Instructions For West Virginia Sales And Use Tax Return, Form Wv/cst-200cu

ADVERTISEMENT

Instructions for West Virginia Sales and Use Tax Return, Form WV/CST-200CU

General Instructions

Monday - Friday: 8:00 a.m. - 5:00 p.m. EST. Or

visit our website at

Any taxpayer that pays a single payment of

$100,000 for any tax type in the immediately

Form

WV/CST-200CU,

revised

10/2011,

preceding tax year shall electronically pay all tax

includes sales of wine and liquor to private clubs

due. West Virginia accepts both ACH Credits

and purchases made using direct pay permits.

and ACH Debits. ACH Credits are initiated by

Direct Pay permit holders are no longer required

the taxpayer through their financial institution.

to file a separate Direct Pay Permit Sales and

ACH Debits are initiated by the Tax Department

Use Tax Return.

based upon information provided to us by the

Mail completed return to:

taxpayer through our Pay-by-Phone automated

tax payment system or by using one of our on-

West Virginia State Tax Department

line filing applications. Visit

and

click on the MyTaxes link or electronic filing for

Tax Account Administration Division

business links.

P. O. Box 1826

This return is used for reporting (or amending

previously filed), state and municipal sales and

Charleston, WV 25327-1826.

use taxes. This return must be filed when due,

To file and pay electronically, visit our website:

even if you have no tax to report or you pay your

https://mytaxes.wvtax.gov/

tax electronically.

Step by Step Instructions for completing

Verify that the tax account number, name,

return

address and reporting period entered on the top

of your return are correct. If you need to change

Your return will be electronically scanned. Send

your name or address, please use form BRT-

the original return only.

Do not send a

801A which can be found at

photocopy. Use only BLACK ink.

If you are completing a return and do not have a

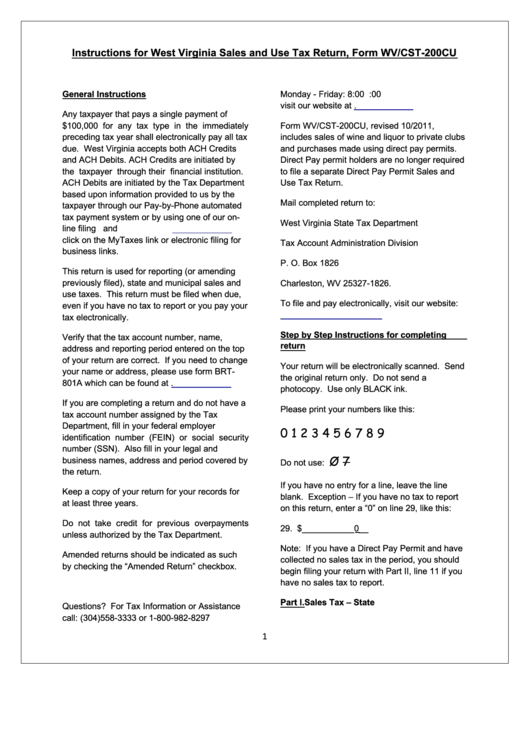

Please print your numbers like this:

tax account number assigned by the Tax

Department, fill in your federal employer

0 1 2 3 4 5 6 7 8 9

identification number (FEIN) or social security

number (SSN).

Also fill in your legal and

Ø 7

business names, address and period covered by

Do not use:

the return.

If you have no entry for a line, leave the line

Keep a copy of your return for your records for

blank. Exception – If you have no tax to report

at least three years.

on this return, enter a “0” on line 29, like this:

Do not take credit for previous overpayments

29. $___________0__

unless authorized by the Tax Department.

Note: If you have a Direct Pay Permit and have

Amended returns should be indicated as such

collected no sales tax in the period, you should

by checking the “Amended Return” checkbox.

begin filing your return with Part II, line 11 if you

have no sales tax to report.

Part I. Sales Tax – State

Questions? For Tax Information or Assistance

call:

(304)558-3333

or

1-800-982-8297

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4