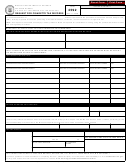

This report and its supporting schedules must be fully completed

20. Motor fuel gallons sold to railroad corporations, airline com panies

and mailed to the Missouri Department of Revenue along with

or used as bunker fuel in vessels are not subject to the transport

any tax and fees due on the last day of each month for the

load fee (Total from attached Schedule 10K, 10R, or 10Y).

purchases made in the preceding calendar month unless such day

21. Total gallons subject to transport load fee (Line 19 minus (–) Line

falls on a week end or state holiday in which case the report, tax,

20).

and fees would be due the next succeeding business day. A report

22. Transport load fee (Line 21 times (X) 0.0025).

is due whether or not there was any activity during the month.

Visit

to access the due date

23. If you have a transport load fee credit from a previous report, you

schedule.

will receive a letter. Enter the amount of your transport load fee

credit and attach a copy of the authorization.

Original reports and schedules must contain all the required

24. Total transport load fee due (Line 22 minus Line 23).

information. Computer generated reports and schedules,

approved by the Department, must contain all the information

required on the original reports and schedules.

Taxes and Fees Due (Round to whole dollars)

25. Total motor fuel tax due (Line 12, all columns except aviation and

Correcting Reports

gasoline).

Additional Report - adds or takes away any additional gallons from

26. Total aviation gasoline tax due (Total from Line 12).

the original report. When filing an additional report, please report only

those gallons in which you are changing.

27. Total inspection fee due (Total from Line 18).

28. Total transport load fee due (Total from Line 24).

Amended Report - filed when all or the majority of the information

originally reported is incorrect. This type of report will replace all

29. Total taxes and fees due (Lines 25, 26, 27, and 28).

information that was first reported.

You Must Round To Whole Gallons And Dollars

Penalty (Round to whole dollars)

(Example: Round down if less than .50 and round up if .50 to .99)

30. If your report is not filed on a timely basis or taxes are not paid

timely (filed and received by the United States Post Office

Taxable Gallons (Round to whole gallons)

cancellation stamped upon the envelope), you are subject to a

1. Gallons of blend stock received tax and fees unpaid (From

penalty of five percent per month up to 25 percent of the total

worksheet, Line 6).

2. Gallons of fuel received in Missouri tax and fees unpaid.

amount of tax (Line 29 times (X) penalty amount, 5 percent up to

Attach an explanation with Schedule 2A (From worksheet,

25 percent).

Line 5). Tank wagon operators report fuel imported into Missouri

on this line.

Interest (Round to whole dollars)

3. Gallons of tax exempt product blended (For taxable use) (From

31. Interest is due on any late payment (Line 29 times (X) the

work sheet, Line 17).

annual interest rate, multiplied by (X) the number of days late

4. Gallons of dyed fuel sold for taxable purposes (From worksheet,

Line 11).

divided by 365 (366 for leap years)). The annual interest rate is

5. Gallons subject to tax and fees (Total of Lines 1, 2, 3, and 4).

subject to change each year. Visit the Department’s website at

6. Gallons of fuel exported (Missouri tax and fees paid) (From

to access the annual interest

worksheet, Line 14).

rate.

7. Calculate allowance. Line 6 times (X) the appropriate

32. Total taxes, fees, penalty, and interest due (Lines 29, 30, and 31).

per cent age. (Applies only when supplier passed allowance to

purchaser of Missouri tax paid fuel.)

8. Net gallons exported of Missouri tax paid fuel. (Line 6 minus (–)

Pool Bond Payment - Participants Only (Round to whole dollars)

Line 7).

33. Pool bond amount due. From Form 4759, Schedule 5T.

9. Net gallons subject to tax and fees (Line 5 minus (–) Line 8).

34. Total remittance due. Total fuel tax, fees, and pool bond amount

due (Total Line 32 plus (+) Line 33).

Tax Calculation (Round to whole dollars)

Tax rate for gasoline, alcohol blended with gasoline, gasohol and

other products blended with gasoline, clear diesel, clear ker o sene

Send your check or money order to the Missouri Department of

and other products blended with clear diesel or clear kerosene

R e v e n u e . Y o u m a y a l s o c h a r g e t h e b a l a n c e d u e t o

is $0.17 per gallon. Aviation gasoline tax rate is $0.09 per gallon.

Mastercard, Discover, American Express, or Visa by calling

The tax rate for CNG and LNG is $.05 per gallon equivalent.

10. Tax due is based on the taxable gallons times (X) the appropriate

t o l l - f r e e ( 8 8 8 ) 9 2 9 - 0 5 1 3 o r y o u m a y p a y o n l i n e a t

tax rates (Line 9 times (X) $0.17, $.05 or $0.09).

A convenience fee

11. If you have a motor fuel tax credit from a previous report,

will be charged to your account for processing. If you pay by check,

you will receive a letter. Enter the amount of your motor fuel tax

you authorize the Department to process the check electronically.

credit and attach a copy of the authorization.

Any returned check may be presented again electronically. Mail the

12. Total motor fuel tax due (Line 10 minus Line 11).

report and schedules to: Missouri Department of Revenue, Taxation

Inspection Fee (Round to whole dollars)

Division, P.O. Box 300, Jefferson City, Missouri 65105-0300.

13. Total gallons subject to inspection fee (From worksheet, Lines 5,

If you have questions or need assistance in completing this form,

6, 17, and 17A minus Line 18).

please call (573) 751-2611 or you can e-mail excise@dor.mo.gov.

14. Gallons of fuel exported fees paid (From worksheet, Line 14).

Y o u m a y a l s o a c c e s s t h e D e p a r t m e n t ’ s w e b s i t e a t

15. Gallons subject to inspection fee (Line 13 minus (–) Line 14).

16. Inspection fee due (Line 15 times (X) .0007).

to obtain this form.

17. If you have an inspection fee credit from a previous report, you

Please ensure that you sign, indicate your title, and date the report.

will receive a letter. Enter the amount of your inspection fee

credit and attach a copy of the authorization.

Motor Fuel Tax, Aviation Gasoline Tax, Inspection Fee, Transport

18. Total inspection fee due (Line 16 minus Line 17).

Load Fee and Pool Bond are five separate accounts. Do not use a

credit on one account to pay for another account. (Example: Motor

Transport Load Fee (Round to whole dollars)

Fuel Tax credit cannot be used to pay Aviation Gasoline Tax.)

19. Total gallons of fuel subject to transport load fee (Line 15 above).

Form 4757 (Revised 04-2017)

1

1 2

2 3

3