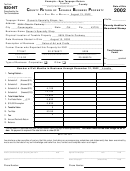

Tax Forms 920-Nt Examples - County Return Of Taxable Business Property, 921-Nt - Ohio Balance Sheet - 2002 Page 5

ADVERTISEMENT

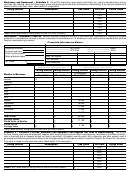

Tax Form

E

– O

B

S

2002

921-NT

XAMPLE

HIO

ALANCE

HEET

(Required to be Filed with Tax Form 920-NT)

Prescribed by the

Tax Commissioner

Queen’s Specialty Shops, Inc.

32-0756971

Name __________________________________ FEIN/Social Security No. _________________

August 13,

Balance Sheet as of First Day of Business ________________________ 2002

Within Ohio

Total

Assets

Net Book Values

Net Book Values

1. Cash and Deposits .........................................................................

525

2. Notes and Accounts Receivable ...................................................

3. Inventories

A) Manufacturing ............................................................................

16,500

B) Merchandising ...........................................................................

C) Supplies–Manufacturing ............................................................

D) Supplies–Other ..........................................................................

E) Consigned .................................................................................

F) Agricultural Machinery & Equipment (Merchandise) ..................

G) Exempted Inventory ...................................................................

H) Other Inventory ..........................................................................

4. Investments ....................................................................................

5. Land ................................................................................................

Ohio Cost

6. Buildings

A) Taxed as Real Estate .........................................

B) Taxed as Personal Property ...............................

7. Leasehold Improvements

A) Taxed as Real Estate .........................................

B) Taxed as Personal Property ...............................

8. Machinery & Equipment

A) Taxed as Real Estate .........................................

B) Taxed as Personal Property ...............................

51,140

51,140

9. Furniture & Fixtures ...............................................

10. Personal Property Leased to Others

A) Taxable ..............................................................

B) Non-Taxable ......................................................

11. Capitalized Leases .................................................

12. Exempt Personal Property located in an:

Enterprise Zone (Attach Form 913EX), or

Hazardous Substance Reclamation Area .............

13. Certified Exempt Facilities ....................................

14. Patterns, Jigs, Dies & Drawings ...........................

15. Construction in Progress

A) Real Property .....................................................

B) Personal Property Capable of Use .....................

C) Personal Property Not Capable of Use ..............

16. Small Tools .............................................................

17. Vehicles & Aircraft

A) Registered or Licensed ......................................

B) Other .................................................................

Prepaid Expenses

143

18. Other Assets _____________________________ ....................

Deferred Charges

_____________________________ ....................

228

19. Total Assets ....................................................................................

68,536

Liabilities and Net Worth

20,000

20. Notes, Accounts Payable, Bonds and Mortgages ...............................................................

9,011

21. Accrued Expenses .................................................................................................................

525

22. Other Liabilities, Deferred Credits ........................................................................................

23. Preferred Stock ......................................................................................................................

3,000

24. Common Stock ......................................................................................................................

36,000

25. Additional Paid-In Capital ......................................................................................................

26. Retained Earnings .................................................................................................................

27. Appropriated Earnings ..........................................................................................................

28. Owner's Capital ......................................................................................................................

29. Other .......................................................................................................................................

68,536

30. Total Liabilities & Net Worth .................................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5