Instructions For Form 3855 - Michigan Tax Amnesty

ADVERTISEMENT

3855, Page 2

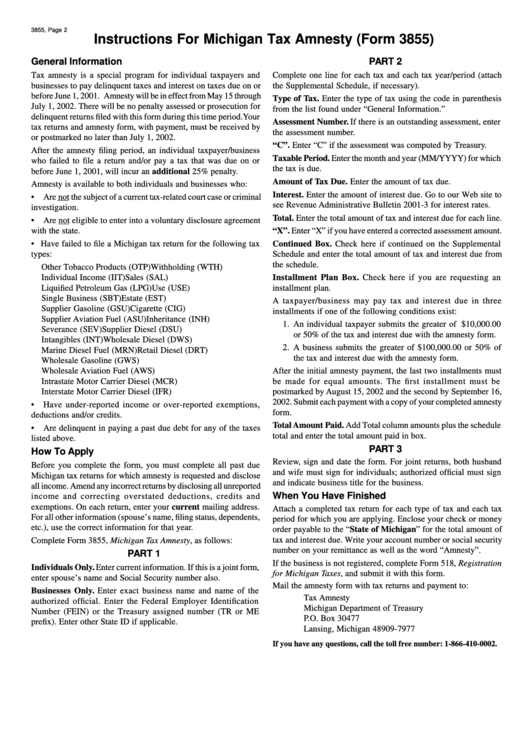

Instructions For Michigan Tax Amnesty (Form 3855)

General Information

PART 2

Tax amnesty is a special program for individual taxpayers and

Complete one line for each tax and each tax year/period (attach

businesses to pay delinquent taxes and interest on taxes due on or

the Supplemental Schedule, if necessary).

before June 1, 2001. Amnesty will be in effect from May 15 through

Type of Tax. Enter the type of tax using the code in parenthesis

July 1, 2002. There will be no penalty assessed or prosecution for

from the list found under “General Information.”

delinquent returns filed with this form during this time period.Your

Assessment Number. If there is an outstanding assessment, enter

tax returns and amnesty form, with payment, must be received by

the assessment number.

or postmarked no later than July 1, 2002.

“C”. Enter “C” if the assessment was computed by Treasury.

After the amnesty filing period, an individual taxpayer/business

Taxable Period. Enter the month and year (MM/YYYY) for which

who failed to file a return and/or pay a tax that was due on or

the tax is due.

before June 1, 2001, will incur an additional 25% penalty.

Amount of Tax Due. Enter the amount of tax due.

Amnesty is available to both individuals and businesses who:

Interest. Enter the amount of interest due. Go to our Web site to

•

Are not the subject of a current tax-related court case or criminal

see Revenue Administrative Bulletin 2001-3 for interest rates.

investigation.

Total. Enter the total amount of tax and interest due for each line.

•

Are not eligible to enter into a voluntary disclosure agreement

with the state.

“X”. Enter “X” if you have entered a corrected assessment amount.

• Have failed to file a Michigan tax return for the following tax

Continued Box. Check here if continued on the Supplemental

types:

Schedule and enter the total amount of tax and interest due from

the schedule.

Other Tobacco Products (OTP)

Withholding (WTH)

Individual Income (IIT)

Sales (SAL)

Installment Plan Box. Check here if you are requesting an

Liquified Petroleum Gas (LPG)

Use (USE)

installment plan.

Single Business (SBT)

Estate (EST)

A taxpayer/business may pay tax and interest due in three

Supplier Gasoline (GSU)

Cigarette (CIG)

installments if one of the following conditions exist:

Supplier Aviation Fuel (ASU)

Inheritance (INH)

1. An individual taxpayer submits the greater of $10,000.00

Severance (SEV)

Supplier Diesel (DSU)

or 50% of the tax and interest due with the amnesty form.

Intangibles (INT)

Wholesale Diesel (DWS)

2. A business submits the greater of $100,000.00 or 50% of

Marine Diesel Fuel (MRN)

Retail Diesel (DRT)

the tax and interest due with the amnesty form.

Wholesale Gasoline (GWS)

Wholesale Aviation Fuel (AWS)

After the initial amnesty payment, the last two installments must

Intrastate Motor Carrier Diesel (MCR)

be made for equal amounts. The first installment must be

Interstate Motor Carrier Diesel (IFR)

postmarked by August 15, 2002 and the second by September 16,

2002. Submit each payment with a copy of your completed amnesty

•

Have under-reported income or over-reported exemptions,

form.

deductions and/or credits.

Total Amount Paid. Add Total column amounts plus the schedule

•

Are delinquent in paying a past due debt for any of the taxes

total and enter the total amount paid in box.

listed above.

PART 3

How To Apply

Review, sign and date the form. For joint returns, both husband

Before you complete the form, you must complete all past due

and wife must sign for individuals; authorized official must sign

Michigan tax returns for which amnesty is requested and disclose

and indicate business title for the business.

all income. Amend any incorrect returns by disclosing all unreported

When You Have Finished

income and correcting overstated deductions, credits and

exemptions. On each return, enter your current mailing address.

Attach a completed tax return for each type of tax and each tax

For all other information (spouse’s name, filing status, dependents,

period for which you are applying. Enclose your check or money

etc.), use the correct information for that year.

order payable to the “State of Michigan” for the total amount of

tax and interest due. Write your account number or social security

Complete Form 3855, Michigan Tax Amnesty, as follows:

number on your remittance as well as the word “Amnesty”.

PART 1

If the business is not registered, complete Form 518, Registration

Individuals Only. Enter current information. If this is a joint form,

for Michigan Taxes, and submit it with this form.

enter spouse’s name and Social Security number also.

Mail the amnesty form with tax returns and payment to:

Businesses Only. Enter exact business name and name of the

Tax Amnesty

authorized official. Enter the Federal Employer Identification

Michigan Department of Treasury

Number (FEIN) or the Treasury assigned number (TR or ME

P.O. Box 30477

prefix). Enter other State ID if applicable.

Lansing, Michigan 48909-7977

If you have any questions, call the toll free number: 1-866-410-0002.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1