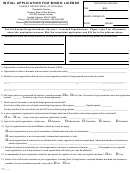

Application For Classification Or Reclassification As Open Space Land Or Timber Land For Current Use Assessment - Washington Department Of Revenue Page 4

ADVERTISEMENT

(c) A natural disaster such as a flood, windstorm, earthquake, or other such calamity rather than by

virtue of the act of the landowner changing the use of such property.

(d) Official action by an agency of the State of Washington or by the county or city where the land is

located disallows the present use of such land.

(e) Transfer of land to a church when such land would qualify for property tax exemption pursuant to

RCW 84.36.020.

(f) Acquisition of property interests by State agencies or agencies or organizations qualified under

RCW 84.34.210 and 64.04.130 (See RCW 84.34.108(6)(f)).

(g) Removal of land classified as farm & agricultural land under RCW 84.34.020(2)(e) (farm

homesite).

(h) Removal of land from classification after enactment of a statutory exemption that qualifies the land

for exemption and receipt of notice from the owner to remove the land from classification.

(i) The creation, sale, or transfer of forestry riparian easements under RCW 76.13.120.

(j) The creation, sale, or transfer of a conservation easement of private forest lands within

unconfined channel migration zones or containing critical habitat for threatened or endangered

species under RCW 76.09.040.

(k) The sale or transfer of land within two years after the death of the owner of at least a fifty percent

interest in the land if the land has been assessed and valued as designated forest land under

chapter 84.33 RCW, or classified under this chapter 84.34 RCW continuously since 1993. The

date of death shown on the death certificate is the date used.

(l) The discovery that the land was classified in error through no fault of the owner.

Affirmation

As owner(s) of the land described in this application, I hereby indicate by my signature that I am

aware of the potential tax liability involved when the land ceases to be classified under provisions of

Chapter 84.34 RCW. I also declare under the penalties for false swearing that this application and

any accompanying documents have been examined by me and to the best of my knowledge it is a

true, correct, and complete statement.

The agreement to tax according to use of the property is not a contract and can be annulled or

canceled at any time by the Legislature (RCW 84.34.070).

Signatures of all Owner(s) or Contract Purchaser(s):

All owners and purchasers must sign.

FOR LEGISLATIVE AUTHORITY USE ONLY

Date application received:

By:

Amount of processing fee collected: $

Transmitted to:

Date:

FOR GRANTING AUTHORITY USE ONLY

Date received:

By:

Application approved

Approved in part

Denied

Owner notified of denial on:

Agreement executed on:

Mailed on:

For tax assistance, visit dor.wa.gov/content/taxes/property/default.aspx or call 1-800-647-7706. To

inquire about the availability of this document in an alternate format for the visually impaired, please

call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4