F

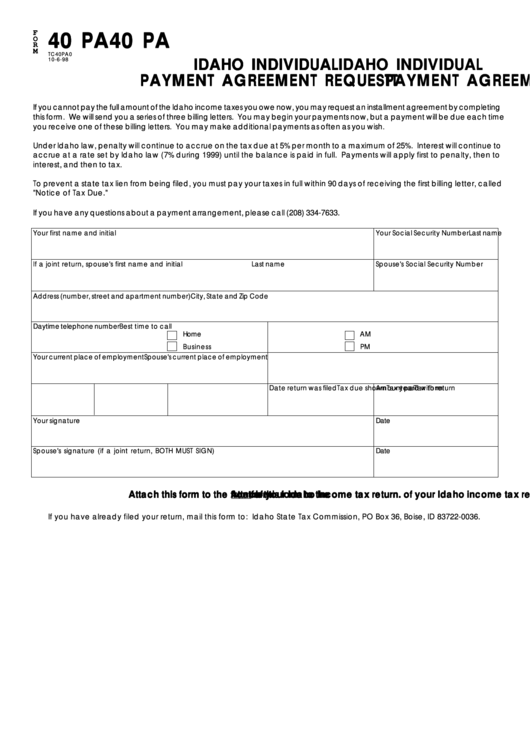

40 PA

40 PA

40 PA

40 PA

40 PA

O

R

M

TC40PA0

10-6-98

IDAHO INDIVIDUAL

IDAHO INDIVIDUAL

IDAHO INDIVIDUAL

IDAHO INDIVIDUAL

IDAHO INDIVIDUAL

PAYMENT AGREEMENT REQUES

PAYMENT AGREEMENT REQUEST T T T T

PAYMENT AGREEMENT REQUES

PAYMENT AGREEMENT REQUES

PAYMENT AGREEMENT REQUES

If you cannot pay the full amount of the Idaho income taxes you owe now, you may request an installment agreement by completing

this form. We will send you a series of three billing letters. You may begin your payments now, but a payment will be due each time

you receive one of these billing letters. You may make additional payments as often as you wish.

Under Idaho law, penalty will continue to accrue on the tax due at 5% per month to a maximum of 25%. Interest will continue to

accrue at a rate set by Idaho law (7% during 1999) until the balance is paid in full. Payments will apply first to penalty, then to

interest, and then to tax.

To prevent a state tax lien from being filed, you must pay your taxes in full within 90 days of receiving the first billing letter, called

"Notice of Tax Due."

If you have any questions about a payment arrangement, please call (208) 334-7633.

Your first name and initial

Last name

Your Social Security Number

If a joint return, spouse's first name and initial

Last name

Spouse's Social Security Number

Address (number, street and apartment number)

City, State and Zip Code

Daytime telephone number

Best time to call

Home

AM

Business

PM

Your current place of employment

Spouse's current place of employment

Tax form

Tax year

Tax due shown

Date return was filed

Amount paid with return

Your signature

Date

Spouse's signature (if a joint return, BOTH MUST SIGN)

Date

Attach this form to the

Attach this form to the

front

front

of your Idaho income tax return.

of your Idaho income tax return.

Attach this form to the

Attach this form to the

Attach this form to the front

front

front of your Idaho income tax return.

of your Idaho income tax return.

of your Idaho income tax return.

If you have already filed your return, mail this form to: Idaho State Tax Commission, PO Box 36, Boise, ID 83722-0036.

1

1