4

Form 8857 (Rev. 1-2014)

Page

Note. If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security

number on the top of all pages you attach.

Part III

Tell us if and how you were involved with finances and preparing returns for those tax years (Continued)

18

For the years you want relief, how were you involved in the household finances? Check all that apply. If the answers are not the

same for all tax years, explain.

You were not involved in handling money for the household. Explain below.

You knew the person on line 5 had separate accounts.

You had joint accounts with the person on line 5, but you had limited use of them or did not use them. Explain below.

You used joint accounts with the person on line 5. You made deposits, paid bills, balanced the checkbook, or reviewed the

monthly bank statements.

You made decisions about how money was spent. For example, you paid bills or made decisions about household purchases.

Other

▶

Explain anything else you want to tell us about your household finances

▶

Did you (or the person on line 5) incur any large expenses, such as trips, home improvements, or private schooling, or make

19

any large purchases, such as automobiles, appliances, or jewelry, during any of the years you want relief or any later years?

Yes. Describe (a) the types and amounts of the expenses and purchases and (b) the years they were incurred or made.

No.

Has the person on line 5 ever transferred assets (money or property) to you? (Property includes real estate, stocks, bonds, or

20

other property that you own or possess now or possessed in the past.) See instructions.

Yes. List the assets, the dates they were transferred, and their fair market values on the dates transferred. If the property was

secured by any debt (such as a mortgage on real estate), explain who was responsible for making payments on the debt, how much

was owed on the debt at the time of transfer and whether the debt has been satisfied. Explain why the assets were transferred to you.

If you no longer possess or own the assets, explain what happened with the assets.

No.

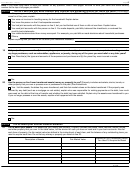

Part IV

Tell us about your current financial situation

21

Tell us about your assets. Your assets are your money and property. Property includes real estate, motor vehicles, stocks, bonds,

and other property that you own. In the table below, list the amount of cash you have on hand and in your bank accounts. Also list

each item of property, the fair market value (as defined in the instructions) of each item, and the balance of any outstanding loans you

used to acquire each item. Do not list any money or property you listed on line 20.

Balance of Any Outstanding Loans

Description of Assets

Fair Market Value

You Used To Acquire the Asset

8857

Form

(Rev. 1-2014)

1

1 2

2 3

3 4

4 5

5 6

6 7

7