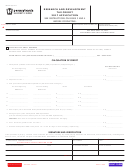

Form 10a104 - Update Or Cancellation Of Kentucky Tax Account(S) - 2017 Page 2

ADVERTISEMENT

10A104 (06-17)

Page 2

SECTION D

SALES AND USE TAX LOCATION INFORMATION

11. Update or Close an existing Business Location for your Sales and Use Tax Account.

CURRENT LOCATION ADDRESS INFORMATION

NEW LOCATION ADDRESS INFORMATION

Close Location

Update/Move Location

Business Location Name “Doing Business as” Name

Business Location Name “Doing Business as” Name

Street Address (DO NOT List a PO Box)

Street Address (DO NOT List a PO Box)

City

State

Zip Code

City

State

Zip Code

County (if in Kentucky)

Location Telephone Number

County (if in Kentucky)

Location Telephone Number

(

)

–

(

)

–

Date Location Closed (mm/dd/yyyy)

/

/

12. - 13. Opened a new Location(s) of Current Business

NEW LOCATION ADDRESS

NEW LOCATION ADDRESS

Business Location Name “Doing Business as” Name

Business Location Name “Doing Business as” Name

Street Address (DO NOT List a PO Box)

Street Address (DO NOT List a PO Box)

City

State

Zip Code

City

State

Zip Code

County (if in Kentucky)

Telephone Number

County (if in Kentucky)

Telephone Number

(

)

–

(

)

–

Date Location Opened (mm/dd/yyyy)

Date Location Opened (mm/dd/yyyy)

/

/

/

/

Description of Business Activity Performed at Location

Description of Business Activity Performed at Location

SECTION E

UPDATE ACCOUNTING PERIOD, OWNERSHIP TYPE, AND/OR RESPONSIBLE PARTIES

14. Accounting Period change with the Internal Revenue Service (IRS)

Accounting Period

Calendar Year (year ending December 31

)

Fiscal Year (year ending ___ ___/___ ___ (mm/dd))

st

52/53 Week Calendar Year:

52/53 Week Fiscal Year:

December __________________________

__________________________________________

(Day of Week that year ends)

(Month & Day of Week that year ends)

15. Taxing Election Change with the IRS

(Note: If your Business Structure has changed, you are required to apply for new tax account numbers with the Department of

Revenue. Please complete Form 10A100, Kentucky Tax Registration Application.)

A. Current Business Structure ____________________________________________________________________

B. CURRENT TAXING ELECTION

NEW TAXING ELECTION

Partnership

Partnership

Corporation

Corporation

S-Corporation

S-Corporation

Cooperative

Cooperative

Trust

Trust

Single Member Disregarded Entity

Single Member Disregarded Entity

(Member Federally Taxed as)

(Member Federally Taxed as)

Individual Sole Proprietorship

Individual Sole Proprietorship

General Partnership/Joint Venture

General Partnership/Joint Venture

Estate

Estate

Trust (non-statutory)/Business Trust

Trust (non-statutory)/Business Trust

Other ______________________________________

Other ______________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4