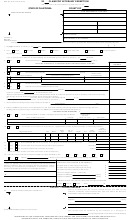

Form Boe-261 - Claim For Veterans' Exemption Page 4

ADVERTISEMENT

BOE-261 (S2B) REV. 9 (8-06)

Question 4.

REAL ESTATE LOCATED OUTSIDE

COUNTY — All your parcels outside this county must be listed here.

(this)

Enter the name of the county seat and the name of the state as well as the parcel number (if any) or other legal description in sufficient

detail so that the property can be identified. If the property is located in California, enter the assessed value if known (from a tax bill);

if located outside the State of California, enter the market value of the property.

Question 5.

BOAT/AIRCRAFT — Enter the California C.F. number of the boat or the F.A.A. number of the aircraft. Show location

information in sufficient detail so that the boat or aircraft can be located by a field deputy.

Question 6.

INTEREST IN AN UNINCORPORATED BUSINESS OR FARM — Enter the name and the address of the business or the

address of the farm in sufficient detail so that the business or agricultural property statement can be located by the Assessor. If you are

a partner, enter the combined interest of yourself and your spouse in the business or farm, such as 50%, 33 1/3%, etc. Whether

requested by the Assessor or not, you must file a Business or Agricultural Property Statement with the Assessor of the county in which

the property is located. Your business vehicles should be reported in question 10. The value of your interest in an incorporated business

should be reported in question 9. Because inventory, business cash on hand, checking accounts, accounts receivable, and other

nonassessable business assets are not included in the business or agricultural property statement, you should compute and enter the

appropriate amount in the space provided. If you have cattle, sheep, or racehorses that have not been reported to the Assessor on a

property statement or the annual racehorse tax forms, list in the “Remarks” section the number of cattle and sheep by type, age, and

sex and the name and location of each racehorse. The value of the animals listed in the “Remarks” section should not be included in the

amount entered in answer to question 6; the Assessor will determine the value of these animals.

Question 7.

MY HOUSEHOLD FURNISHINGS AND PERSONAL EFFECTS ARE LOCATED AT — Enter the street address and city

or other specific location. A post office box number is not acceptable.

Question 8.

REPORT ALL CASH IN POSSESSION, IN SAFE DEPOSIT BOXES, AND IN PERSONAL CHECKING AND SAVING

ACCOUNTS IN BANKS, SAVINGS AND LOAN, BUILDING AND LOAN, POSTAL SAVINGS, CREDIT UNIONS, ETC. — Enter the total

amount of all funds placed in the above or similar type organizations; include cash in your possession or place of safekeeping. Do not

include the same amounts covered in question 6. If these are joint accounts with persons other than your spouse, give details in the

“Remarks” section.

Question 9.

STOCKS AND BONDS (listed or unlisted), INCLUDING MUTUAL FUNDS AND U.S. BONDS — Enter the name of the

issuing corporation or government, quantity held, market value as of the close of business the end of December (12:01 a.m., January

1) and the total value of the stocks or bonds; attach a separate sheet if needed. If your own business is incorporated, enter the market

value of the shares which you own as of 12:01 a.m., January 1.

Question 10. AUTOMOBILES, TRUCKS, TRAILERS, MOTORCYCLES, ETC.: REGISTERED IN MY NAME, MY SPOUSE’S NAME,

OR NAME OF MY BUSINESS — List the registered owner correctly. If the automobile is owned by two or more people, as in the case

of a partnership, your proportionate share of the value will be used. The Assessor determines the value based on the information

furnished. The license fee and the class can be found on the registration slip of the vehicle. If a trailer, show total fees in “License Fee”

column and size of unit in “Model” column. Where applicable, indicate a double-unit mobile home by writing “dble” to the left of the name

of the registered owner. List unlicensed vehicles (mini-bikes, dune buggies, snowmobiles, etc.) in the “REMARKS” area; show year,

make, model, and cost.

Question 11. MONEY OWED TO ME AND/OR MY SPOUSE ON MORTGAGES, TRUST DEEDS, PERSONAL LOANS, ETC. — Enter the

face value of debts owed to you or your spouse less any repayments to and including the last day in December. If in your opinion, the

debts have a present cash value less than this amount, explain in the “Remarks” section.

Question 12. CASH OR LOAN VALUE (NOT FACE VALUE) OF LIFE INSURANCE POLICIES — Include each policy which can be

cashed in by you or your spouse, whether or not you desire to cash it in or obtain a loan, and whether or not either of you is the insured

or the beneficiary. You may determine the amount of cash or loan value by referring to the table provided in your policy. Take the figure

(usually stated as a certain amount per $1,000 of insurance) for the current anniversary date and multiply it by the number of multiples

of $1,000 in the face amount of the policy. From this amount, deduct any indebtedness to the company on or secured by the policy.

Question 13. ANY OTHER INVESTMENTS OR INTERESTS IN PROPERTY. IF YES, SHOW TYPE, LOCATION, AND VALUE OF

EACH ITEM ON THE REVERSE SIDE — List on the reverse side of the form any other property not included in questions 3-12. On the

front of the form enter the total value of the items listed on the reverse side. Examples of items that might be entered are: 1. Livestock

not reported in question 6; 2. Riding horses; 3. Cabin on government or other leased land; 4. Furniture or goods in a warehouse;

5. Property owned in part by other than the claimant or spouse (explain); 6. Membership in country clubs and similar organizations

where the membership can be sold for cash; 7. Funds or property held in your name or for your account or benefit by a trustee when you

have the power to revoke the trust; 8. Interest in pension or retirement funds and profit-sharing plans to the extent such interest can be

withdrawn or otherwise used without interruption in employment.

Question 14. I ELECT TO HAVE THE VETERANS’ EXEMPTION APPLIED TO — After reading the paragraph on the previous page

headed “Claimants with more than one taxable property,” insert numbers in the boxes to indicate the order in which you wish the

veterans’ exemption applied. If you wish the exemption applied to property located outside this county, you must contact the Assessor

of this county and complete an additional form. Taxable properties to which the exemption may be applied are those located in California

and reported in answer to questions 3, 4, and 5, part of those reported in answer to question 6 and possibly some of those reported in

answer to question 13. Non-veterans as well as veterans are exempt from taxation on items reported in answer to questions 7 to 12,

inclusive, and some items that claimants would report in answer to questions 6 and 13; the veterans’ exemption need not be applied to

these properties.

CERTIFICATION — The claim may be signed (a) by the person entitled to the exemption (the veteran, the veteran’s widow or widower,

the veteran’s pensioned mother, or the veteran’s pensioned father), (b) the claimant’s spouse, or (c) a legal guardian or conservator of

the claimant or one granted a power of attorney by the claimant. A member of the veteran’s immediate family other than the spouse

(such as parent, child, brother, or sister) may sign only under one or more of the following conditions; (a) the veteran is in active military

service of the United States or an allied nation during time of war, (b) the veteran is outside the continental limits of the United States,

(c) the veteran is insane or mentally incompetent. When a claim is signed by a legal guardian or conservator or a person holding power

of attorney, the agent should sign his or her own name and enter his legal capacity below the signature; he or she should then complete

the certificate on the back of the claim form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4