Clear Data

Help

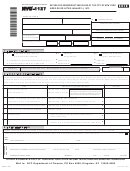

Transitional HST rules for prepayments on taxable

Completing Part 2

supplies made in, or brought into, Prince Edward Island

Enter your Business Number (if applicable), the reporting period,

and information from lines 501, 505, and 515 in Part 1 into

In most cases, if you are a GST/HST registrant and meet the

the corresponding boxes in Part 2 (at the bottom of page 1).

following conditions, you should file your regular GST/HST return for

registrants to self-assess the provincial part of the HST. However, if

Make sure to sign Part 2 and complete the identification area

your regular GST/HST return for the reporting period that includes

at the bottom of page 2.

April 1, 2013, is due after July 31, 2013, and you meet the following

If you pay by cheque, write your Business Number, if applicable,

conditions, you must use Form GST489. You must report and pay

on your cheque, and make it payable to the Receiver General.

the tax no later than July 31, 2013.

Make your payment in Canadian funds. You do not have to make

Example:

Yearly (2013)

a payment if the tax payable is $2 or less. We will charge a late

fee for any dishonoured payment.

Tax becomes payable:

April 1

Reporting period:

January 1 – December 31

Definition

Due date:

July 31, 2013

Participating province – means a province that has harmonized

its provincial sales tax with the GST to implement the harmonized

If you are not registered for the GST/HST, and you meet the

sales tax (HST). Participating provinces include New Brunswick,

following conditions, file this return and pay the provincial part of

Newfoundland and Labrador, Nova Scotia, Ontario, and Prince

the HST by July 31, 2013.

Edward Island, but do not include the Nova Scotia offshore area

Conditions to be met

or the Newfoundland offshore area except to the extent that offshore

A payment that becomes due or was made without becoming

•

activities, as defined in subsection 123(1) of the Excise Tax Act are

due after November 8, 2012, and before February 1, 2013, for

carried on in that area.

the following taxable supplies made in Prince Edward Island:

Note

–

British Columbia was a participating province from July 1, 2010

a supply of goods by way of sale to the extent that the goods

until March 31, 2013.

were delivered, and ownership is transferred, to you on or

after April 1, 2013;

Where do I send this return?

–

a supply of property by way of lease, licence, or similar

You cannot file this return at your financial institution. Mail Part 2

arrangement to the extent that the consideration is attributable

of this return with your payment to the following address:

to that part of a lease or licence interval that occurs on or after

April 1, 2013 (unless the lease interval begins before

Canada Revenue Agency

April 2013 and ends before May 2013);

Tax Centre

–

a supply of a service, to the extent that the consideration

Po Box 12071 Station A

St. John's NL A1B 3Z1

relates to the part of the service that is performed on or after

April 1, 2013 (unless 90% or more of the service is performed

For more information

before April 2013);

For more information, go to or call

–

a supply of membership in a club, organization, or association

1-800-959-5525.

to the extent that the consideration is attributable to the part

Note

of the membership period that occurs on or after April 1, 2013

If the physical location of your business is in Quebec, you have

(unless 90% of the membership period occurs before

to file your returns with Revenu Québec using its forms, unless

April 2013);

you are a selected listed financial institution. For more information,

–

a supply of an admission to an event or activity to the extent

see the Revenu Québec publication IN–203–V, General

that the consideration is for the part of the event or activity

Information Concerning the QST and the GST/HST, available

that occurs on or after April 1, 2013 (unless 90% or more of

at , or call 1-800-567-4692.

the event or activity occurs before April 2013); or

–

a supply of a passenger transportation pass to the extent that

the consideration is for part of the pass period that occurs on

or after April 1, 2013 (unless the pass period begins before

April 2013 and ends before May 2013).

You are not a consumer and one of the following applies to you:

•

–

you acquire these supplies for consumption, use, or supply

otherwise than exclusively in the course of your commercial

activities (for example, you are a business making GST/HST

exempt supplies, but in circumstances where the service

would be subject to an input tax credit limitation);

–

you have to recapture input tax credits for the provincial part

of the HST on any of these supplies;

–

you use simplified procedures for calculating your net tax

(such as the quick method, the special quick method, or the

special net tax calculation for certain charities); or

–

you are a registrant that is a selected listed financial institution.

For more information, see GST/HST Notice 278, Harmonized Sales

Tax for Prince Edward Island – Questions and Answers on General

Transitional Rules for Personal Property and Services.

Page 4

1

1 2

2 3

3 4

4