Confidential Business Personal Property Rendition - Hunt County Appraisal District - 2014 Page 8

ADVERTISEMENT

PROPERTY ID #

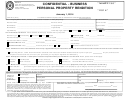

8. AUTOMOBILES, TRUCKS, TRAILERS AND BUSES

List all owned vehicles used in the business. Leased vehicles should be reported in Section 9. Vehicles disposed of after Jan.1

st

are taxable for the year & must

be reported below. Although it is optional, you may specify the tonnage & body type for trucks. And, place a “D” if Diesel or “G” is Gas in the body type column.

Good faith estimate

Make / Model /

Property address or

Original Cost

Year

VIN Number

Office Use

of Market Value*

Body Type

address where taxable

when new**

acquired**

(optional)

Only

(or)

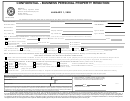

SPECIAL EQUIPMENT MOUNTED ON VEHICLES

Good faith estimate

EQUIPMENT

Property address or

Original Cost

Year

VIN Number

Office Use

of Market Value*

DESCRIPTION

address where taxable

when new**

acquired**

(optional)

Only

(or)

Attach Additional Sheets if Necessary

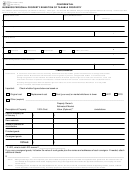

9. LEASED, LOANED OR RENTED PERSONAL PROPERTY

When required by the chief appraiser, you must render any taxable property that you own or manage and control as a fiduciary on January 1

(Section 22.01 (b), Tax Code). List

st

below any property leased, loaned or rented to you, regardless of tax liability. If necessary, attach additional sheets. Or, you may attach a computer-generated copy listing the

information below. If you have none, please write “NONE”.

Name, address, phone #

Description of

Property address or

Good faith estimate of

Original cost when

Year

of Owner of item

Property

address where taxable

Market Value* (or)

new**

acquired**

Description of

Owner name &

Property address or

Good faith estimate of

Original cost when

Year

Goods/Merchandise

address

address where taxable

Market Value* (or)

new**

acquired**

Consigned to you

*If you provide an amount in the “good faith estimate of market value,” you need not complete an “original cost when new” and “year acquired.” “Good faith estimate of market value”

is not admissible in subsequent protest, hearing, appeal, suit, or other proceeding involving the property except for: (1) proceedings to determine whether a person complied with

rendition requirements; (2) proceedings for determination of fraud or intent to evade tax; or (3) a protest under Section 41.41 of the Tax Code.

** If you provide an amount in “original cost when new” and “year acquired,” you need not complete “good faith estimate of market value”.

Page 8 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8