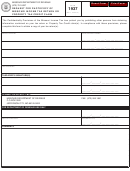

Form Ct-1120k Draft - Business Tax Credit Summary - Ct Department Of Revenue Services - 2013 Page 2

ADVERTISEMENT

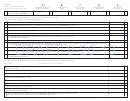

Part I-D

A

B

C

D

E

Tax Credits With Carryforward

Carryforward Amount From

2013

Credit

Amount Applied to

Amount Applied to Other

Carryforward

Provisions

Previous Income Years

Amount Claimed

Corporation Tax

Taxes or Exchanged

Amount to

2014

20 Housing Program Contribution

See instructions. Form CT-1120 HPC

00

00

00

00

21

Reserved for future use

22 Research and Experimental Expenditures

Form CT-1120RC: Enter amount

00

00

00

00

00

exchanged in Column D.

23 Research and Development

Form CT-1120 RDC: Enter amount

00

00

00

00

00

exchanged in Column D.

24 Fixed Capital Investment

00

00

00

00

Form CT-1120 FCIC

25 Human Capital Investment

00

00

00

00

DRAFT 8-26-13

Form CT-1120 HCIC

26 Insurance Reinvestment Fund

00

00

00

00

00

Form CT-IRF

27 Small Business Administration Guaranty

00

00

00

00

Fee - Form CT-1120 SBA

28 Historic Homes Rehabilitation

00

00

00

00

00

Form CT-1120HH

00

00

00

00

29 Donation of Land - Form CT-1120DL

30 Historic Structures Rehabilitation

00

00

00

00

00

Form CT-1120HS

00

00

00

00

00

31 Historic Preservation - Form CT-1120HP

32 Urban and Industrial Site Reinvestment

00

00

00

00

00

Form CT-UISR

00

00

00

00

00

33 Green Buildings - Form CT-1120GB

34 Reserved for future use

35 Total Part I-D: Add Lines 20 through 33

in Columns A through E. Do not include

amounts on Line 22 and Line 23 in

00

00

00

00

00

Column D.

Form CT-1120K (Rev. 12/13)

Page 2 of 5

\\drs-ps102\perdrs\Per_DRS\Special\AFP\PROD\FORMS\13\CT\CT-1120K\Form CT-1120K 20130822.indd 20130822

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5