Publication 936 - Home Mortgage Interest Deduction - 2011 Page 11

ADVERTISEMENT

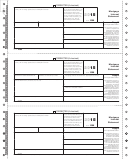

Table 1. Worksheet To Figure Your Qualified Loan Limit and Deductible Home

Mortgage Interest For the Current Year

See the Table 1 Instructions.

Keep for Your Records

Part I

Qualified Loan Limit

1.

1.

Enter the average balance of all your grandfathered debt. See line 1 instructions . .

2.

2.

Enter the average balance of all your home acquisition debt. See line 2 instructions

3.

3.

Enter $1,000,000 ($500,000 if married filing separately) . . . . . . . . . . . . . . . . . . . . .

4.

4.

Enter the larger of the amount on line 1 or the amount on line 3 . . . . . . . . . . . . . . .

5.

5.

Add the amounts on lines 1 and 2. Enter the total here . . . . . . . . . . . . . . . . . . . . . .

6.

6.

Enter the smaller of the amount on line 4 or the amount on line 5 . . . . . . . . . . . . . .

7.

If you have home equity debt, enter the smaller of $100,000 ($50,000 if married

filing separately) or your limited amount.

7.

See the line 7 instructions for the limit which may apply to you. . . . . . . . . . . . . . . . .

8.

Add the amounts on lines 6 and 7. Enter the total. This is your qualified loan limit.

8.

Part II

Deductible Home Mortgage Interest

9.

Enter the total of the average balances of all mortgages on all qualified homes.

9.

See line 9 instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

If line 8 is less than line 9, go on to line 10.

•

If line 8 is equal to or more than line 9, stop here. All of your interest on all the

mortgages included on line 9 is deductible as home mortgage interest on

Schedule A (Form 1040).

10. Enter the total amount of interest that you paid. See line 10 instructions . . . . . . . . . .

10.

11. Divide the amount on line 8 by the amount on line 9.

× .

Enter the result as a decimal amount (rounded to three places) . . . . . . . . . . . . . . . .

11.

12. Multiply the amount on line 10 by the decimal amount on line 11.

Enter the result. This is your deductible home mortgage interest.

Enter this amount on Schedule A (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

13. Subtract the amount on line 12 from the amount on line 10. Enter the result.

This is not home mortgage interest. See line 13 instructions . . . . . . . . . . . . . . . .

13.

Example. Ms. Brown had a home equity

Complete lines 1 and 2 of Table 1 by includ-

b. Next, any grandfathered debt, and

loan secured by her main home all year. She

ing the separate average balances of any

c. Finally, any home acquisition debt.

grandfathered debt and home acquisition debt in

received monthly statements showing her aver-

your mixed-use mortgage. Do not use the meth-

age balance for each month. She can figure her

2. Add together the monthly balances figured

ods described earlier in this section to figure the

average balance for the year by adding her

in (1).

average balance of either category. Instead, for

monthly average balances and dividing the total

each category, use the following method.

3. Divide the result in (2) by 12.

by 12.

Complete line 9 of Table 1 by including the

1. Figure the balance of that category of debt

Mixed-use mortgages. A mixed-use mort-

average balance of the entire mixed-use mort-

for each month. This is the amount of the

gage is a loan that consists of more than one of

gage, figured under one of the methods de-

loan proceeds allocated to that category,

the three categories of debt (grandfathered

scribed earlier in this section.

reduced by your principal payments on the

debt, home acquisition debt, and home equity

mortgage previously applied to that cate-

debt). For example, a mortgage you took out

Example 1. In 1986, Sharon took out a

gory. Principal payments on a mixed-use

during the year is a mixed-use mortgage if you

$1,400,000 mortgage to buy her main home

mortgage are applied in full to each cate-

used its proceeds partly to refinance a mortgage

(grandfathered debt). On March 2, 2011, when

gory of debt, until its balance is zero, in the

that you took out in an earlier year to buy your

the home had a fair market value of $1,700,000

following order:

home (home acquisition debt) and partly to buy

and she owed $1,100,000 on the mortgage,

a car (home equity debt).

a. First, any home equity debt,

Sharon took out a second mortgage for

Publication 936 (2011)

Page 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16