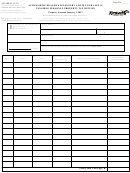

SECTION V

FORM 103 - LONG

TANGIBLE PERSONAL PROPERTY

SCHEDULE A

See 50 IAC 4.2-4

CONFIDENTIAL

JANUARY 1, 2017

Federal Identification Number

Line

Report all personal property assessable to this taxpayer below. (Round all figures below to nearest dollar)

1

Total cost of tangible depreciable personal property. (50 IAC 4.2-4-2)

$

2

Adjustment to federal tax basis per Form 106. (50 IAC 4.2-4-4)

3

Total cost and base year value of tangible depreciable personal property. (Line 1 plus 2)

$

Deduct Exempt Property (See 50 IAC 4.2-11.1)

COST

4

Stationary industrial air purification systems. (Attach Form 103-P)

$

5

Industrial waste control facilities. (Attach Form 103-P)

6

Enterprise information technology equipment. (Attach Form 103-IT)

Number of Units

7

Vehicles / airplanes subject to excise tax.

$

Total cost of exempt property (Deduct from Line 3 and enter on Line 8)

8

Subtotal

$

Additions: See 50 IAC 4.2-1-1.1 and 50 IAC 4.2-4-3(b) and 4

9

Cost of all depreciable personal property still in use but written off. (50 IAC 4.2-4-3(b))

$

10

Cost of installation and foundations applicable to depreciable personal property. (50 IAC 4.2-4-2(d))

Cost of interest incurred during construction and installation applicable to depreciable personal property.

11

(50 IAC 4.2-4-3(j))

Total cost and base year value of assessable depreciable personal property.

12

(add Lines 8, 9, 10 and 11. Line 12 must agree with Line 52 Column A)

$

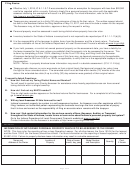

TOTAL COST

ADJUSTMENTS

ADJUSTED COST

POOLING SUMMARY

TRUE TAX VALUE

COLUMN A

COLUMN B

COLUMN C

(From Schedule A-1 or Form 103-P5)

COLUMN D

52

Total All Pools

$

$

$

$

30% of Adjusted Cost (Line 52, Column C) (enter zero (0) if filing 103-P5

53

$

and entity is a qualified steel mill or oil refinery per IC 6-1.1-3-23).

54

Greater of Lines 52D or 53.

$

Adjustments to True Tax Value

Cost

Equipment not placed in service and/or critical

55

X 10%

$

spare parts (50 IAC 4.2-6-1 & 6) per Form 106.

Cost

56

Tools, dies, jigs, fixtures, etc., per Form 103-T. (50 IAC 4.2-6-2)

$

$

Cost

Permanently retired equipment (50 IAC 4.2-4-3) and/or returnable

57

$

containers (50 IAC 4.2-6-4) per Form 106.

$

Cost

Commercial aircraft and commercial bus line fleet, not subject to excise tax per

58

$

Form 103-I. (50 IAC 4.2-10)

$

59

Total additions to True Tax Value. (Lines 55, 56, 57 and 58)

$

60

Total True Tax Value before adjustments for "Abnormal Obsolescence." (Line 54 plus Line 59)

$

61

Abnormal Obsolescence Adjustment per Form 106. (50 IAC 4.2-4-8)

$

62

Total True Tax Value of personal property. (To page 1, Form 103 Summary)

$

Page 2 of 4

1

1 2

2 3

3 4

4