Form Crf-002 - State Tax Registration Application

ADVERTISEMENT

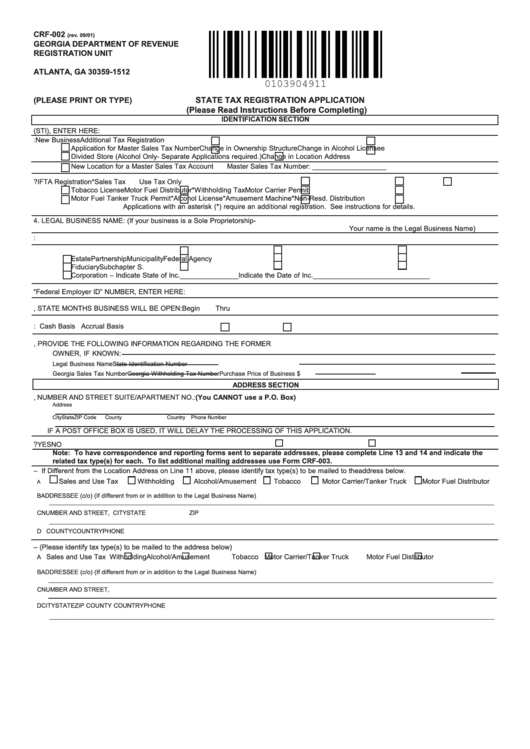

CRF-002

(rev. 09/01)

GEORGIA DEPARTMENT OF REVENUE

REGISTRATION UNIT

P.O. BOX 49512

ATLANTA, GA 30359-1512

STATE TAX REGISTRATION APPLICATION

(PLEASE PRINT OR TYPE)

(Please Read Instructions Before Completing)

IDENTIFICATION SECTION

1.

IF YOU HAVE A STATE TAXPAYER IDENTIFIER (STI), ENTER HERE:

2.

REASON FOR APPLICATION:

New Business

Additional Tax Registration

Application for Master Sales Tax Number

Change in Ownership Structure

Change in Alcohol Licensee

Divided Store (Alcohol Only- Separate Applications required.)

Change in Location Address

New Location for a Master Sales Tax Account

Master Sales Tax Number: ___________________

3.

FOR WHICH OF THE FOLLOWING ARE YOU APPLYING?

IFTA Registration*

Sales Tax

Use Tax Only

Tobacco License

Motor Fuel Distributor*

Withholding Tax

Motor Carrier Permit

Motor Fuel Tanker Truck Permit*

Alcohol License*

Amusement Machine*

Non-Resd. Distribution

Applications with an asterisk (*) require an additional registration. See instructions for details.

4. LEGAL BUSINESS NAME:

(If your business is a Sole Proprietorship-

Your name is the Legal Business Name)

5.

TRADE NAME / DBA NAME:

6.

TYPE OF OWNERSHIP

Sole Proprietorship

County Government

State Agency

Estate

Partnership

Municipality

Federal Agency

Fiduciary

Subchapter S. Corp.

Professional Association

LLC

Corporation – Indicate State of Inc._______________

Indicate the Date of Inc.

______________________________

7.

IF THE BUSINESS LISTED ABOVE HAS A “Federal Employer ID” NUMBER, ENTER HERE:

8.

IF SEASONAL BUSINESS, STATE MONTHS BUSINESS WILL BE OPEN:

Begin

Thru

9.

WHAT ACCOUNTING METHOD WILL YOU USE:

Cash Basis

Accrual Basis

10. IF THIS APPLICATION IS FOR A BUSINESS YOU PURCHASED, PROVIDE THE FOLLOWING INFORMATION REGARDING THE FORMER

OWNER, IF KNOWN:

Legal Business Name

State Identification Number

Georgia Sales Tax Number

Georgia Withholding Tax Number

Purchase Price of Business $

ADDRESS SECTION

11.

PHYSICAL LOCATION ADDRESS, NUMBER AND STREET SUITE/APARTMENT NO.: (You CANNOT use a P.O. Box)

Address

City

State

ZIP Code

County

Country

Phone Number

IF A POST OFFICE BOX IS USED, IT WILL DELAY THE PROCESSING OF THIS APPLICATION.

12.

IS THE ABOVE ADDRESS LOCATED WITHIN THE CITY LIMITS?

YES

NO

Note: To have correspondence and reporting forms sent to separate addresses, please complete Line 13 and 14 and indicate the

related tax type(s) for each. To list additional mailing addresses use Form CRF-003.

13. MAILING ADDRESS – If Different from the Location Address on Line 11 above, please identify tax type(s) to be mailed to the address below.

Sales and Use Tax

Withholding

Alcohol/Amusement

Tobacco

Motor Carrier/Tanker Truck

Motor Fuel Distributor

A

B ADDRESSEE (c/o) (If different from or in addition to the Legal Business Name)

C NUMBER AND STREET, P.O. BOX or RFD NO.

CITY

STATE

ZIP

D COUNTY

COUNTRY

PHONE

14. ADDITIONAL MAILING ADDRESS – (Please identify tax type(s) to be mailed to the address below)

Sales and Use Tax

Withholding

Alcohol/Amusement

Tobacco

Motor Carrier/Tanker Truck

Motor Fuel Distributor

A

B ADDRESSEE (c/o) (If different from or in addition to the Legal Business Name)

C NUMBER AND STREET, P.O. BOX or RFD NO.

D CITY

STATE

ZIP

COUNTY

COUNTRY

PHONE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2