Confidential Business Personal Property Rendition - Hunt County Appraisal District - 2014 Page 7

ADVERTISEMENT

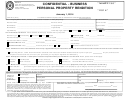

PROPERTY ID #

6.

Good faith

Property address

Original

%

RCNLD

Machinery &

estimate of

Year Acquired

or address where

cost when

Good**

Value***

Equipment

Market Value*

**

taxable

new**

*

(Optional)

(12)

(or)

2013

94

2012

88

*If you provide an amount in the “good

faith estimate of market value,” you

2011

83

need not complete a “original cost

2010

77

when new” and “year acquired,”

“Good faith estimate of market value”

2009

70

is not admissible in subsequent

protest, hearing, appeal, suit, or other

2008

63

proceeding involving the property

2007

57

except for: (1) proceedings to

determine whether a person complied

2006

51

with

rendition

requirements;

(2)

2005

45

proceedings for determination of fraud

or intent to evade tax; or (3) a protest

2004

39

under Section 41.41 of the Tax Code.

2003

33

2002

24

**If you provide an amount in “original

2001 & prior

15

cost when new” and “year acquired,”

you need not complete “good faith

TOTALS

estimate of market value.”

***If you provide an amount in

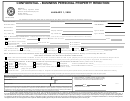

7.

Good faith

“original cost when new” and “year

Heavy Mach. &

Property address

Original

%

RCNLD

acquired”, these are the most

estimate of

Year Acquired

Equip,

or address where

cost when

Good**

Value***

common percent good factors used to

Market Value*

**

Industrial

taxable

new**

*

(Optional)

determine the replacement cost new

(or)

Ext Life (15)

less depreciation (RCNLD) to assist in

determining an opinion of value.

2013

95

Original cost multiplied by the % good

2012

91

equals RCNLD.

2011

88

2010

83

2009

77

2008

74

2007

70

2006

66

2005

61

2004

58

2003

52

2002

44

2001

37

2000

33

1999

26

1998 & prior

20

TOTALS

Page 7 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8