstances:

provincial part of the HST under paragraphs 172.1(5)(c) and

Goods are acquired in a non-participating province or territory

•

172.1(6)(c) of the Excise Tax Act, that is greater than zero;

inside Canada, and brought into a participating province

the goods, services, or intangible personal property are zero-rated

•

(see definition on page 4).

or exempt from GST/HST (no GST/HST applies);

Goods are acquired in a participating province with a lower HST

•

temporary importations, such as conveyances and baggage, are

•

rate and brought into another participating province with a

brought into a participating province by a non-resident person;

higher HST rate.

property belongs to a returning resident where the property was

•

Commercial goods (goods that are for sale or for any other

•

owned and possessed by that resident for 31 days or more;

commercial, industrial, occupational, institutional, or other like

personal and household effects are of a deceased person who

•

use) are imported into a participating province from outside

was a resident of a participating province;

Canada.

a prize or trophy was won abroad or in another province (except

•

Goods are delivered or made available to you in a participating

•

merchantable goods);

province, or sent by mail or courier to you at an address in a

tourist literature is supplied free of charge to a board of trade,

•

participating province, from a non-registered non-resident of

chamber of commerce, municipal or automobile association,

Canada.

or to a similar organization that resupplies it free of charge to

Services and intangible personal property (for example,

•

the public;

intellectual property) were supplied to you in a non-participating

replacement property or a part under warranty is supplied free

•

province, or in a participating province with a lower HST rate,

of charge;

you are a resident of a participating province, and they are used,

it is the exclusive product of direct sellers, where the alternate

consumed, or supplied by you significantly (more than 10%) in

•

participating provinces with a higher HST rate. You will also

collection method for direct-selling organizations is being used;

need to multiply the service or intangible personal property by

property is brought into a participating province at a particular

•

the extent to which the service or property is used in each

time after it was previously acquired and removed from a

participating province. See "Tax calculation" on page 3.

participating province where, if applicable, self-assessment

has occurred at a rate higher than the rate in the destination

Motor vehicles imported from outside Canada or brought into a

•

participating province, and in any event, no rebate has been

participating province from another province where you are the

claimed for the HST already paid;

person importing or bringing the vehicle into the participating

property is donated to a charity or a public institution; or

•

province and you are not required to register the vehicle in the

participating province under the laws of that province relating to

it is a transportation or telecommunication service.

•

the registration of motor vehicles.

Note

Special rules for motor vehicles

If you import services or intangible personal property from outside

For a motor vehicle imported or brought into a participating province,

Canada for consumption, use, or supply in Canada, you should

use this form (GST489) if you are not required to register the vehicle

use Form GST59, GST/HST Return for Imported Taxable

in the province (for example, the vehicle is a gift and someone else

Supplies, to self-assess any applicable GST/HST.

will register it, or the vehicle is not required to be registered in the

province). In any other case, do not use this form to report the tax

Exceptions

because it will be collected by the provincial licensing authority when

Some of the exceptions from self-assessment of the HST are

the vehicle is registered with the province.

listed below. Generally no self-assessment is required if:

HST was already paid on the goods, services or intangible

•

personal property at the same or higher rate in the province of

acquisition as in the destination participating province;

you are a selected listed financial institution and the amount of

•

tax that would be payable is not a prescribed amount of tax;

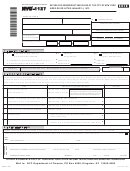

Detach and return lower part (Part 2)

Page 2

Identification

You have to complete this section.

To file this return, mail Part 2 to the following address:

Legal name

Canada Revenue Agency

Tax Centre

Po Box 12071 Station A

Trading name (if different from above)

St. John's NL A1B 3Z1

You cannot file this return at your financial institution. Write your

Mailing address (Unit No – Street No Street name, PO Box, RR)

Business Number, if you have one, on your cheque, and make it

payable to the Receiver General. Make your payment in Canadian

funds. You do not have to pay an amount of $2 or less.

City

Do not staple, clip, tape, or fold voucher, cheque, or money order.

Do not mail cash.

Province or territory

Postal code

Contact name

Telephone number

1

1 2

2 3

3 4

4