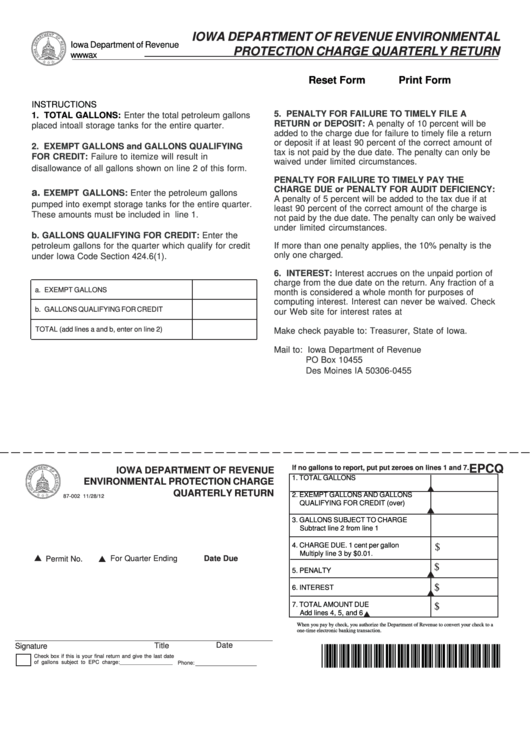

IOWA DEPARTMENT OF REVENUE ENVIRONMENTAL

Iowa Department of Revenue

PROTECTION CHARGE QUARTERLY RETURN

Reset Form

Print Form

INSTRUCTIONS

5. PENALTY FOR FAILURE TO TIMELY FILE A

Enter the total petroleum gallons

1. TOTAL GALLONS:

RETURN or DEPOSIT: A penalty of 10 percent will be

placed intoall storage tanks for the entire quarter.

added to the charge due for failure to timely file a return

or deposit if at least 90 percent of the correct amount of

2. EXEMPT GALLONS and GALLONS QUALIFYING

tax is not paid by the due date. The penalty can only be

FOR CREDIT: Failure to itemize will result in

waived under limited circumstances.

disallowance of all gallons shown on line 2 of this form.

PENALTY FOR FAILURE TO TIMELY PAY THE

CHARGE DUE or PENALTY FOR AUDIT DEFICIENCY:

a.

EXEMPT GALLONS: Enter the petroleum gallons

A penalty of 5 percent will be added to the tax due if at

pumped into exempt storage tanks for the entire quarter.

least 90 percent of the correct amount of the charge is

These amounts must be included in line 1.

not paid by the due date. The penalty can only be waived

under limited circumstances.

b. GALLONS QUALIFYING FOR CREDIT: Enter the

petroleum gallons for the quarter which qualify for credit

If more than one penalty applies, the 10% penalty is the

only one charged.

under Iowa Code Section 424.6(1).

6. INTEREST: Interest accrues on the unpaid portion of

charge from the due date on the return. Any fraction of a

a. EXEMPT GALLONS

month is considered a whole month for purposes of

computing interest. Interest can never be waived. Check

b. GALLONS QUALIFYING FOR CREDIT

our Web site for interest rates at .

TOTAL (add lines a and b, enter on line 2)

Make check payable to: Treasurer, State of Iowa.

Mail to: Iowa Department of Revenue

PO Box 10455

Des Moines IA 50306-0455

EPCQ

If no gallons to report, put put zeroes on lines 1 and 7.

IOWA DEPARTMENT OF REVENUE

1. TOTAL GALLONS

ENVIRONMENTAL PROTECTION CHARGE

L

QUARTERLY RETURN

2. EXEMPT GALLONS AND GALLONS

87-002 11/28/12

QUALIFYING FOR CREDIT (over)

L

3. GALLONS SUBJECT TO CHARGE

Subtract line 2 from line 1

4. CHARGE DUE. 1 cent per gallon

$

Multiply line 3 by $0.01.

L

Date Due

Permit No.

For Quarter Ending

L

$

5. PENALTY

L

$

6. INTEREST

L

7. TOTAL AMOUNT DUE

$

Add lines 4, 5, and 6

L

When you pay by check, you authorize the Department of Revenue to convert your check to a

one-time electronic banking transaction.

Date

Title

Signature

*1287002019999*

Check box if this is your final return and give the last date

______________

of gallons subject to EPC charge:__________________

Phone:

1

1