Publication 936 - Home Mortgage Interest Deduction - 2011 Page 6

ADVERTISEMENT

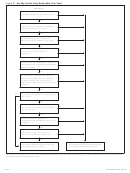

Figure B. Are My Points Fully Deductible This Year?

Start Here:

No

Is the loan secured by your main home?

Yes

No

Is the payment of points an established

business practice in your area?

Yes

Yes

Were the points paid more than the

amount generally charged in your area?

No

No

Do you use the cash method of

accounting?

Yes

Were the points paid in place of amounts

Yes

that ordinarily are separately stated on the

settlement sheet?

No

Were the funds you provided (other than

those you borrowed from your lender or

No

mortgage broker), plus any points the

seller paid, at least as much as the points

charged?*

Yes

Yes

Did you take out the loan to improve your

main home?

No

No

Did you take out the loan to buy or build

your main home?

Yes

Were the points computed as a

No

percentage of the principal amount of the

mortgage?

Yes

No

Is the amount paid clearly shown as

points on the settlement statement?

Yes

You can fully deduct the points this year

You cannot fully deduct the points this

on Schedule A (Form 1040).

year. See the discussion on Points.

* The funds you provided do not have to have been applied to the points. They can include a down payment, an escrow deposit, earnest money, and other funds

you paid at or before closing for any purpose.

Publication 936 (2011)

Page 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16