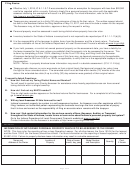

Filing Basics:

Effective July 1, 2015, IC 6-1.1-3-7.2 was amended to allow an exemption for taxpayers with less than $20,000

cost to be reported within a county. Failure to timely file a personal property tax return with the applicable

assessor declaring the exemption will result in a $25 penalty. For more information, refer to this link:

Taxpayers may request up to a thirty (30) day extension of time to file their return. The written request should

be sent to the Assessor before the filing deadline of May 15, 2017, and should include a reason for the request.

The Assessor may, at their discretion, approve or deny the request in writing.

Personal property must be assessed in each taxing district where property has a tax situs.

Inventory located in the State of Indiana is exempt and is not required to be reported per IC 6-1.1-1-11(b)(3).

It is the responsibility of the taxpayer to obtain forms from the Assessor and file a timely return. The forms

are also available on-line at the Indiana Department of Local Government Finance’s website at

If you hold, possess, or control not-owned personal property on the assessment date, you have a liability for

the taxes imposed for that year unless you establish that the property is to be assessed to the owner. This

is done by completing a Form 103-N, attaching it to the Form 103-Long, and filing it with the Assessor.

A taxpayer declaring the exemption on page one of this form may, as deemed necessary by the applicable

assessor, need to file Form 103-O or 103-N, as applicable, to verify that he is the appropriate taxpayer to claim

the exemption.

NOTE: Failure to properly disclose lease information may result in a double assessment. (IC 6-1.1-2-4(a))

Taxpayers who discover an error was made on their original timely filed personal property tax return have

the right to file an amended return. The amended return must be filed within twelve (12) months of the due

date or the extended due date (if up to a thirty (30) day extension was granted) of their original return.

Frequently Asked Questions:

A.

How do I find out my Taxing District Name and Number?

You will need to contact your County Assessor for assistance since heavily populated areas can have several

taxing districts within a single township.

B.

How do I find out my NAICS number?

This six-digit code number appears on the federal returns filed for businesses. For a complete list of the codes,

go to

C.

Will my local Assessor fill this form out for me?

Indiana’s personal property tax system is a self-assessment system. An Assessor can offer assistance with the

filing; however, an authorized person representing the business must sign the form under penalties of perjury

that it is true and correct so the responsibility of filing an accurate return remains with the taxpayer.

D.

How can I find contact information for the various county offices (Assessor, Auditor, or Treasurer)

throughout the State of Indiana, locate forms or learn more about Indiana’s personal property tax system?

Go to the Indiana Department of Local Government Finance’s website at

Contact information for the Assessor is available at

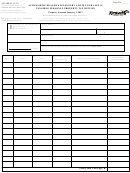

SECTION VI

INFORMATION OF NOT-OWNED PERSONAL PROPERTY WHICH IS TO BE ASSESSED TO THE OWNER

NOTE: This form is for the reporting of two or less Operating Leases. For all other leases, the Form 103-N (for the lessee)

and the Form 103-O (for the lessor) should be utilized. For more information on the reporting of leased equipment, refer to

50 IAC 4.2-8. Failure to properly disclose lease information may result in a double assessment.

Name and

Location of

Date of Lease

Model Number

Cost,

Quantity

Address of the Owner

Property

(month, day, year)

and Description

if Known

Page 4 of 4

1

1 2

2 3

3 4

4