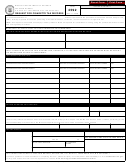

Clear

Liquified

100%

Dyed

Compressed

From

Aviation

Diesel

Jet

Gasoline

Gasohol

Natual

Diesel &

Receipts (Invoiced Gallons)

Ethyl

Natural Gas

Schedule

Gasoline

& Clear

Fuel

Gas (LNG)

Alcohol

(CNG)

Kerosene

Kerosene

1

1. Gallons received in Missouri tax and fees paid .......

1B

2. Gallons received for export, destination state tax

paid ..........................................................................

1C

3. Gallons received tax and fee paid with an import

payment voucher ......................................................

4. Gallons imported from another state, Missouri tax

1E

and fees paid ...........................................................

5. Gallons received tax and fees unpaid (provide

2A

explanation on Schedule 2A) (Example: tank wagon

imports) ....................................................................

5a. Gallons received of tax exempt product

2A

(Example: alcohol, bio-diesel – undyed B100) .......

6. Gallons of blend stock received tax and fees unpaid

(List type of blend stock) _________________

2B

(Enter gallons under the appropriate product

column) ....................................................................

7. Gallons of clear kerosene received fees paid

2G

(For sale through barricaded pumps) .......................

8. Gallons received tax exempt fuel for sale to U.S.

government (Attach copy of

Form

4776) .................

9. Total Receipts ............................................................................................

10. Gallons sold or used by distributor ..........................

5

11. Gallons of dyed fuel sold for taxable purposes .........

10G

12. Gallons of other authorized tax exempt sales

(alcohol, bio-diesel – undyed B100) .......................

7A

13. Gallons exported (Destination state tax paid to

supplier) ..................................................................

7B

14. Gallons exported (Missouri tax and fees paid) .......

10J

15. Gallons of clear kerosene delivered to filling stations

(Barricaded pumps only) .........................................

16. Total Disbursements .................................................................

Tax Exempt Product Removed from Storage for Blending

5W

17. Gallons of tax exempt product blended during

reporting period tax and fees unpaid. ..................

17A. Gallons of tax exempt product blended during

10A

reporting period fees unpaid ................................

10U

18. Gallons of fee exempt product ..................................

Form 4757 (Revised 04-2017)

1

1 2

2 3

3