Hiring Incentives For Employers Worksheet - Work Opportunity Tax Credit (Wot)

ADVERTISEMENT

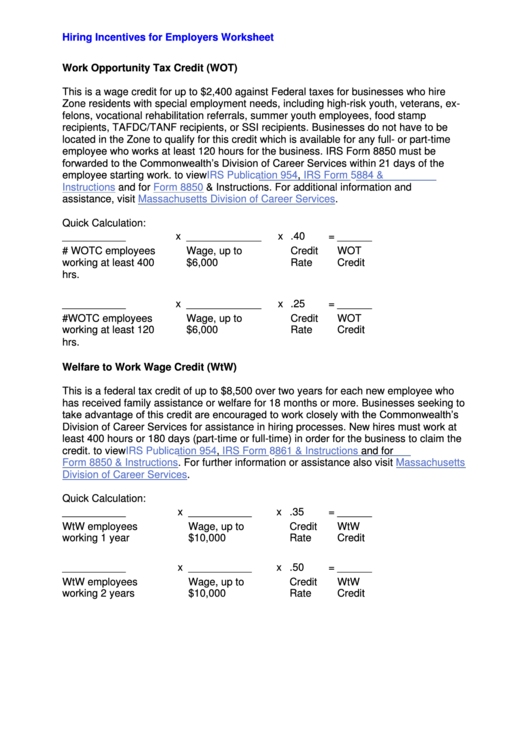

Hiring Incentives for Employers Worksheet

Work Opportunity Tax Credit (WOT)

This is a wage credit for up to $2,400 against Federal taxes for businesses who hire

Zone residents with special employment needs, including high-risk youth, veterans, ex-

felons, vocational rehabilitation referrals, summer youth employees, food stamp

recipients, TAFDC/TANF recipients, or SSI recipients. Businesses do not have to be

located in the Zone to qualify for this credit which is available for any full- or part-time

employee who works at least 120 hours for the business. IRS Form 8850 must be

forwarded to the Commonwealth’s Division of Career Services within 21 days of the

employee starting work. Click here to view

IRS Publication

954,

IRS Form 5884 &

Instructions

and for

Form 8850

& Instructions. For additional information and

assistance, visit

Massachusetts Division of Career

Services.

Quick Calculation:

___________

x _____________

x .40

= ______

# WOTC employees

Wage, up to

Credit

WOT

working at least 400

$6,000

Rate

Credit

hrs.

___________

x _____________

x .25

= ______

#WOTC employees

Wage, up to

Credit

WOT

working at least 120

$6,000

Rate

Credit

hrs.

Welfare to Work Wage Credit (WtW)

This is a federal tax credit of up to $8,500 over two years for each new employee who

has received family assistance or welfare for 18 months or more. Businesses seeking to

take advantage of this credit are encouraged to work closely with the Commonwealth’s

Division of Career Services for assistance in hiring processes. New hires must work at

least 400 hours or 180 days (part-time or full-time) in order for the business to claim the

credit. Click here to view

IRS Publication

954,

IRS Form 8861 & Instructions

and for

Form 8850 &

Instructions. For further information or assistance also visit

Massachusetts

Division of Career

Services.

Quick Calculation:

___________

x ___________

x .35

= ______

WtW employees

Wage, up to

Credit

WtW

working 1 year

$10,000

Rate

Credit

___________

x ___________

x .50

= ______

WtW employees

Wage, up to

Credit

WtW

working 2 years

$10,000

Rate

Credit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2