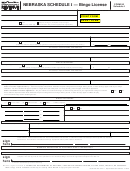

FORM 458

Worksheet A — Part I

Schedule I

Line 8, Other Income or Adjustments

Worksheet A

A Net business income including rental, or farm income, or (loss) ......................................................... A

B Capital gain or (loss) ........................................................................................................................... B

C Other gain or (loss) ............................................................................................................................. C

D Unemployment compensation ............................................................................................................. D

E Any other income or (adjustments reducing income.) Explain:

E

F Penalty on early withdrawal of savings................................................................................................

F

G Total of lines A through E, minus line F (enter this amount here and on Part I, line 8) ................... G

Retain a copy for your records.

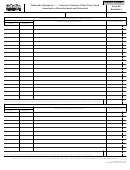

Instructions

Who Must File. This Form 458 Schedule I must be filed by persons applying for a homestead exemption, who are not filing

as a veteran drawing compensation from the Department of Veteran’s Affairs (DVA) or as a paraplegic veteran or multiple

amputee whose home was substantially contributed to by the DVA. This form is to be attached to and filed with the Nebraska

Homestead Exemption Application or Certification of Status, Form 458. (See Form 458 Instructions). If you filed, or would

have filed as married for Nebraska individual income tax purposes for 2015, you must include income for both you and your

spouse, even if you filed as “married, filing separately.” Each additional owner who occupied the homestead during any part

of 2015 must also report their income on a separate schedule.

When and Where to File. Schedule I must be attached to the Form 458 and filed with your county assessor, after

February 1, 2016 and by June 30, 2016.

Specific Instructions

Note – Do NOT include the following on the income statement:

•

Department of Veterans Affairs disability compensation;

•

Supplemental Security Income (SSI);

•

Worker’s Compensation Act payments;

•

Child support payments;

•

Aid to Dependent Children (ADC); and

•

Nebraska Department of Health and Human Services aid.

Exclude Social Security payments based on disability for applicants and spouses under their full retirement age (generally

age 66) EXCEPT for any portion of the benefits included in federal adjusted gross income (AGI). Disability benefits

automatically convert to retirement benefits at full retirement age and must be reported. See

SSA Publication No.

05-10035.

Part I

Line 1, Wages and Salaries. Include any wages, salaries, fees, commissions, tips, bonuses, etc. received in 2015, even

if you do not have a Federal Form W-2. If you have a Federal Form W-2, this information is shown in Box 1.

Line 2, Social Security Retirement Income. Report net benefits received in 2015, as shown in Box 5, Federal

Form SSA-1099. Do NOT subtract Medicare premiums or any other adjustments from the amount in Box 5.

Line 3, Tier I Railroad Retirement Income. Include Tier I net Social Security equivalent benefit received in 2015, as

shown in Box 5, Federal Form RRB-1099.

Line 4a and 4b, Total Pensions and Annuities. On line 4a, include total payments from retirement plans, life insurance

annuity contracts, profit-sharing plans, and employee savings plans. Include any gross distribution received in 2015, as shown

in Box 1, Federal Form 1099-R. Include Tier II, contributory amount paid, vested dual benefits, and supplemental annuities

as shown in Box 7, Federal Form RRB-1099-R. On line 4b, report the taxable amount from Box 2(a), Form 1099-R. See

Federal Form 1099-R and IRS Publication 575.

Line 5a and 5b, IRA Distributions. On line 5a, report the total payments received in 2015 from your IRA as shown in

Box 1, Federal Form 1099-R. On line 5b, report the taxable amount from Box 2(a), Form 1099-R. Do not report any amount

from a qualified IRA rollover. See Federal Form 1099-R and IRS Publication 590.

Line 6, Tax Exempt Interest and Dividends. Report the total interest received in 2015 on tax exempt obligations. State

and local bond income from both Nebraska and out-of-state obligations must be included. Include any exempt interest from

a mutual fund or other regulated investment company. Do not include interest earned on your IRA, or excludable interest on

series EE bonds. See Federal Form 8815.

1

1 2

2