Form Ia 98 - Notice Of Unemployment Insurance Tax Rates - New York State Department Of Labor

ADVERTISEMENT

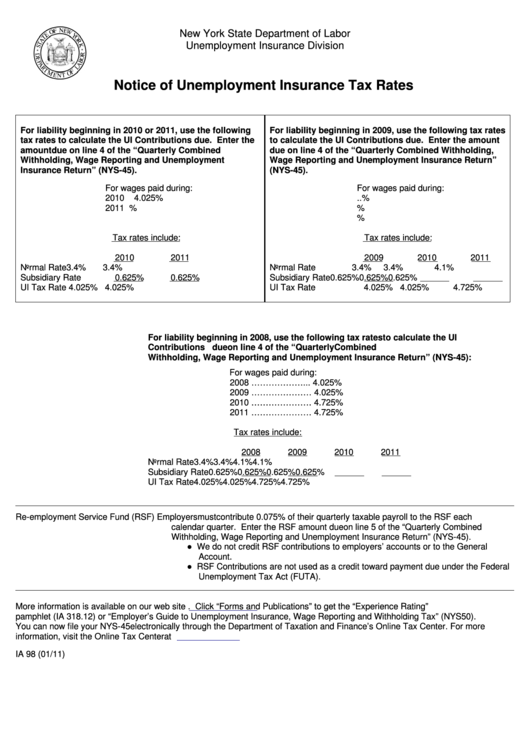

New York State Department of Labor

Unemployment Insurance Division

Notice of Unemployment Insurance Tax Rates

For liability beginning in 2010 or 2011, use the following

For liability beginning in 2009, use the following tax rates

tax rates to calculate the UI Contributions due. Enter the

to calculate the UI Contributions due. Enter the amount

amount due on line 4 of the “Quarterly Combined

due on line 4 of the “Quarterly Combined Withholding,

Withholding, Wage Reporting and Unemployment

Wage Reporting and Unemployment Insurance Return”

Insurance Return” (NYS-45).

(NYS-45).

For wages paid during:

For wages paid during:

2010 ........................ 4.025%

2009......................... 4.025%

2011 ......................... 4.025%

2010......................... 4.025%

2011......................... 4.725%

Tax rates include:

Tax rates include:

2010

2011

2009

2010

2011

Normal Rate

3.4%

3.4%

Normal Rate

3.4%

3.4%

4.1%

Subsidiary Rate

0.625%

0.625%

Subsidiary Rate

0.625%

0.625%

0.625%

UI Tax Rate

4.025%

4.025%

UI Tax Rate

4.025%

4.025%

4.725%

For liability beginning in 2008, use the following tax rates to calculate the UI

Contributions due. Enter the amount due on line 4 of the “Quarterly Combined

Withholding, Wage Reporting and Unemployment Insurance Return” (NYS-45):

For wages paid during:

2008 ………………... 4.025%

2009 ………………… 4.025%

2010 ………………… 4.725%

2011 ………………… 4.725%

Tax rates include:

2008

2009

2010

2011

Normal Rate

3.4%

3.4%

4.1%

4.1%

Subsidiary Rate

0.625%

0.625%

0.625%

0.625%

UI Tax Rate

4.025%

4.025%

4.725%

4.725%

Re-employment Service Fund (RSF)

Employers must contribute 0.075% of their quarterly taxable payroll to the RSF each

calendar quarter. Enter the RSF amount due on line 5 of the “Quarterly Combined

Withholding, Wage Reporting and Unemployment Insurance Return” (NYS-45).

● We do not credit RSF contributions to employers’ accounts or to the General

Account.

● RSF Contributions are not used as a credit toward payment due under the Federal

Unemployment Tax Act (FUTA).

More information is available on our web site Click “Forms and Publications” to get the “Experience Rating”

pamphlet (IA 318.12) or “Employer’s Guide to Unemployment Insurance, Wage Reporting and Withholding Tax” (NYS50).

You can now file your NYS-45 electronically through the Department of Taxation and Finance’s Online Tax Center. For more

information, visit the Online Tax Center at

IA 98 (01/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1