Form 1205-0371 - Employer Certification Work Opportunity Tax Credit

ADVERTISEMENT

U.S. Department Labor

OMB No. 1205-0371

Employment and Training Administration

Expiration Date: June 30, 2015

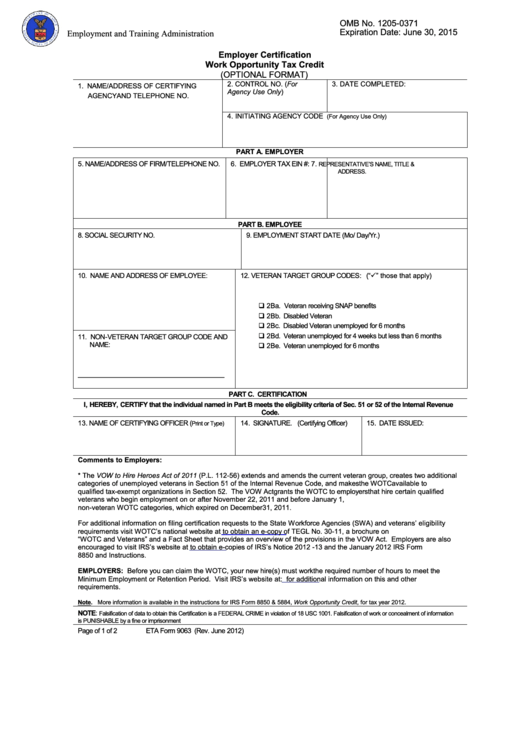

Employer Certification

Work Opportunity Tax Credit

(OPTIONAL FORMAT)

2. CONTROL NO. (For

3. DATE COMPLETED:

1. NAME/ADDRESS OF CERTIFYING

Agency Use Only)

AGENCY AND TELEPHONE NO.

4. INITIATING AGENCY CODE

(For Agency Use Only)

PART A. EMPLOYER

5. NAME/ADDRESS OF FIRM/TELEPHONE NO.

6. EMPLOYER TAX EIN #:

7.

REPRESENTATIVE’S NAME, TITLE &

ADDRESS.

PART B. EMPLOYEE

8. SOCIAL SECURITY NO.

9. EMPLOYMENT START DATE (Mo/ Day/Yr.)

10. NAME AND ADDRESS OF EMPLOYEE:

12. VETERAN TARGET GROUP CODES: (“” those that apply)

2Ba. Veteran receiving SNAP benefits

2Bb. Disabled Veteran

2Bc. Disabled Veteran unemployed for 6 months

2Bd. Veteran unemployed for 4 weeks but less than 6 months

11. NON-VETERAN TARGET GROUP CODE AND

NAME:

2Be. Veteran unemployed for 6 months

________________________________________

PART C. CERTIFICATION

I, HEREBY, CERTIFY that the individual named in Part B meets the eligibility criteria of Sec. 51 or 52 of the Internal Revenue

Code.

13. NAME OF CERTIFYING OFFICER (

14. SIGNATURE. (Certifying Officer)

15. DATE ISSUED:

Print or Type)

Comments to Employers:

* The VOW to Hire Heroes Act of 2011 (P.L. 112-56) extends and amends the current veteran group, creates two additional

categories of unemployed veterans in Section 51 of the Internal Revenue Code, and makes the WOTC available to

qualified tax-exempt organizations in Section 52. The VOW Act grants the WOTC to employers that hire certain qualified

veterans who begin employment on or after November 22, 2011 and before January 1, 2013. This Act did not extend the

non-veteran WOTC categories, which expired on December 31, 2011.

For additional information on filing certification requests to the State Workforce Agencies (SWA) and veterans’ eligibility

requirements visit WOTC’s national website at

to obtain an e-copy of TEGL No. 30-11, a brochure on

“WOTC and Veterans” and a Fact Sheet that provides an overview of the provisions in the VOW Act. Employers are also

encouraged to visit IRS’s website at

to obtain e-copies of IRS’s Notice 2012 -13 and the January 2012 IRS Form

8850 and Instructions.

EMPLOYERS: Before you can claim the WOTC, your new hire(s) must work the required number of hours to meet the

Minimum Employment or Retention Period. Visit IRS’s website at:

for additional information on this and other

requirements.

Note. More information is available in the instructions for IRS Form 8850 & 5884, Work Opportunity Credit, for tax year 2012.

NOTE:

Falsification of data to obtain this Certification is a FEDERAL CRIME in violation of 18 USC 1001. Falsification of work or concealment of information

is PUNISHABLE by a fine or imprisonment

Page of 1 of 2

ETA Form 9063 (Rev. June 2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1