Bmo Funds Ira Distribution Form

Download a blank fillable Bmo Funds Ira Distribution Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Bmo Funds Ira Distribution Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

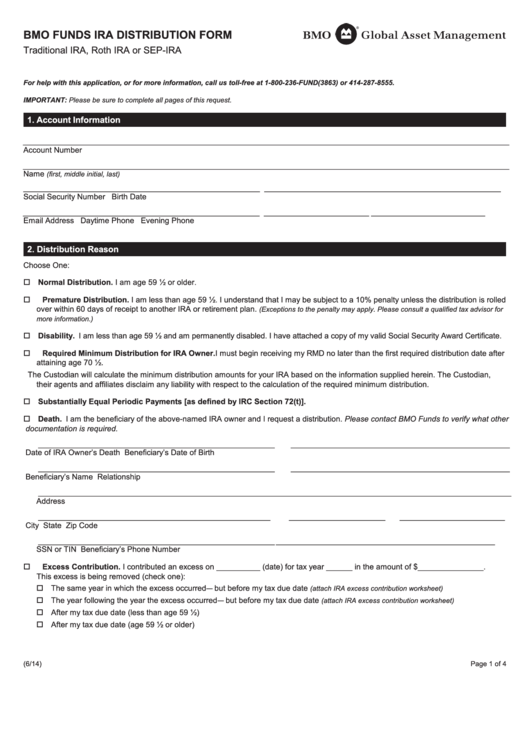

BMO FUNDS IRA DISTRIBUTION FORM

Traditional IRA, Roth IRA or SEP-IRA

For help with this application, or for more information, call us toll-free at 1-800-236-FUND(3863) or 414-287-8555.

IMPORTANT: Please be sure to complete all pages of this request.

1. Account Information

_______________________________________________________________________________________________________________

Account Number

_______________________________________________________________________________________________________________

Name

(first, middle initial, last)

______________________________________________________

______________________________________________________

Social Security Number

Birth Date

______________________________________________________

________________________

__________________________

Email Address

Daytime Phone

Evening Phone

2. Distribution Reason

Choose One:

o Normal Distribution. I am age 59 ½ or older.

o P remature Distribution. I am less than age 59 ½. I understand that I may be subject to a 10% penalty unless the distribution is rolled

over within 60 days of receipt to another IRA or retirement plan.

(Exceptions to the penalty may apply. Please consult a qualified tax advisor for

more information.)

o Disability. I am less than age 59 ½ and am permanently disabled. I have attached a copy of my valid Social Security Award Certificate.

o R equired Minimum Distribution for IRA Owner. I must begin receiving my RMD no later than the first required distribution date after

attaining age 70 ½.

The Custodian will calculate the minimum distribution amounts for your IRA based on the information supplied herein. The Custodian,

their agents and affiliates disclaim any liability with respect to the calculation of the required minimum distribution.

o Substantially Equal Periodic Payments [as defined by IRC Section 72(t)].

o Death. I am the beneficiary of the above-named IRA owner and I request a distribution. Please contact BMO Funds to verify what other

documentation is required.

______________________________________________________

__________________________________________________

Date of IRA Owner’s Death

Beneficiary’s Date of Birth

______________________________________________________

__________________________________________________

Beneficiary’s Name

Relationship

____________________________________________________________________________________________________________

Address

_____________________________________________________

______________________

________________________

City

State

Zip Code

______________________________________________________

__________________________________________________

SSN or TIN

Beneficiary’s Phone Number

o E xcess Contribution. I contributed an excess on __________ (date) for tax year ______ in the amount of $_______________.

This excess is being removed (check one):

o The same year in which the excess occurred — but before my tax due date

(attach IRA excess contribution worksheet)

o The year following the year the excess occurred — but before my tax due date

(attach IRA excess contribution worksheet)

o After my tax due date (less than age 59 ½)

o After my tax due date (age 59 ½ or older)

(6/14)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4