Instructions For Schedule M-1mtc - Alternative Minimum Tax Credit - 1999

ADVERTISEMENT

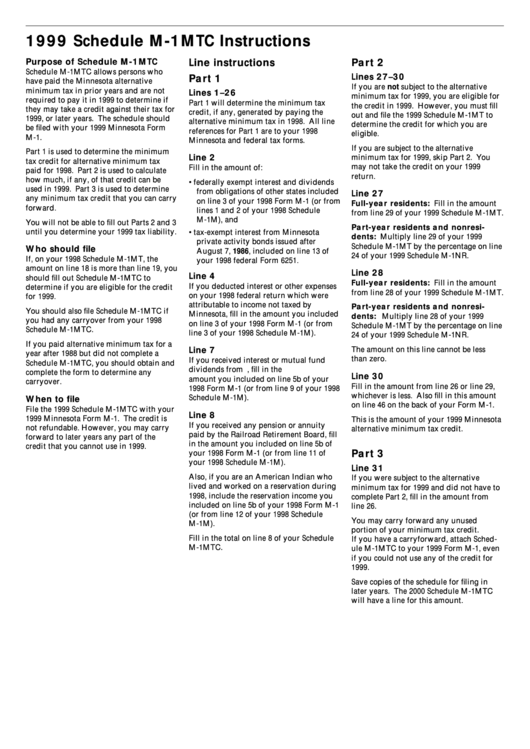

1999 Schedule M-1MTC Instructions

Purpose of Schedule M-1MTC

Line instructions

Part 2

Schedule M-1MTC allows persons who

Lines 27–30

Part 1

have paid the Minnesota alternative

If you are not subject to the alternative

minimum tax in prior years and are not

Lines 1–26

minimum tax for 1999, you are eligible for

required to pay it in 1999 to determine if

Part 1 will determine the minimum tax

the credit in 1999. However, you must fill

they may take a credit against their tax for

credit, if any, generated by paying the

out and file the 1999 Schedule M-1MT to

1999, or later years. The schedule should

alternative minimum tax in 1998. All line

determine the credit for which you are

be filed with your 1999 Minnesota Form

references for Part 1 are to your 1998

eligible.

M-1.

Minnesota and federal tax forms.

If you are subject to the alternative

Part 1 is used to determine the minimum

Line 2

minimum tax for 1999, skip Part 2. You

tax credit for alternative minimum tax

may not take the credit on your 1999

Fill in the amount of:

paid for 1998. Part 2 is used to calculate

return.

how much, if any, of that credit can be

• federally exempt interest and dividends

used in 1999. Part 3 is used to determine

from obligations of other states included

Line 27

any minimum tax credit that you can carry

on line 3 of your 1998 Form M-1 (or from

Full-year residents: Fill in the amount

forward.

lines 1 and 2 of your 1998 Schedule

from line 29 of your 1999 Schedule M-1MT.

M-1M), and

You will not be able to fill out Parts 2 and 3

Part-year residents and nonresi-

until you determine your 1999 tax liability.

• tax-exempt interest from Minnesota

dents: Multiply line 29 of your 1999

private activity bonds issued after

Schedule M-1MT by the percentage on line

Who should file

August 7, 1986, included on line 13 of

24 of your 1999 Schedule M-1NR.

If, on your 1998 Schedule M-1MT, the

your 1998 federal Form 6251.

amount on line 18 is more than line 19, you

Line 28

Line 4

should fill out Schedule M-1MTC to

Full-year residents: Fill in the amount

If you deducted interest or other expenses

determine if you are eligible for the credit

from line 28 of your 1999 Schedule M-1MT.

on your 1998 federal return which were

for 1999.

attributable to income not taxed by

Part-year residents and nonresi-

You should also file Schedule M-1MTC if

Minnesota, fill in the amount you included

dents: Multiply line 28 of your 1999

you had any carryover from your 1998

on line 3 of your 1998 Form M-1 (or from

Schedule M-1MT by the percentage on line

Schedule M-1MTC.

line 3 of your 1998 Schedule M-1M).

24 of your 1999 Schedule M-1NR.

If you paid alternative minimum tax for a

Line 7

The amount on this line cannot be less

year after 1988 but did not complete a

than zero.

If you received interest or mutual fund

Schedule M-1MTC, you should obtain and

dividends from U.S. bonds, fill in the

complete the form to determine any

Line 30

amount you included on line 5b of your

carryover.

Fill in the amount from line 26 or line 29,

1998 Form M-1 (or from line 9 of your 1998

whichever is less. Also fill in this amount

When to file

Schedule M-1M).

on line 46 on the back of your Form M-1.

File the 1999 Schedule M-1MTC with your

Line 8

1999 Minnesota Form M-1. The credit is

This is the amount of your 1999 Minnesota

If you received any pension or annuity

not refundable. However, you may carry

alternative minimum tax credit.

paid by the Railroad Retirement Board, fill

forward to later years any part of the

in the amount you included on line 5b of

credit that you cannot use in 1999.

Part 3

your 1998 Form M-1 (or from line 11 of

your 1998 Schedule M-1M).

Line 31

Also, if you are an American Indian who

If you were subject to the alternative

lived and worked on a reservation during

minimum tax for 1999 and did not have to

1998, include the reservation income you

complete Part 2, fill in the amount from

included on line 5b of your 1998 Form M-1

line 26.

(or from line 12 of your 1998 Schedule

You may carry forward any unused

M-1M).

portion of your minimum tax credit.

Fill in the total on line 8 of your Schedule

If you have a carryforward, attach Sched-

M-1MTC.

ule M-1MTC to your 1999 Form M-1, even

if you could not use any of the credit for

1999.

Save copies of the schedule for filing in

later years. The 2000 Schedule M-1MTC

will have a line for this amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1