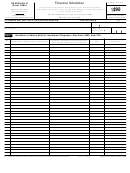

3

Schedule H (Form 5500) 2016

Page

(a) Amount

(b) Total

-123456789012345

2b(6)

(6) Net investment gain (loss) from common/collective trusts .........................

-123456789012345

2b(7)

(7) Net investment gain (loss) from pooled separate accounts .......................

-123456789012345

2b(8)

(8) Net investment gain (loss) from master trust investment accounts ............

-123456789012345

2b(9)

(9) Net investment gain (loss) from 103-12 investment entities ......................

(10) Net investment gain (loss) from registered investment

-123456789012345

2b(10)

companies (e.g., mutual funds) .................................................................

-123456789012345

c

Other income ..................................................................................................

2c

-123456789012345

d

Total income. Add all income amounts in column (b) and enter total .....................

2d

Expenses

e

Benefit payment and payments to provide benefits:

-123456789012345

2e(1)

(1) Directly to participants or beneficiaries, including direct rollovers ..............

-123456789012345

2e(2)

(2) To insurance carriers for the provision of benefits .....................................

-123456789012345

2e(3)

(3) Other ........................................................................................................

-123456789012345

2e(4)

(4) Total benefit payments. Add lines 2e(1) through (3) ..................................

-123456789012345

2f

f

Corrective distributions (see instructions) .......................................................

-123456789012345

g

2g

Certain deemed distributions of participant loans (see instructions) ................

-123456789012345

2h

h

Interest expense .............................................................................................

-123456789012345

i

2i(1)

Administrative expenses: (1) Professional fees ..............................................

-123456789012345

2i(2)

(2) Contract administrator fees .......................................................................

-123456789012345

2i(3)

(3) Investment advisory and management fees ..............................................

-123456789012345

2i(4)

(4) Other ........................................................................................................

-123456789012345

2i(5)

(5) Total administrative expenses. Add lines 2i(1) through (4) ........................

-123456789012345

j

2j

Total expenses. Add all expense amounts in column (b) and enter total ........

Net Income and Reconciliation

-123456789012345

k

2k

Net income (loss). Subtract line 2j from line 2d ...........................................................

l

Transfers of assets:

-123456789012345

(1) To this plan ...............................................................................................

2l(1)

-123456789012345

(2) From this plan ...........................................................................................

2l(2)

Accountant’s Opinion

Part III

3

Complete lines 3a through 3c if the opinion of an independent qualified public accountant is attached to this Form 5500. Complete line 3d if an opinion is not

attached.

a

The attached opinion of an independent qualified public accountant for this plan is (see instructions):

X

X

X

X

(1)

Unqualified

(2)

Qualified

(3)

Disclaimer

(4)

Adverse

X

X

b

Yes

No

Did the accountant perform a limited scope audit pursuant to 29 CFR 2520.103-8 and/or 103-12(d)?

c

Enter the name and EIN of the accountant (or accounting firm) below:

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCD

123456789

(1) Name:

(2) EIN:

d

The opinion of an independent qualified public accountant is not attached because:

X

X

(1)

This form is filed for a CCT, PSA, or MTIA.

(2)

It will be attached to the next Form 5500 pursuant to 29 CFR 2520.104-50.

Part IV

Compliance Questions

4

CCTs and PSAs do not complete Part IV. MTIAs, 103-12 IEs, and GIAs do not complete lines 4a, 4e, 4f, 4g, 4h, 4k, 4m, 4n, or 5.

103-12 IEs also do not complete lines 4j and 4l. MTIAs also do not complete line 4l.

During the plan year:

Yes

No

Amount

a

Was there a failure to transmit to the plan any participant contributions within the time

period described in 29 CFR 2510.3-102? Continue to answer “Yes” for any prior year failures until

fully corrected. (See instructions and DOL’s Voluntary Fiduciary Correction Program.) ....................

4a

b

Were any loans by the plan or fixed income obligations due the plan in default as of the

close of the plan year or classified during the year as uncollectible? Disregard participant loans

secured by participant’s account balance. (Attach Schedule G (Form 5500) Part I if “Yes” is

checked.) ........................................................................................................................................

4b

1

1 2

2 3

3 4

4