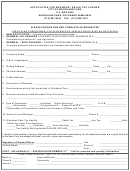

CITY OF SEATTLE

APPLICATION FOR BUSINESS LICENSE TAX CERTIFICATE - Page 2

NATURE OF BUSINESS:

Check all that apply and provide detail below. This information should be as detailed as possible.

Manufacturing-Extracting

Printing & Publishing

Tour Operator

Wholesale

Retail

Service

Transportation

Other

Utility Services

Charging Admission for Events/Shows

Gambling Activity

DOES YOUR BUSINESS OWN OR OPERATE PRICE SCANNING EQUIPMENT?

YES

NO

DESCRIBE IN DETAIL THE PRINCIPAL PRODUCT(s) OR SERVICE(s) RENDERED:

NOTE: Additional licenses or endorsements may be required depending on the business activity - please see instruction sheet under regulatory licenses.

NAME(S) OF SOLE PROPRIETOR, PARTNERS, CORPORATE OFFICERS, AND RESIDENT AGENTS:

List true name(s), residence address,

telephone number and date of birth of the sole proprietor or all partners or corporate officers/directors and their titles (attach a separate sheet, if needed).

NAME AND TITLE

RESIDENCE ADDRESS

CITY, STATE, ZIP

TELEPHONE

TAX REPORTING STATUS -

Seattle BUSINESS LICENSE TAX FORMS must be filed by every business, EVEN IF NO TAX IS DUE.

Based on the taxable revenue for your business as described below, please check one of the following reporting frequencies:

QUARTERLY -

Estimated ANNUAL taxable revenue is expected to be $150,000 or more.

ANNUAL -

Estimated ANNUAL taxable revenue is expected to be less than $150,000.

A Business granted ANNUAL reporting status by License & Tax Administration must file a combined tax return if there is more than one location.

If applicable, tax forms are mailed to the last known address - failure to receive the form does not preclude the requirements to file timely.

IF YOU PURCHASED THIS BUSINESS, DID YOU TAKE OVER

THE ENTIRE BUSINESS

ONLY A PORTION

FORMER OWNER'S NAME

CURRENT ADDRESS

CITY, STATE, ZIP

TELEPHONE

CUSTOMER NUMBER

A SIGNATURE IS REQUIRED IN ORDER TO PROCESS THE APPLICATION

As applicant, I

, certify or declare under penalty of perjury under the laws of the State of Washington

that the foregoing is true and correct. All information given is subject to verification with State of Washington, Department of Revenue.

SIGNATURE

DATE

PLEASE PRINT your NAME

TITLE

FOR OFFICE USE ONLY

Select appropriate fee based on estimated Seattle TAXABLE revenue:

$55.00

Taxable revenue will be LESS than $20,000

Processed by

$110.00

Taxable revenue will be $20,000 to $499,999

$480.00

Taxable revenue will be $500,000 to $1,999,999

$1,000.00

Taxable revenue will be $2,000,000 or greater

Tax Forms Mailed

For start date prior to 2017: calculate fees at $110 for the years 2015 and 2016 ($55 if

Enforcement

gross less than $20,000); $90 for years prior ($45 if gross less than $20,000)

IMPORTANT!

If start date is July 1 or later: Pay only half of the first year's fee

License # Issued

$

Additional Seattle Locations

X $10.00 =

TOTAL DUE

$

...................................................................................

1

1 2

2