Save

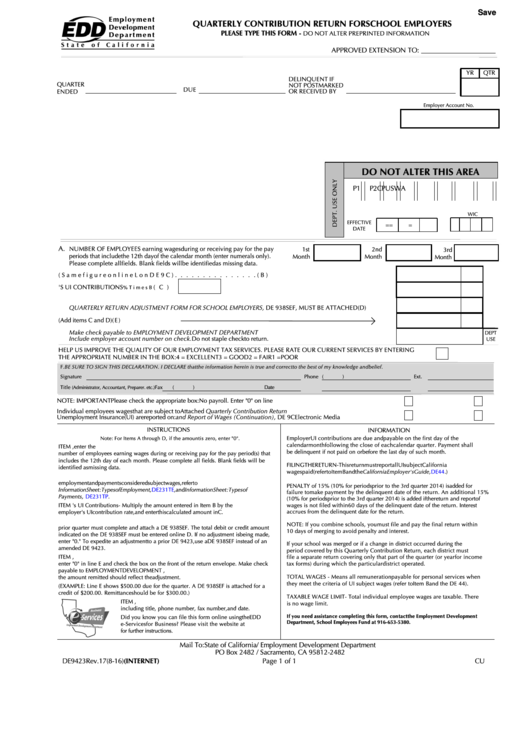

QUARTERLY CONTRIBUTION RETURN FOR SCHOOL EMPLOYERS

PLEASE TYPE THIS FORM -

DO NOT ALTER PREPRINTED INFORMATION

APPROVED EXTENSION TO: _____________________

YR

QTR

DELINQUENT IF

QUARTER

NOT POSTMARKED

DUE

OR RECEIVED BY

ENDED

Employer Account No.

DO NOT ALTER THIS AREA

P1

P2

C

P

U

S

W

A

WIC

Mo.

Day

Yr.

EFFECTIVE

=

=

=

DATE

A.

NUMBER OF EMPLOYEES earning wages during or receiving pay for the pay

1st

2nd

3rd

periods that include the 12th day of the calendar month (enter numerals only).

Month

Month

Month

Please complete all fields. Blank fields will be identified as missing data.

B. TOTAL SUBJECT WAGES PAID THIS QUARTER (Same figure on line L on DE 9C) . . . . . . . . . . . . . . .

(B)

C. EMPLOYER'S UI CONTRIBUTIONS

. . . . . . . . . . . . . . . . . . . . .

(C)

% Times B

D. ADJUSTMENT TO PRIOR QUARTERS

QUARTERLY RETURN ADJUSTMENT FORM FOR SCHOOL EMPLOYERS, DE 938SEF, MUST BE ATTACHED

(D)

E. TOTAL TAXES DUE (Add items C and D)

( E )

Make check payable to EMPLOYMENT DEVELOPMENT DEPARTMENT

DEPT

Include employer account number on check. Do not staple check to return.

USE

HELP US IMPROVE THE QUALITY OF OUR EMPLOYMENT TAX SERVICES. PLEASE RATE OUR CURRENT SERVICES BY ENTERING

THE APPROPRIATE NUMBER IN THE BOX: 4 = EXCELLENT

3 = GOOD

2 = FAIR

1 = POOR

F.

BE SURE TO SIGN THIS DECLARATION. I DECLARE that the information herein is true and correct to the best of my knowledge and belief.

Signature

Phone (

)

Ext.

Title

Fax

(

)

Date

(Administrator, Accountant, Preparer. etc.)

NOTE: IMPORTANT

Please check the appropriate box:

No payroll. Enter "0" on line B.

Final return

Individual employees wages that are subject to

Attached Quarterly Contribution Return

Unemployment Insurance (UI) are reported on:

and Report of Wages (Continuation), DE 9C

Electronic Media

INSTRUCTIONS

INFORMATION

Employer UI contributions are due and payable on the first day of the

Note: For Items A through D, if the amount is zero, enter "0".

calendar month following the close of each calendar quarter. Payment shall

ITEM A. Number of Employees - For each of the three months in the quarter, enter the

be delinquent if not paid on or before the last day of such month.

number of employees earning wages during or receiving pay for the pay period(s) that

includes the 12th day of each month. Please complete all fields. Blank fields will be

FILING THE RETURN - This return must report all UI subject California

identified as missing data.

wages paid (refer to Item B and the California Employer's Guide,

DE

44.)

ITEM B. Total Wages in Subject Employment - Enter the total of ALL UI subject wages

paid. For special classes of employment and payments considered subject wages, refer to

PENALTY of 15% (10% for periods prior to the 3rd quarter 2014) is added for

Information Sheet: Types of Employment,

DE

231TE, and Information Sheet: Types of

failure to make payment by the delinquent date of the return. An additional 15%

Payments,

DE

231TP.

(10% for periods prior to the 3rd quarter 2014) is added if the return and report of

ITEM C. Employer's UI Contributions - Multiply the amount entered in Item B by the

wages is not filed within 60 days of the delinquent date of the return. Interest

employer's UI contribution rate, and enter this calculated amount in C.

accrues from the delinquent date for the return.

ITEM D. Adjustment to Prior Quarters - Employers who are making an adjustment to a

NOTE: If you combine schools, you must file and pay the final return within

prior quarter must complete and attach a DE 938SEF. The total debit or credit amount

10 days of merging to avoid penalty and interest.

indicated on the DE 938SEF must be entered on line D. If no adjustment is being made,

enter "0." To expedite an adjustment to a prior DE 9423, use a DE 938SEF instead of an

If your school was merged or if a change in district occurred during the

amended DE 9423.

period covered by this Quarterly Contribution Return, each district must

ITEM E. Total Taxes Due - Add items C and D. Enter the sum in E. If the sum is zero,

file a separate return covering only that part of the quarter (or year for income

enter "0" in line E and check the box on the front of the return envelope. Make check

tax forms) during which the particular district operated.

payable to EMPLOYMENT DEVELOPMENT DEPARTMENT. If a DE 938SEF is attached,

TOTAL WAGES - Means all remuneration payable for personal services when

the amount remitted should reflect the adjustment.

they meet the criteria of UI subject wages (refer to Item B and the DE 44).

(EXAMPLE: Line E shows $500.00 due for the quarter. A DE 938SEF is attached for a

credit of $200.00. Remittance should be for $300.00.)

TAXABLE WAGE LIMIT - Total individual employee wages are taxable. There

ITEM F. Signature of preparer or responsible individual,

is no wage limit.

including title, phone number, fax number, and date.

If you need assistance completing this form, contact the Employment Development

Did you know you can file this form online using the EDD

Department, School Employees Fund at 916-653-5380.

e-Services for Business? Please visit the website at

for further instructions.

Mail To: State of California / Employment Development Department

PO Box 2482 / Sacramento, CA 95812-2482

DE 9423 Rev. 17 (8-16) (INTERNET)

Page 1 of 1

CU

1

1