Publication 936 - Home Mortgage Interest Deduction - 2011 Page 12

ADVERTISEMENT

$200,000. She used $180,000 of the proceeds

acquisition debt for 2012 is $179,750

and the outstanding home acquisition and

($2,157,000 ÷ 12).

to make substantial improvements to her home

grandfathered debt for each home on the

(home acquisition debt) and the remaining

date that the last debt was secured by the

$20,000 to buy a car (home equity debt). Under

home.

Line 1

the loan agreement, Sharon must make princi-

See

Home equity debt limit

under Home Eq-

pal payments of $1,000 at the end of each

Figure the average balance for the current year

uity Debt, earlier, for more information about fair

month. During 2011, her principal payments on

of each mortgage you had on all qualified homes

market value.

the second mortgage totaled $10,000.

on October 13, 1987 (grandfathered debt). Add

To complete Table 1, line 2, Sharon must

the results together and enter the total on line 1.

figure a separate average balance for the part of

Include the average balance for the current year

Line 9

her second mortgage that is home acquisition

for any grandfathered debt part of a mixed-use

Figure the average balance for the current year

debt. The January and February balances were

mortgage.

zero. The March through December balances

of each outstanding home mortgage. Add the

were all $180,000, because none of her princi-

average balances together and enter the total

Line 2

pal payments are applied to the home acquisi-

on line 9. See

Average Mortgage

Balance, ear-

tion debt. (They are all applied to the home

lier.

Figure the average balance for the current year

equity debt, reducing it to $10,000 [$20,000 −

Note. When figuring the average balance of

of each mortgage you took out on all qualified

$10,000].) The monthly balances of the home

a mixed-use mortgage, for line 9 determine the

homes after October 13, 1987, to buy, build, or

acquisition debt total $1,800,000 ($180,000 ×

average balance of the entire mortgage.

substantially improve the home (home acquisi-

10). Therefore, the average balance of the home

tion debt). Add the results together and enter the

acquisition debt for 2011 was $150,000

total on line 2. Include the average balance for

($1,800,000 ÷ 12).

Line 10

the current year for any home acquisition debt

part of a mixed-use mortgage.

Example 2. The facts are the same as in

If you make payments to a financial institution, or

Example 1. In 2012, Sharon’s January through

to a person whose business is making loans,

October principal payments on her second mort-

Line 7

you should get Form 1098 or a similar statement

gage are applied to the home equity debt, reduc-

from the lender. This form will show the amount

If you have home equity debt, complete line 7.

ing it to zero. The balance of the home

of interest to enter on line 10. Also include on

acquisition debt remains $180,000 for each of

The amount on line 7 cannot be more than

this line any other interest payments made on

those months. Because her November and De-

the smaller of:

debts secured by a qualified home for which you

cember principal payments are applied to the

did not receive a Form 1098. Do not include

1. $100,000 ($50,000 if married filing sepa-

home acquisition debt, the November balance is

points or mortgage insurance premiums on this

rately), or

$179,000 ($180,000 − $1,000) and the Decem-

line.

ber balance is $178,000 ($180,000 − $2,000).

2. The total of each home’s fair market value

The monthly balances total $2,157,000

(FMV) reduced (but not below zero) by the

Claiming your deductible points. Figure

[($180,000 × 10) + $179,000 + $178,000].

amount of its home acquisition debt and

your deductible points as follows.

Therefore, the average balance of the home

grandfathered debt. Determine the FMV

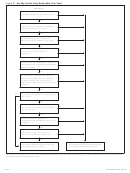

Table 2. Where To Deduct Your Interest Expense

IF you have ...

THEN deduct it on ...

AND for more information go to ...

deductible student loan interest

Form 1040, line 33, or Form 1040A,

Publication 970, Tax Benefits for

line 18

Education.

deductible home mortgage interest

Schedule A (Form 1040), line 10

this publication (936).

and points reported on Form 1098

deductible home mortgage interest

Schedule A (Form 1040), line 11

this publication (936).

not reported on Form 1098

deductible points not reported on

Schedule A (Form 1040), line 12

this publication (936).

Form 1098

deductible mortgage insurance

Schedule A (Form 1040), line 13

this publication (936).

premiums

deductible investment interest (other

Schedule A (Form 1040), line 14

Publication 550, Investment Income

than incurred to produce rents or

and Expenses.

royalties)

deductible business interest

Schedule C or C-EZ (Form 1040)

Publication 535.

(non-farm)

deductible farm business interest

Schedule F (Form 1040)

Publications 225, Farmer’s Tax Guide,

and 535.

deductible interest incurred to

Schedule E (Form 1040)

Publications 527 and 535.

produce rents or royalties

personal interest

not deductible.

Publication 936 (2011)

Page 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16