Instructions For Form Ct-3m/4m - New York State Department Of Taxation And Finance

ADVERTISEMENT

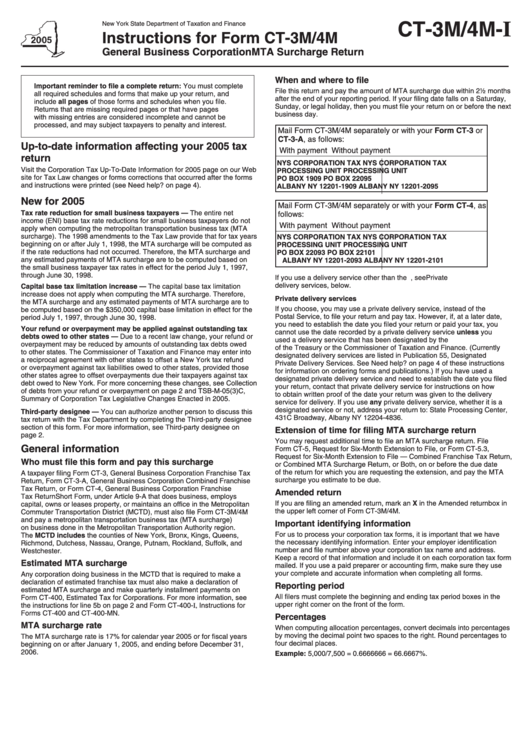

CT-3M/4M- I

New York State Department of Taxation and Finance

Instructions for Form CT-3M/4M

General Business Corporation MTA Surcharge Return

When and where to file

Important reminder to file a complete return: You must complete

File this return and pay the amount of MTA surcharge due within 2½ months

all required schedules and forms that make up your return, and

after the end of your reporting period. If your filing date falls on a Saturday,

include all pages of those forms and schedules when you file.

Sunday, or legal holiday, then you must file your return on or before the next

Returns that are missing required pages or that have pages

business day.

with missing entries are considered incomplete and cannot be

processed, and may subject taxpayers to penalty and interest.

Mail Form CT-3M/4M separately or with your Form CT-3 or

CT-3-A, as follows:

Up-to-date information affecting your 2005 tax

With payment

Without payment

return

NYS CORPORATION TAX

NYS CORPORATION TAX

Visit the Corporation Tax Up-To-Date Information for 2005 page on our Web

PROCESSING UNIT

PROCESSING UNIT

site for Tax Law changes or forms corrections that occurred after the forms

PO BOX 1909

PO BOX 22095

and instructions were printed (see Need help? on page 4).

ALBANY NY 12201-1909

ALBANY NY 12201-2095

New for 2005

Mail Form CT-3M/4M separately or with your Form CT-4, as

Tax rate reduction for small business taxpayers — The entire net

follows:

income (ENI) base tax rate reductions for small business taxpayers do not

With payment

Without payment

apply when computing the metropolitan transportation business tax (MTA

surcharge). The 1998 amendments to the Tax Law provide that for tax years

NYS CORPORATION TAX

NYS CORPORATION TAX

beginning on or after July 1, 1998, the MTA surcharge will be computed as

PROCESSING UNIT

PROCESSING UNIT

if the rate reductions had not occurred. Therefore, the MTA surcharge and

PO BOX 22093

PO BOX 22101

any estimated payments of MTA surcharge are to be computed based on

ALBANY NY 12201-2093

ALBANY NY 12201-2101

the small business taxpayer tax rates in effect for the period July 1, 1997,

through June 30, 1998.

If you use a delivery service other than the U.S. Postal Service, see Private

delivery services, below.

