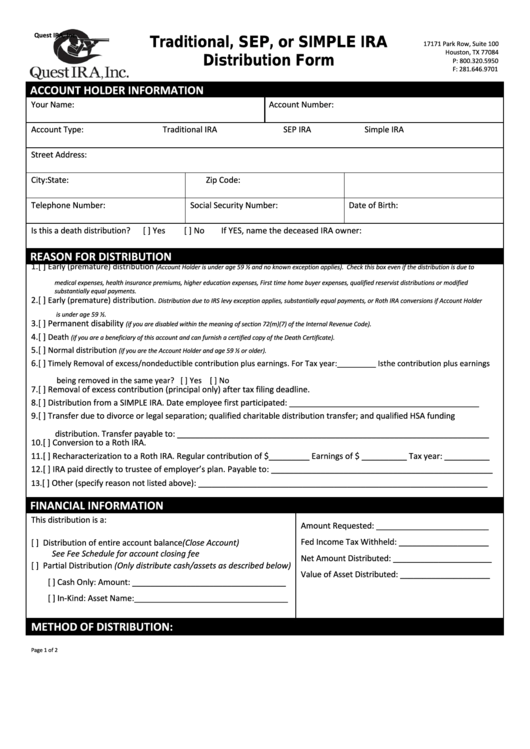

Quest IRA, Inc.

Traditional, SEP, or SIMPLE IRA

17171 Park Row, Suite 100

Houston, TX 77084

Distribution Form

P: 800.320.5950

F: 281.646.9701

ACCOUNT HOLDER INFORMATION

Your Name:

Account Number:

Account Type:

Traditional IRA

SEP IRA

Simple IRA

Street Address:

City:

State:

Zip Code:

Telephone Number:

Social Security Number:

Date of Birth:

Is this a death distribution?

[ ] Yes

[ ] No

If YES, name the deceased IRA owner:

REASON FOR DISTRIBUTION

1. [ ]

Early (premature) distribution

(Account Holder is under age 59 ½ and no known exception applies). Check this box even if the distribution is due to

medical expenses, health insurance premiums, higher education expenses, First time home buyer expenses, qualified reservist distributions or modified

substantially equal payments.

2. [ ]

Early (premature) distribution.

Distribution due to IRS levy exception applies, substantially equal payments, or Roth IRA conversions if Account Holder

is under age 59 ½.

3. [ ] Permanent disability

(if you are disabled within the meaning of section 72(m)(7) of the Internal Revenue Code).

4. [ ]

Death

(if you are a beneficiary of this account and can furnish a certified copy of the Death Certificate).

5. [ ]

Normal distribution

(if you are the Account Holder and age 59 ½ or older).

6. [ ]

Timely Removal of excess/nondeductible contribution plus earnings. For Tax year:_________ Is the contribution plus earnings

being removed in the same year? [ ] Yes [ ] No

7. [ ] Removal of excess contribution (principal only) after tax filing deadline.

8. [ ] Distribution from a SIMPLE IRA. Date employee first participated: __________________________________________

9. [ ] Transfer due to divorce or legal separation; qualified charitable distribution transfer; and qualified HSA funding

distribution. Transfer payable to: _____________________________________________________________________

10. [ ] Conversion to a Roth IRA.

11. [ ] Recharacterization to a Roth IRA. Regular contribution of $_________ Earnings of $ __________ Tax year: __________

12. [ ] IRA paid directly to trustee of employer’s plan. Payable to: _________________________________________________

[ ] Other (specify reason not listed above): ________________________________________________________________

13.

FINANCIAL INFORMATION

This distribution is a:

Amount Requested: _________________________

[ ] Distribution of entire account balance (Close Account)

Fed Income Tax Withheld: ____________________

See Fee Schedule for account closing fee

Net Amount Distributed: ______________________

[ ] Partial Distribution (Only distribute cash/assets as described below)

Value of Asset Distributed: ____________________

[ ] Cash Only: Amount: __________________________________

[ ] In-Kind: Asset Name:__________________________________

METHOD OF DISTRIBUTION:

Page 1 of 2

1

1 2

2