Form T1 General - Income Tax And Benefit Return - 2013

ADVERTISEMENT

Protected B

when completed

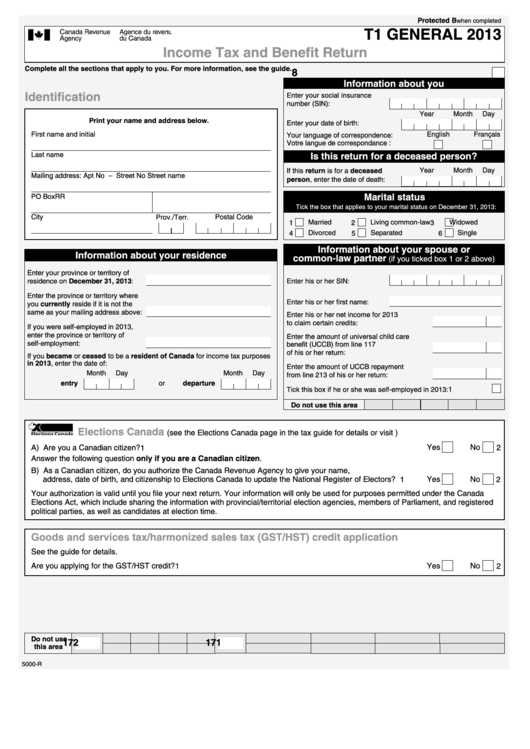

T1 GENERAL 2013

Income Tax and Benefit Return

Complete all the sections that apply to you. For more information, see the guide.

8

Information about you

Identification

Enter your social insurance

number (SIN):

Year

Month

Day

Print your name and address below.

Enter your date of birth:

First name and initial

English

Français

Your language of correspondence:

Votre langue de correspondance :

Last name

Is this return for a deceased person?

Year

Month

Day

If this return is for a deceased

Mailing address: Apt No – Street No Street name

person, enter the date of death:

PO Box

RR

Marital status

Tick the box that applies to your marital status on December 31, 2013:

City

Prov./Terr.

Postal Code

Married

Living common-law

Widowed

1

2

3

Divorced

Separated

Single

4

5

6

Information about your spouse or

Information about your residence

common-law partner

(if you ticked box 1 or 2 above)

Enter your province or territory of

residence on December 31, 2013:

Enter his or her SIN:

Enter the province or territory where

Enter his or her first name:

you currently reside if it is not the

same as your mailing address above:

Enter his or her net income for 2013

to claim certain credits:

If you were self-employed in 2013,

enter the province or territory of

Enter the amount of universal child care

self-employment:

benefit (UCCB) from line 117

of his or her return:

If you became or ceased to be a resident of Canada for income tax purposes

in 2013, enter the date of:

Enter the amount of UCCB repayment

Month

Day

Month

Day

from line 213 of his or her return:

entry

or

departure

Tick this box if he or she was self-employed in 2013:

1

Do not use this area

Elections Canada

(see the Elections Canada page in the tax guide for details or visit )

A) Are you a Canadian citizen? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

1

No

2

Answer the following question only if you are a Canadian citizen.

B) As a Canadian citizen, do you authorize the Canada Revenue Agency to give your name,

address, date of birth, and citizenship to Elections Canada to update the National Register of Electors? . . . . . .

Yes

No

1

2

Your authorization is valid until you file your next return. Your information will only be used for purposes permitted under the Canada

Elections Act, which include sharing the information with provincial/territorial election agencies, members of Parliament, and registered

political parties, as well as candidates at election time.

Goods and services tax/harmonized sales tax (GST/HST) credit application

See the guide for details.

Are you applying for the GST/HST credit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

1

2

Do not use

172

171

this area

5000-R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4