Form 10a104 - Update Or Cancellation Of Kentucky Tax Account(S) - 2017 Page 4

ADVERTISEMENT

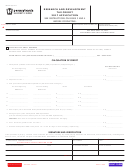

10A104 (06-17)

Page 4

SECTION G

REQUEST CANCELLATION OF ACCOUNT(S)

24. TAX ACCOUNTS FOR WHICH CANCELLATION IS REQUESTED

25. REASON FOR CANCELLATION

(Check all that Apply)

Business closed/No

Business sold (See #27)

Employer’s Withholding Tax

Sales and Use Tax

further Kentucky activity

Ceased having employees

Ceased making retail and/or

Consumer’s Use Tax

Transient Room Tax

wholesale sales of tangible

Death of owner

personal property or digital

Motor Vehicle Tire Fee

Telecommunications Tax

property

Converted to another

Utility Gross Receipts

Corporation Income Tax

ownership type and must

Merged out of existence

License Tax

and/or Limited Liability

reapply for new accounts

(See #28)

Entity Tax

Coal Severance and

No further Kentucky activity

Other (Specify):

Processing Tax

Pass-Through Non-

Resident Withholding

_________________________

Commercial Mobile Radio

_________________________

Service (CMRS) Prepaid

Service Charge Account

NOTE:

A corporation’s or limited liability pass-through entity’s

income tax/LLET account number is cancelled with the filing of the

“final” return. A corporation or limited liability pass-through entity

/

/

26. Effective Date to Cancel Account(s)

organized in Kentucky shall not file a final return before it is officially

dissolved pursuant to the provisions of KRS Chapter 14A.

27. If business sold, list the information for the new owner(s).

Name

Name

Address

Address

City

State

Zip Code

City

State

Zip Code

Telephone Number

Telephone Number

(

)

–

(

)

–

28. If merged out of existence, list the information for the new business.

Business Name

Address

FEIN

Telephone Number

City

State

Zip Code

(

)

–

IMPORTANT: THIS UPDATE FORM MUST BE SIGNED BELOW:

The statements contained in this Form and any accompanying schedules are hereby certified to be correct to the best knowledge and belief of the undersigned who is duly

authorized to sign the Form.

Printed Name: ______________________________________________________

Printed Name: ______________________________________________________

Signature: _________________________________________________________

Signature: _________________________________________________________

Title: ______________________________________ Date: ____/____/______

Title: ______________________________________

Date: ____/____/______

Telephone Number: __________________________________________________

Telephone Number: __________________________________________________

Data Integrity Section

(502) 564-2694

For assistance in completing the Update Form, please call the

at

, or you may use the Telecommunications Device for the Deaf.

SEND completed form to:

KENTUCKY DEPARTMENT OF REVENUE

FAX to:

502-564-0796

P.O. BOX 299, STATION 20A

FRANKFORT, KENTUCKY 40602-0299

EMAIL:

DOR.WEBResponseDataIntegrity@ky.gov

The Kentucky Department of Revenue does not

discriminate on the basis of race, color, national origin,

sex, age, religion, disability, sexual orientation, gender

identity, veteran status, genetic information or ancestry

in employment or the provision of services.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4