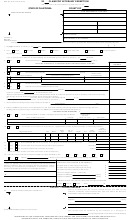

Form Boe-261 - Claim For Veterans' Exemption Page 3

ADVERTISEMENT

BOE-261 (S2F) REV. 9 (8-06)

VETERANS’ EXEMPTION INFORMATION AND INSTRUCTIONS

(Read carefully)

California law provides for the exemption from taxation of the property to the amount of $4,000 of a resident (a) who is serving in or has

served in and has been discharged under honorable conditions from service in the Armed Forces in time of war or other specified time,

(b) who is the unmarried widow or widower of a deceased veteran, or (c) who is the pensioned parent of a deceased veteran. The

claimant must meet certain property ownership qualifications. No such exemption shall apply if (a) the unmarried veteran or unmarried

pensioned parent owns property valued at $5,000 or more, (b) a married veteran or married pensioned parent who, together with the

spouse, owns property valued at $10,000 or more, or (c) the unmarried widow or widower of a deceased veteran owns property in

excess of $10,000. Special provisions regarding exemptions for a veteran who, because of injury or disease incurred in military service,

is blind in both eyes, has lost the use of two or more limbs, or is totally disabled are not covered in these instructions; a veteran with the

above described injuries, or the unmarried widow or widower of such a veteran, should file BOE-261-G, Disabled Veterans’ Property Tax

Exemption.

Beginning in 1981 property was assessed at its full value instead of 25 percent of its value as in prior years, yet the $5,000 ($10,000)

limitation has not been changed. In determining whether the $5,000 ($10,000) limitation disqualifies a claimant the current statute

(section 205.1, Revenue and Taxation Code) provides that whenever assessed value is used to determine eligibility, 25 percent of the

assessed value of taxable real and personal property and the market value of nontaxable personal property are to be used in order to

maintain the same proportionate values as in prior years. Therefore, 25 percent of the assessed value is used for items listed in

questions 3, 4, and 5, the taxable portion of your business (question 6), and the taxable items listed in question 13. The market value is

used for items listed in questions 7, 8, 9, 10, 11, 12, the nontaxable portion of your business which may now include inventory or

livestock (question 6), and the nontaxable items listed in question 13. The amount of encumbrance on property cannot be deducted in

determining the value of the property.

The claim for exemption must be filed at the Assessor’s Office by 5 p.m. on February 15 or mailed by that date. The lesser of $3,200 or

80 percent of the full value of the property will be granted if the claim is filed between February 16 and December 10 of the calendar

year in which the fiscal year begins.

Exemption may be allowed only upon (1) personal property assessed to the person entitled to the exemption, (2) real property recorded

in the name of the claimant or in the names of the claimant and spouse as of the lien date, and (3) real property being purchased under

an unrecorded contract of sale where the claimant furnishes or shows the contract to the Assessor and files an affidavit that he or she

purchased the property under such contract and is responsible under the contract for payment of the taxes. In addition, if the claimant

is married and does not own property eligible for the full amount of the exemption, property of the spouse may be exempt for the unused

balance of the exemption.

CLAIMANTS WITH MORE THAN ONE TAXABLE PROPERTY

Passage of the Property Tax Relief Act of 1972 makes the choice of the property against which the veterans’ exemption is allowed when

a claimant has more than one taxable property much more important than it previously was. A $7,000 homeowners’ exemption is

available to owner-occupants on January 1 each year of a single living unit, whether in a separate or a multiple-unit structure. It

provided, however, that the homeowners’ exemption and the veterans’ exemption were not allowable on the same property. Anyone

who is eligible for a veterans’ exemption and owns taxable property other than his or her principal place of residence, whether in this

county or elsewhere in California, will find it to his or her advantage to claim the veterans’ exemption on such other property. For

example, if you own and occupy a home assessed at $14,000 and own other property assessed at $2,000, you may claim the homeowners’

exemption on the home and the veterans’ exemption on the other property. If both claims are approved, your total exempt assessed

value will be $9,000 ($7,000 on the home plus $2,000 on the other property) rather than the $4,000 that would be exempt if you claimed

the veterans’ exemption on your home. See instructions for question 14.

CLAIMANTS WITH ONLY ONE TAXABLE PROPERTY

If your dwelling is the only taxable property you own or are purchasing and is your principal place of residence, you will find it to your

advantage to claim the $7,000 homeowners’ exemption. If the property you own is not eligible for the homeowners’ exemption or it is not

your principal place of residence, file your veterans’ exemption claim. To become eligible for the homeowners’ exemption, obtain a copy

of the form on which to claim this exemption from the Assessor, complete it, and file it with the Assessor by February 15.

Check yes or no wherever boxes for such entries are provided. Where dollar amounts are to be entered, show amounts as of

12:01 a.m., January 1.

Question 1.

MY LEGAL RESIDENCE ON JANUARY 1 WAS — Enter street number, city, state and zip code where you live when not

called elsewhere for labor or other special or temporary purposes and a telephone number where you can be reached. There can be

only one legal residence. The intent of the applicant that a certain place is his residence must be coupled with the substantial physical

presence of the applicant at that place. However, a person serving in the armed forces does not lose residence by reason of being

stationed outside of the state of his or her residence. Likewise, the fact that a member of the armed forces is present in California does

not make him a legal resident. A member not claiming residence in the State of California should not complete this form, but should

complete the form BOE-261-D, Soldier’s and Sailor’s Civil Relief Act Declaration, which can be obtained from the Assessor.

Question 2.

I AM SINGLE, MARRIED, WIDOW, WIDOWER, LEGALLY SEPARATED, DIVORCED, PENSIONED PARENT. MY

SPOUSE’S NAME IS — Check the appropriate box. Check “Divorced” only if the decree is final. If you are a married man, enter the first

name, initial, and maiden name of your wife. The pension referred to here is based upon the service of a deceased veteran.

REAL ESTATE LOCATED IN

COUNTY — All your parcels in this county must be listed here. If parcel

Question 3.

(this)

numbers are preprinted in this question, you need only check the accuracy of those numbers listed and add any that have been omitted.

If parcel numbers are not preprinted, enter the parcel number from your tax bill. If you do not have a parcel number, enter the legal

description of the property, listing either the section, township, and range, or the lot, block, and tract, or the metes and bounds description

from your deed. (Unless otherwise requested, the Assessor will allow the exemption on properties in the order in which they are listed

in the answer to this question.) If you desire that the exemption be applied to other property, you must check one of the boxes in

question 14.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4