Capital base tax limitation increase — The capital base tax limitation

increase does not apply when computing the MTA surcharge. Therefore,

Private delivery services

the MTA surcharge and any estimated payments of MTA surcharge are to

If you choose, you may use a private delivery service, instead of the U.S.

be computed based on the $350,000 capital base limitation in effect for the

Postal Service, to file your return and pay tax. However, if, at a later date,

period July 1, 1997, through June 30, 1998.

you need to establish the date you filed your return or paid your tax, you

Your refund or overpayment may be applied against outstanding tax

cannot use the date recorded by a private delivery service unless you

debts owed to other states — Due to a recent law change, your refund or

used a delivery service that has been designated by the U.S. Secretary

overpayment may be reduced by amounts of outstanding tax debts owed

of the Treasury or the Commissioner of Taxation and Finance. (Currently

to other states. The Commissioner of Taxation and Finance may enter into

designated delivery services are listed in Publication 55, Designated

a reciprocal agreement with other states to offset a New York tax refund

Private Delivery Services. See Need help? on page 4 of these instructions

or overpayment against tax liabilities owed to other states, provided those

for information on ordering forms and publications.) If you have used a

other states agree to offset overpayments due their taxpayers against tax

designated private delivery service and need to establish the date you filed

debt owed to New York. For more concerning these changes, see Collection

your return, contact that private delivery service for instructions on how

of debts from your refund or overpayment on page 2 and TSB-M-05(3)C,

to obtain written proof of the date your return was given to the delivery

Summary of Corporation Tax Legislative Changes Enacted in 2005.

service for delivery. If you use any private delivery service, whether it is a

designated service or not, address your return to: State Processing Center,

Third-party designee — You can authorize another person to discuss this

431C Broadway, Albany NY 12204-4836.

tax return with the Tax Department by completing the Third-party designee

section of this form. For more information, see Third-party designee on

Extension of time for filing MTA surcharge return

page 2.

You may request additional time to file an MTA surcharge return. File

General information

Form CT-5, Request for Six-Month Extension to File, or Form CT-5.3,

Request for Six-Month Extension to File — Combined Franchise Tax Return,

Who must file this form and pay this surcharge

or Combined MTA Surcharge Return, or Both, on or before the due date

of the return for which you are requesting the extension, and pay the MTA

A taxpayer filing Form CT-3, General Business Corporation Franchise Tax

surcharge you estimate to be due.

Return, Form CT-3-A, General Business Corporation Combined Franchise

Tax Return, or Form CT-4, General Business Corporation Franchise

Amended return

Tax Return Short Form, under Article 9-A that does business, employs

If you are filing an amended return, mark an X in the Amended return box in

capital, owns or leases property, or maintains an office in the Metropolitan

the upper left corner of Form CT-3M/4M.

Commuter Transportation District (MCTD), must also file Form CT-3M/4M

and pay a metropolitan transportation business tax (MTA surcharge)

Important identifying information

on business done in the Metropolitan Transportation Authority region.

For us to process your corporation tax forms, it is important that we have

The MCTD includes the counties of New York, Bronx, Kings, Queens,

the necessary identifying information. Enter your employer identification

Richmond, Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and

number and file number above your corporation tax name and address.

Westchester.

Keep a record of that information and include it on each corporation tax form

Estimated MTA surcharge

mailed. If you use a paid preparer or accounting firm, make sure they use

your complete and accurate information when completing all forms.

Any corporation doing business in the MCTD that is required to make a

declaration of estimated franchise tax must also make a declaration of

Reporting period

estimated MTA surcharge and make quarterly installment payments on

All filers must complete the beginning and ending tax period boxes in the

Form CT-400, Estimated Tax for Corporations. For more information, see

upper right corner on the front of the form.

the instructions for line 5b on page 2 and Form CT-400-I, Instructions for

Forms CT-400 and CT-400-MN.

Percentages

MTA surcharge rate

When computing allocation percentages, convert decimals into percentages

by moving the decimal point two spaces to the right. Round percentages to

The MTA surcharge rate is 17% for calendar year 2005 or for fiscal years

four decimal places.

beginning on or after January 1, 2005, and ending before December 31,

2006.

Example: 5,000/7,500 = 0.6666666 = 66.6667%.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4