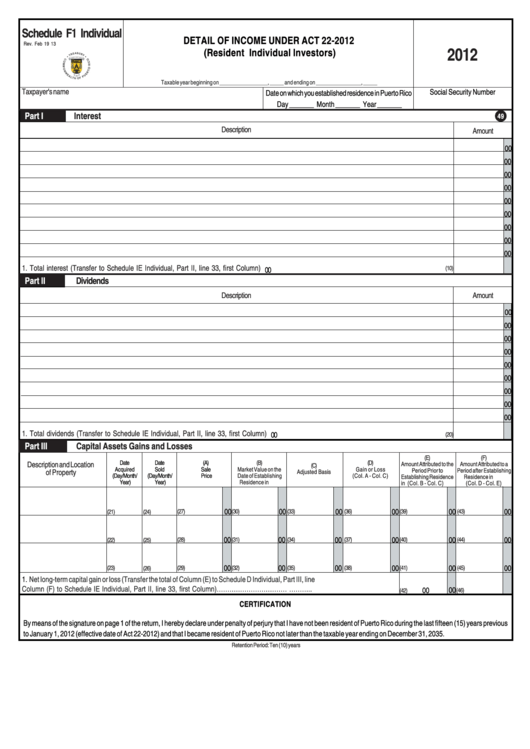

Schedule F1 Individual - Detail Of Income Under Act 22-2012

ADVERTISEMENT

Schedule F1 Individual

DETAIL OF INCOME UNDER ACT 22-2012

Rev. Feb 19 13

2012

(Resident Individual Investors)

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Date on which you established residence in Puerto Rico

Day _______ Month _______ Year _______

Part I

Interest

49

Description

Amount

00

00

00

00

00

00

00

00

00

1. Total interest (Transfer to Schedule IE Individual, Part II, line 33, first Column) .................................................................................................

(10)

00

Part II

Dividends

Amount

Description

00

00

00

00

00

00

00

00

00

1. Total dividends (Transfer to Schedule IE Individual, Part II, line 33, first Column) ..............................................................................................

00

(20)

Part III

Capital Assets Gains and Losses

(E)

(F)

Date

Date

(A)

(B)

(D)

Description and Location

Amount Attributed to the

Amount Attributed to a

(C)

Acquired

Sold

Sale

Market Value on the

Gain or Loss

Period Prior to

Period after Establishing

of Property

Adjusted Basis

(Day/Month/

(Day/Month/

Price

Date of Establishing

(Col. A - Col. C)

Establishing Residence

Residence in P.R.

Year)

Year)

Residence in P.R.

in P.R. (Col. B - Col. C)

(Col. D - Col. E)

00

00

00

00

00

00

(33)

(36)

(21)

(24)

(27)

(30)

(39)

(43)

00

00

00

00

00

00

(28)

(31)

(34)

(37)

(40)

(44)

(22)

(25)

00

00

00

00

00

00

(23)

(29)

(32)

(35)

(38)

(41)

(45)

(26)

1.

Net long-term capital gain or loss (Transfer the total of Column (E) to Schedule D Individual, Part III, line 22.Transfer the total of

Column (F) to Schedule IE Individual, Part II, line 33, first Column)…………………………….........................................………..

00

00

(42)

(46)

CERTIFICATION

By means of the signature on page 1 of the return, I hereby declare under penalty of perjury that I have not been resident of Puerto Rico during the last fifteen (15) years previous

to January 1, 2012 (effective date of Act 22-2012) and that I became resident of Puerto Rico not later than the taxable year ending on December 31, 2035.

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1