Instructions For Form 4571 - Michigan Business Tax (Mbt) Common Credits For Small Businesses

ADVERTISEMENT

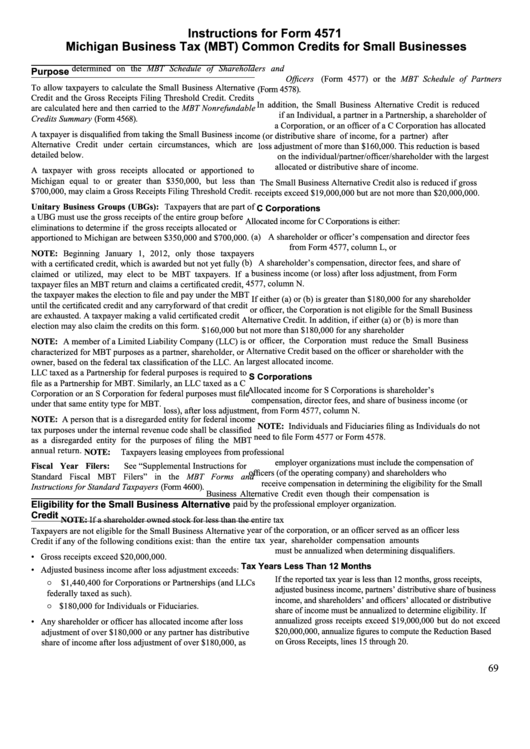

Instructions for Form 4571

Michigan Business Tax (MBT) Common Credits for Small Businesses

determined on the MBT Schedule of Shareholders and

Purpose

Officers (Form 4577) or the MBT Schedule of Partners

To allow taxpayers to calculate the Small Business Alternative

(Form 4578).

Credit and the Gross Receipts Filing Threshold Credit. Credits

In addition, the Small Business Alternative Credit is reduced

are calculated here and then carried to the MBT Nonrefundable

if an Individual, a partner in a Partnership, a shareholder of

Credits Summary (Form 4568).

a Corporation, or an officer of a C Corporation has allocated

A taxpayer is disqualified from taking the Small Business

income (or distributive share of income, for a partner) after

Alternative Credit under certain circumstances, which are

loss adjustment of more than $160,000. This reduction is based

detailed below.

on the individual/partner/officer/shareholder with the largest

allocated or distributive share of income.

A taxpayer with gross receipts allocated or apportioned to

Michigan equal to or greater than $350,000, but less than

The Small Business Alternative Credit also is reduced if gross

$700,000, may claim a Gross Receipts Filing Threshold Credit.

receipts exceed $19,000,000 but are not more than $20,000,000.

Unitary Business Groups (UBGs): Taxpayers that are part of

C Corporations

a UBG must use the gross receipts of the entire group before

Allocated income for C Corporations is either:

eliminations to determine if the gross receipts allocated or

(a) A shareholder or officer’s compensation and director fees

apportioned to Michigan are between $350,000 and $700,000.

from Form 4577, column L, or

NOTE: Beginning January 1, 2012, only those taxpayers

(b) A shareholder’s compensation, director fees, and share of

with a certificated credit, which is awarded but not yet fully

business income (or loss) after loss adjustment, from Form

claimed or utilized, may elect to be MBT taxpayers. If a

4577, column N.

taxpayer files an MBT return and claims a certificated credit,

the taxpayer makes the election to file and pay under the MBT

If either (a) or (b) is greater than $180,000 for any shareholder

until the certificated credit and any carryforward of that credit

or officer, the Corporation is not eligible for the Small Business

are exhausted. A taxpayer making a valid certificated credit

Alternative Credit. In addition, if either (a) or (b) is more than

election may also claim the credits on this form.

$160,000 but not more than $180,000 for any shareholder

or officer, the Corporation must reduce the Small Business

NOTE: A member of a Limited Liability Company (LLC) is

Alternative Credit based on the officer or shareholder with the

characterized for MBT purposes as a partner, shareholder, or

largest allocated income.

owner, based on the federal tax classification of the LLC. An

LLC taxed as a Partnership for federal purposes is required to

S Corporations

file as a Partnership for MBT. Similarly, an LLC taxed as a C

Allocated income for S Corporations is shareholder’s

Corporation or an S Corporation for federal purposes must file

compensation, director fees, and share of business income (or

under that same entity type for MBT.

loss), after loss adjustment, from Form 4577, column N.

NOTE: A person that is a disregarded entity for federal income

NOTE: Individuals and Fiduciaries filing as Individuals do not

tax purposes under the internal revenue code shall be classified

need to file Form 4577 or Form 4578.

as a disregarded entity for the purposes of filing the MBT

annual return.

NOTE: Taxpayers leasing employees from professional

employer organizations must include the compensation of

Fiscal Year Filers: See “Supplemental Instructions for

officers (of the operating company) and shareholders who

Standard Fiscal MBT Filers” in the MBT Forms and

receive compensation in determining the eligibility for the Small

Instructions for Standard Taxpayers (Form 4600).

Business Alternative Credit even though their compensation is

Eligibility for the Small Business Alternative

paid by the professional employer organization.

Credit

NOTE: If a shareholder owned stock for less than the entire tax

year of the corporation, or an officer served as an officer less

Taxpayers are not eligible for the Small Business Alternative

than the entire tax year, shareholder compensation amounts

Credit if any of the following conditions exist:

must be annualized when determining disqualifiers.

• Gross receipts exceed $20,000,000.

Tax Years Less Than 12 Months

• Adjusted business income after loss adjustment exceeds:

If the reported tax year is less than 12 months, gross receipts,

○ $1,440,400 for Corporations or Partnerships (and LLCs

adjusted business income, partners’ distributive share of business

federally taxed as such).

income, and shareholders’ and officers’ allocated or distributive

○ $180,000 for Individuals or Fiduciaries.

share of income must be annualized to determine eligibility. If

annualized gross receipts exceed $19,000,000 but do not exceed

• Any shareholder or officer has allocated income after loss

$20,000,000, annualize figures to compute the Reduction Based

adjustment of over $180,000 or any partner has distributive

on Gross Receipts, lines 15 through 20.

share of income after loss adjustment of over $180,000, as

69

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3