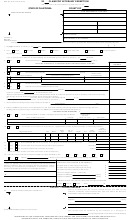

Form Boe-261 - Claim For Veterans' Exemption Page 2

ADVERTISEMENT

BOE-261 (S1B) REV. 9 (8-06)

PROVISIONS OF THE REVENUE AND TAXATION CODE

252.

VETERANS’ EXEMPTION. When making the first claim any person claiming the veterans’ exemption, or the spouse, legal

guardian, or conservator of such person, or one who has been granted a power of attorney by such person, shall appear before the

assessor, shall give all information required and answer all questions in an affidavit prescribed by the State Board of Equalization, and

shall subscribe and swear to the affidavit before the assessor. The assessor may require other proof of the facts stated before allowing

the exemption. In subsequent years the person claiming the veterans’ exemption, or the spouse, legal guardian, or conservator of such

person, or one who has been granted a power of attorney by such person, may file the affidavit under penalty of perjury by mail. Where

a claim is filed by a legal guardian or conservator of a person claiming the veterans’ exemption, or one who has been granted a power

of attorney by such claimant, the person filing the affidavit shall declare that he has sufficient knowledge of the financial affairs of the

claimant to give all information required and answer all questions in the affidavit under penalty of perjury.

252.1. VETERANS’ EXEMPTION; TRANSMITTAL OF DUPLICATE. Among other facts, the veterans’ exemption affidavit shall contain

a statement, showing the claimant’s residence. When the affidavit is filed in a county other than the county of the claimant’s residence,

it shall be filed in duplicate and the assessor shall transmit the duplicate copy to the assessor of the county of residence.

VETERANS’ EXEMPTION; MAKING AFFIDAVIT. If, because of active military service of the United States in time of war, sick-

253.

ness or other cause found to be unavoidable in the judgment of the assessor, an applicant for the veterans’ exemption is unable to

attend in person before the assessor, and no deputy is available to go to the place where he is located, then the applicant may make

and subscribe the affidavit before any person authorized to administer an oath. If, during time of war, the applicant is in active military

service of the United States or of any nation with which the United States is allied, or is outside of the continental limits of the United

States, or if the person entitled to the exemption is insane or mentally incompetent, a member of his immediate family, or his guardian,

or legal representative, having personal knowledge of the facts required to be set forth, may appear before the assessor and may make

and subscribe the affidavit on his behalf.

255.

TIME TO FILE AFFIDAVITS. (a) Affidavits required for [the veterans’ exemption] shall be filed with the assessor between the lien

date and 5 p.m. on February 15.

260.

NONCOMPLIANCE WITH PROCEDURE. If any person, claiming any exemption named in this article, fails to follow the required

procedure, the exemption is waived by the person.

261.

RECORDATION REQUIREMENT.

(a) Except as otherwise provided in subdivisions (b) . . . as a prerequisite to the allowance of either the veterans’ or welfare

exemption with respect to taxes on real property, the interest of the claimant in the property must be of record on the lien date in the

office of the recorder of the county in which the property is located. Failure of the claimant to establish the fact of such recordation to the

assessor constitutes a waiver of the exemption.

(b) A claimant for the veterans’ exemption who on the lien date has an interest in real property consisting of an unrecorded

contract of sale may in lieu of the recordation pursuant to subdivision (a) furnish or show the contract to the assessor and file an

affidavit with the assessor stating all of the following:

(1) That he purchased the real property pursuant to such unrecorded contract of sale.

(2) That under such unrecorded contract of sale he is obligated and responsible for the payment of the taxes.

273.5. VETERANS’ EXEMPTION; PARTIAL CANCELLATION OF TAX. (a) If a claimant for the veterans’ exemption for the 1976-77

fiscal year or any year thereafter fails to file the required affidavit with the assessor by 5 p.m. on February 15 of the calendar year in

which the fiscal year begins, but files that claim on or before the following December 10, an exemption of the lesser of three thousand

two hundred dollars ($3,200) or 80 percent of the full value of the property shall be granted by the assessor.

PROVISIONS OF THE PENAL CODE

126.

PUNISHMENT OF PERJURY. Perjury is punishable by imprisonment in the state prison for two, three or four years.

SUBORNATION OF PERJURY. Every person who willfully procures another person to commit perjury is guilty of subornation of

127.

perjury, and is punishable in the same manner as he would be if personally guilty of the perjury so procured.

129.

FALSE RETURN REQUIRED TO BE UNDER OATH. Every person who, being required by law to make any return, statement, or

report, under oath, willfully makes and delivers any such return, statement, or report, purporting to be under oath, knowing the same to

be false in any particular, is guilty of perjury, whether such oath was in fact taken or not.

YOU MUST FILE THIS CLAIM FOR VETERANS’ EXEMPTION WITH THE ASSESSOR BY FEBRUARY 15.

CERTIFICATION

I hereby certify that I am the (legal guardian) (conservator) (attorney in fact) for

and that I have signed

and filed this claim for a veterans’ exemption in that capacity. I further certify that I have sufficient knowledge

of the financial affairs of

to give all information and to answer all questions in this

affidavit under penalty of perjury.

SIGNATURE

DATE

REMARKS: (enter number of applicable line)

RECEIPT — DO NOT DETACH

Provisions of the Revenue and Taxation Code:

252.1. DUPLICATE TRANSMITTED TO COUNTY OF RESIDENCE. Among other facts, the veterans’ exemption affidavit shall contain a statement,

showing the claimant’s residence. When the affidavit is filed in a county other than the county of the claimant’s residence, it shall be filed in duplicate

and the assessor shall transmit the duplicate copy to the assessor of the county of residence.

255.

TIME TO FILE AFFIDAVITS. (a) Affidavits required for [the veterans’ exemption] shall be filed with the assessor between the lien date and

5 p.m. on February 15.

260.

NONCOMPLIANCE WITH PROCEDURE. If any person, claiming any exemption named in this article, fails to follow the required procedure, the

exemption is waived by the person.

(a) If a claimant for the veterans’ exemption for the 1976-77 fiscal year or any year thereafter fails to file the required

273.5. LATE FILING.

affidavit with the assessor by 5 p.m. on February 15 of the calendar year in which the fiscal year begins, but files that claim on or before

the following December 10, an exemption of the lesser of three thousand two hundred dollars ($3,200) or 80 percent of the full value of

the property shall be granted by the assessor.

This receipt is proof you have filed for the veterans’ exemption

and is not an indication that you have received the veterans’ exemption.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4