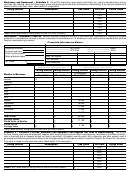

Tax Forms 920-Nt Examples - County Return Of Taxable Business Property, 921-Nt - Ohio Balance Sheet - 2002 Page 2

ADVERTISEMENT

This exemption is not transferable to another taxpayer and

of months in Ohio business. If monthly inventory records are

cannot be carried forward or back to any other year. A tax-

not maintained, a gross profits computation may be used

payer not having a personal property tax liability because of

(Rule 5703-3-16).

the $10,000 exemption is by Ohio law required to file a per-

sonal property tax return. A return must be filed to enable

The value of manufacturing inventory must include the costs

reimbursement to the County by the State for taxes not paid

of raw material, goods-in-process and finished goods. Goods-

due to the exemptions, and to substantiate the amount and

in-process and finished goods must include all factory bur-

location of the exemption claimed. When a return is not

den and overhead costs attributable to the manufacturing

timely filed, one-half of the allowable exemption is for-

facilities and process. Such costs include, but shall not be

feited.

limited to, indirect labor, insurance, utilities, taxes, transpor-

tation, rents and leases, repairs and maintenance, deprecia-

Exempt Property – Includes property used in agriculture,

tion and amortization (Rule 5703-3-27).

pollution control facilities certified as exempt, energy conver-

sion facilities certified exempt, patterns, jigs, dies and draw-

The value of merchandising inventory must include the costs

ings not held for sale, construction in progress not capable of

to acquire the inventory, taxes and freight. Inventories car-

use, and registered motor vehicles and aircraft.

ried at retail must be restated at cost. Consigned manufac-

turing or merchandising inventory must be listed by the owner,

Leased Property – Must be listed by the owner, regardless

but inventory consigned to a merchant from outside Ohio must

of the terms of the lease. If the lessee is obligated to pur-

be listed by the merchant.

chase the property, then he is deemed to be the owner, oth-

erwise the lessor is deemed to be the owner. If you lease

Supply inventories of a manufacturer must be listed in Sched-

property to a public utility or an interexchange telecommuni-

ule 3 on the average basis. All other supply inventories must

cations company, contact the Department of Taxation, Prop-

be listed as of the listing date in Schedule 4. Inventories of

erty Tax Division, for instructions. Lessee’s must list all tan-

taxpayers other than manufacturers and merchants must be

gible personal property held under lease on tax listing date

listed as of listing date in Schedule 4. Such inventories in-

on Tax Form 920, Ohio Balance Sheet, Exhibit C.

clude those of mines, quarries, laundries, dry cleaners, con-

tractors, repair shops, garages, etc.

Inventories – Ohio law requires inventories of manufactur-

ers and merchants to be listed on the average monthly basis.

Taxing Districts – Property must be listed in the taxing dis-

The average value is determined by dividing the sum of the

trict where it is located. Taxing district names normally con-

month-end values in each taxing district by the number of

sist of a township, city or village and school district. Cities

months engaged in business in Ohio in that year., i.e., a mer-

may have more than one taxing district. If you do not know

chant moving from taxing district “A” to taxing district “B” dur-

your taxing district, check your real estate bills or contact your

ing the year would report the monthly values for each taxing

county auditor.

district separately and divide the total of each by the number

Sample Tax Return of a New Taxpayer

Queen’s Specialty Shops, Inc., incorporated in Ohio on July

days of engaging in business, which in this example would

15, 2002. The shop is a small retail operation that special-

be November 12, 2002. Month-end inventory values are es-

izes in the sale of original art and craft items. Although the

timated for August through December, and the total of all such

business was incorporated in July, it was a month later when

values is divided by five to determine the average. The true

the company opened its doors for business the first day of

value of all other property is its cost. All listed values are then

business was August 13, 2002.

prorated by the fraction of four-twelfths, since the taxpayer

will be engaged in business for four full months in 2002. The

The furniture and fixtures consist of wall shelving, center dis-

completed tax return required to be filed by Queen’s Spe-

play islands a desk and file cabinet in a small room at the

cialty Shops, Inc. for 2002 follows.

rear of the shop. The inventory is purchased from a select

group of local amateur artists.

While this return indicates that no tax is owed by the tax-

payer because of the $10,000 exemption, the return must be

The accounting records will be kept on an accrual basis. In-

filed. The county and school district will be reimbursed for

ventory records reflect cost and will be accurately maintained

the amount of tangible property taxes not paid due to the

to provide future month-end inventory values.

$10,000 exemption. A return must be filed so that the county

auditor may certify to the Auditor of State the amount of taxes

A new taxpayer return and balance sheet using an August

to be reimbursed from the state treasury.

13, 2002 listing date are required to be filed within ninety

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5