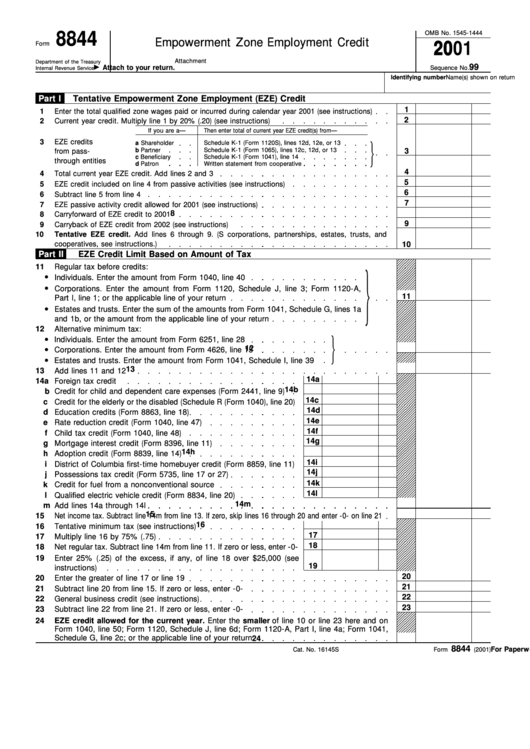

8844

OMB No. 1545-1444

Empowerment Zone Employment Credit

Form

2001

Attachment

Department of the Treasury

99

Attach to your return.

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Part I

Tentative Empowerment Zone Employment (EZE) Credit

1

1

Enter the total qualified zone wages paid or incurred during calendar year 2001 (see instructions)

2

2

Current year credit. Multiply line 1 by 20% (.20) (see instructions)

If you are a—

Then enter total of current year EZE credit(s) from—

3

EZE credits

a Shareholder

Schedule K-1 (Form 1120S), lines 12d, 12e, or 13

b Partner

Schedule K-1 (Form 1065), lines 12c, 12d, or 13

3

from pass-

c Beneficiary

Schedule K-1 (Form 1041), line 14

through entities

d Patron

Written statement from cooperative

4

4

Total current year EZE credit. Add lines 2 and 3

5

5

EZE credit included on line 4 from passive activities (see instructions)

6

6

Subtract line 5 from line 4

7

7

EZE passive activity credit allowed for 2001 (see instructions)

8

8

Carryforward of EZE credit to 2001

9

9

Carryback of EZE credit from 2002 (see instructions)

10

Tentative EZE credit. Add lines 6 through 9. (S corporations, partnerships, estates, trusts, and

cooperatives, see instructions.)

10

Part II

EZE Credit Limit Based on Amount of Tax

11

Regular tax before credits:

●

Individuals. Enter the amount from Form 1040, line 40

●

Corporations. Enter the amount from Form 1120, Schedule J, line 3; Form 1120-A,

11

Part I, line 1; or the applicable line of your return

●

Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G, lines 1a

and 1b, or the amount from the applicable line of your return

12

Alternative minimum tax:

●

Individuals. Enter the amount from Form 6251, line 28

12

●

Corporations. Enter the amount from Form 4626, line 15

●

Estates and trusts. Enter the amount from Form 1041, Schedule I, line 39

13

13

Add lines 11 and 12

14a

14a

Foreign tax credit

14b

b

Credit for child and dependent care expenses (Form 2441, line 9)

14c

c

Credit for the elderly or the disabled (Schedule R (Form 1040), line 20)

14d

d

Education credits (Form 8863, line 18)

14e

e

Rate reduction credit (Form 1040, line 47)

14f

f

Child tax credit (Form 1040, line 48)

14g

g

Mortgage interest credit (Form 8396, line 11)

14h

h

Adoption credit (Form 8839, line 14)

14i

i

District of Columbia first-time homebuyer credit (Form 8859, line 11)

14j

j

Possessions tax credit (Form 5735, line 17 or 27)

14k

k

Credit for fuel from a nonconventional source

14l

l

Qualified electric vehicle credit (Form 8834, line 20)

14m

m

Add lines 14a through 14l

15

15

Net income tax. Subtract line 14m from line 13. If zero, skip lines 16 through 20 and enter -0- on line 21

16

16

Tentative minimum tax (see instructions)

17

17

Multiply line 16 by 75% (.75)

18

18

Net regular tax. Subtract line 14m from line 11. If zero or less, enter -0-

19

Enter 25% (.25) of the excess, if any, of line 18 over $25,000 (see

19

instructions)

20

20

Enter the greater of line 17 or line 19

21

21

Subtract line 20 from line 15. If zero or less, enter -0-

22

22

General business credit (see instructions)

23

23

Subtract line 22 from line 21. If zero or less, enter -0-

24

EZE credit allowed for the current year. Enter the smaller of line 10 or line 23 here and on

Form 1040, line 50; Form 1120, Schedule J, line 6d; Form 1120-A, Part I, line 4a; Form 1041,

Schedule G, line 2c; or the applicable line of your return

24

8844

For Paperwork Reduction Act Notice, see page 3.

Cat. No. 16145S

Form

(2001)

1

1 2

2 3

3 4

4