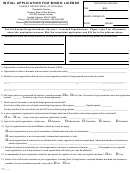

Application For Classification Or Reclassification As Open Space Land Or Timber Land For Current Use Assessment - Washington Department Of Revenue Page 3

ADVERTISEMENT

9. Describe the present improvements on this property (buildings, etc.).

10. Is this land subject to a lease or agreement which permits any other use than its present use?

Yes

No

If yes, attach a copy of the lease agreement.

NOTICE: The assessor may require owners to submit pertinent data

regarding the use of classified land.

Open Space Land Means:

(a) Any land area so designated by a comprehensive land use plan adopted by a city or county

authority, or

(b) Any land area, in which the preservation in its present use would:

(i)

Conserve and enhance natural or scenic resources,

(ii)

Protect streams or water supply,

(iii)

Promote conservation of soils, wetlands, beaches or tidal marshes,

(iv)

Enhance the value to the public of abutting or neighboring parks, forests, wildlife preserves,

nature reservations or sanctuaries or other open space,

(v)

Enhance recreation opportunities,

(vi)

Preserve historic sites,

(vii)

Preserve visual quality along highway, road, and street corridor or scenic vistas, or

(viii) Retain in its natural state tracts of land not less than one acre situated in an urban area and

open to public use on such conditions as may be reasonably required by the granting

authority.

(c) Or, any land meeting the definition of “farm and agricultural conservation land”.

Statement of Additional Tax, Interest, and Penalty Due Upon Removal of Classification

1. Upon removal of classification, an additional tax shall be imposed which shall be due and payable

to the county treasurer 30 days after removal or upon sale or transfer, unless the new owner has

signed the Notice of Continuance. The additional tax shall be the sum of the following:

(a) The difference between the property tax paid as “Open Space Land” or “Timber Land” and the

amount of property tax otherwise due and payable for the last seven years had the land not been

so classified; plus

(b) Interest upon the amounts of the difference (a), paid at the same statutory rate charged on

delinquent property taxes.

(c) A penalty of 20% shall be applied to the additional tax and interest if the classified land is applied

to some other use except through compliance with the property owner’s request for withdrawal

process, or except as a result of those conditions listed in (2) below.

2. The additional tax, interest, and penalty specified in (1) above shall not be imposed if removal

resulted solely from:

(a) Transfer to a governmental entity in exchange for other land located within the State of

Washington.

(b) A taking through the exercise of the power of eminent domain, or sale or transfer to an entity

having the power of eminent domain in anticipation of the exercise of such power.

3

REV 64 0021e (w)

(7/17/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4