Instructions For Form Ut-1a - Aircraft Certification Request - Minnesota Department Of Transportation

ADVERTISEMENT

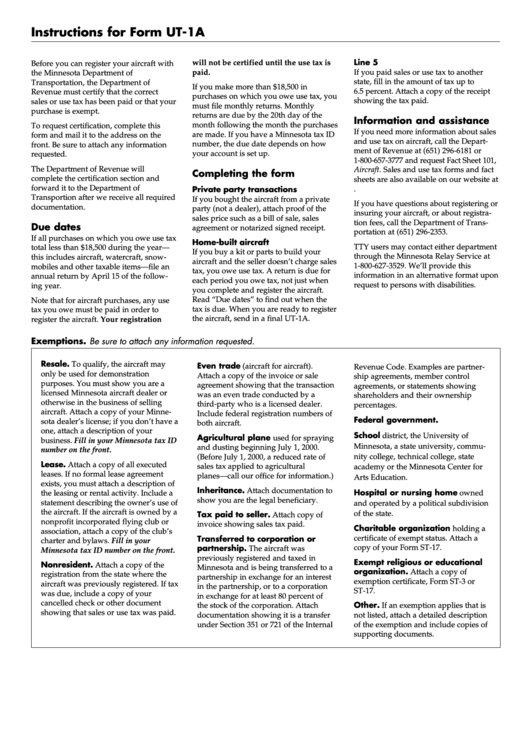

Instructions for Form UT-1A

Line 5

will not be certified until the use tax is

Before you can register your aircraft with

paid.

If you paid sales or use tax to another

the Minnesota Department of

state, fill in the amount of tax up to

Transportation, the Department of

If you make more than $18,500 in

6.5 percent. Attach a copy of the receipt

Revenue must certify that the correct

purchases on which you owe use tax, you

showing the tax paid.

sales or use tax has been paid or that your

must file monthly returns. Monthly

purchase is exempt.

returns are due by the 20th day of the

Information and assistance

month following the month the purchases

To request certification, complete this

If you need more information about sales

are made. If you have a Minnesota tax ID

form and mail it to the address on the

and use tax on aircraft, call the Depart-

number, the due date depends on how

front. Be sure to attach any information

ment of Revenue at (651) 296-6181 or

your account is set up.

requested.

1-800-657-3777 and request Fact Sheet 101,

The Department of Revenue will

Aircraft. Sales and use tax forms and fact

Completing the form

complete the certification section and

sheets are also available on our website at

forward it to the Department of

Private party transactions

Transportion after we receive all required

If you bought the aircraft from a private

If you have questions about registering or

documentation.

party (not a dealer), attach proof of the

insuring your aircraft, or about registra-

sales price such as a bill of sale, sales

tion fees, call the Department of Trans-

Due dates

agreement or notarized signed receipt.

portation at (651) 296-2353.

If all purchases on which you owe use tax

Home-built aircraft

TTY users may contact either department

total less than $18,500 during the year—

If you buy a kit or parts to build your

through the Minnesota Relay Service at

this includes aircraft, watercraft, snow-

aircraft and the seller doesn’t charge sales

1-800-627-3529. We’ll provide this

mobiles and other taxable items—file an

tax, you owe use tax. A return is due for

information in an alternative format upon

annual return by April 15 of the follow-

each period you owe tax, not just when

request to persons with disabilities.

ing year.

you complete and register the aircraft.

Read “Due dates” to find out when the

Note that for aircraft purchases, any use

tax is due. When you are ready to register

tax you owe must be paid in order to

the aircraft, send in a final UT-1A.

register the aircraft. Your registration

Exemptions. Be sure to attach any information requested.

Resale. To qualify, the aircraft may

Even trade (aircraft for aircraft).

Revenue Code. Examples are partner-

only be used for demonstration

Attach a copy of the invoice or sale

ship agreements, member control

purposes. You must show you are a

agreement showing that the transaction

agreements, or statements showing

licensed Minnesota aircraft dealer or

was an even trade conducted by a

shareholders and their ownership

otherwise in the business of selling

third-party who is a licensed dealer.

percentages.

aircraft. Attach a copy of your Minne-

Include federal registration numbers of

Federal government.

sota dealer’s license; if you don’t have a

both aircraft.

one, attach a description of your

School district, the University of

Agricultural plane used for spraying

business. Fill in your Minnesota tax ID

Minnesota, a state university, commu-

and dusting beginning July 1, 2000.

number on the front.

nity college, technical college, state

(Before July 1, 2000, a reduced rate of

Lease. Attach a copy of all executed

sales tax applied to agricultural

academy or the Minnesota Center for

leases. If no formal lease agreement

planes—call our office for information.)

Arts Education.

exists, you must attach a description of

Inheritance. Attach documentation to

Hospital or nursing home owned

the leasing or rental activity. Include a

show you are the legal beneficiary.

statement describing the owner’s use of

and operated by a political subdivision

the aircraft. If the aircraft is owned by a

Tax paid to seller. Attach copy of

of the state.

nonprofit incorporated flying club or

invoice showing sales tax paid.

Charitable organization holding a

association, attach a copy of the club’s

certificate of exempt status. Attach a

Transferred to corporation or

charter and bylaws. Fill in your

partnership. The aircraft was

copy of your Form ST-17.

Minnesota tax ID number on the front.

previously registered and taxed in

Exempt religious or educational

Nonresident. Attach a copy of the

Minnesota and is being transferred to a

organization. Attach a copy of

registration from the state where the

partnership in exchange for an interest

exemption certificate, Form ST-3 or

aircraft was previously registered. If tax

in the partnership, or to a corporation

ST-17.

was due, include a copy of your

in exchange for at least 80 percent of

cancelled check or other document

Other. If an exemption applies that is

the stock of the corporation. Attach

showing that sales or use tax was paid.

documentation showing it is a transfer

not listed, attach a detailed description

under Section 351 or 721 of the Internal

of the exemption and include copies of

supporting documents.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1