Form Rt-7 - Employer'S Reemployment Tax - Annual Report For Employer'S Of Domestic Employees Only Page 4

ADVERTISEMENT

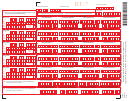

RT-7

RT ACCOUNT NUMBER

CALENDAR YEAR ENDING

EMPLOYER’S NAME

/

/

F.E.I. NUMBER

10. EMPLOYEE’S SOCIAL SECURITY NUMBER

-

11. EMPLOYEE’S NAME

(Please print first twelve characters of last name, first

12a. EMPLOYEE’S GROSS WAGES PAID EACH QUARTER

12b. EMPLOYEE’S TAXABLE WAGES PAID EACH QUARTER

eight characters of first name and middle initial in boxes.)

GROSS WAGES PAID EACH QUARTER

SOCIAL SECURITY NUMBER

EMPLOYEE

FIRST QUARTER ENDING 3/31

SECOND QUARTER ENDING 6/30

THIRD QUARTER ENDING 9/30

FOURTH QUARTER ENDING 12/31

-

-

12a.

6

Last

Name

TAXABLE WAGES PAID EACH QUARTER

12b.

First

Middle

Name

Initial

GROSS WAGES PAID EACH QUARTER

SOCIAL SECURITY NUMBER

EMPLOYEE

FIRST QUARTER ENDING 3/31

SECOND QUARTER ENDING 6/30

THIRD QUARTER ENDING 9/30

FOURTH QUARTER ENDING 12/31

-

-

12a.

7

Last

TAXABLE WAGES PAID EACH QUARTER

Name

12b.

First

Middle

Name

Initial

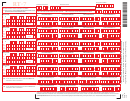

GROSS WAGES PAID EACH QUARTER

SOCIAL SECURITY NUMBER

EMPLOYEE

FIRST QUARTER ENDING 3/31

SECOND QUARTER ENDING 6/30

THIRD QUARTER ENDING 9/30

FOURTH QUARTER ENDING 12/31

-

-

12a.

8

Last

TAXABLE WAGES PAID EACH QUARTER

Name

12b.

First

Middle

Name

Initial

GROSS WAGES PAID EACH QUARTER

SOCIAL SECURITY NUMBER

EMPLOYEE

FIRST QUARTER ENDING 3/31

SECOND QUARTER ENDING 6/30

THIRD QUARTER ENDING 9/30

FOURTH QUARTER ENDING 12/31

-

-

12a.

9

Last

TAXABLE WAGES PAID EACH QUARTER

12b.

Name

First

Middle

Name

Initial

GROSS WAGES PAID EACH QUARTER

SOCIAL SECURITY NUMBER

EMPLOYEE

FIRST QUARTER ENDING 3/31

SECOND QUARTER ENDING 6/30

THIRD QUARTER ENDING 9/30

FOURTH QUARTER ENDING 12/31

-

-

12a.

10

Last

TAXABLE WAGES PAID EACH QUARTER

Name

12b.

First

Middle

Name

Initial

Enter the total of all Line 12a. entries from

Enter the total of all Line 12a. entries from

Enter the total of all Line 12a. entries from

Enter the total of all Line 12a. entries from

above for First Quarter Ending 3/31

above for Second Quarter Ending 6/30

above for Third Quarter Ending 9/30

above for Fourth Quarter Ending 12/31

13a. TOTAL GROSS WAGES EACH QUARTER THIS PAGE

,

.

,

.

,

.

,

.

INCLUDE IN LINE 2 ON PAGE 1

Enter the total of all Line 12b. entries from

Enter the total of all Line12b. entries from

Enter the total of all Line 12b. entries from

Enter the total of all Line 12b. entries from

above for First Quarter Ending 3/31

above for Second Quarter Ending 6/30

above for Third Quarter Ending 9/30

above for Fourth Quarter Ending 12/31

13b. TOTAL TAXABLE WAGES EACH QUARTER THIS PAGE

,

.

,

.

,

.

,

.

INCLUDE IN LINE 4 ON PAGE 1

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are

confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site

at and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4