__ __ __ . __ __ %

__ __ __ . __ __ %

__ __ __ . __ __ %

__ __ __ . __ __ %

__ __ __ . __ __ %

Enter your Revenue Account Number here.

u

________________

Enter your Revenue Account Number here. >

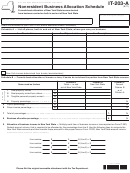

Schedule P - Computation of Louisiana Net Income

Column 3 must be completed. Column 2 must also be completed if the separate accounting method is used.

Those corporations employing the separate accounting method should review R.S. 47:287.94H for guidance.

2. LA amounts

3. Totals

1. Items

(Lines 1 through 25)

1. Gross receipts_______________Less returns and allowances_______________ .............................................

2. Less: Cost of goods sold and/or operations (Attach schedules.) .........................................................................

3. Gross profit ...........................................................................................................................................................

4. Gross rents ...........................................................................................................................................................

5. Gross royalties ......................................................................................................................................................

6. Income from estates, trusts, partnerships.............................................................................................................

7. Income from construction, repair, etc. ..................................................................................................................

8. Other income (Attach schedule.) ..........................................................................................................................

9. Total income (Add Lines 3 through 8.) .................................................................................................................

10. Compensation of officers .....................................................................................................................................

11. Salaries and wages (not deducted elsewhere) .....................................................................................................

12. Repairs (Do not include cost of improvements or capital expenditures.) .............................................................

13. Bad debts ..............................................................................................................................................................

14. Rent ......................................................................................................................................................................

15. Taxes (Attach schedule.) ......................................................................................................................................

16. Interest ..................................................................................................................................................................

17. Contributions .........................................................................................................................................................

18. Depreciation (Attach schedule.) ............................................................................................................................

19. Depletion (Attach schedule.) .................................................................................................................................

20. Advertising ............................................................................................................................................................

21. Pension, profit sharing, stock bonus, and annuity plans ......................................................................................

22. Other employee benefit plans ...............................................................................................................................

23. Other deductions (Attach schedule.) ....................................................................................................................

24. Total deductions (Add Lines 10 through 23.) .......................................................................................................

25. Net income from Louisiana sources

..

(If separate [direct] method of reporting is used, enter here and on Line 31.)

26. Net income from all sources (Subtract Line 24, Column 3 from Line 9, Column 3.) ...........................................

27. Allocable income from all sources (See instructions.) Attach schedule supporting each amount.

A. Net rents and royalties from immovable or corporeal movable property .........................................................

B. Royalties from the use of patents, trademarks, etc. (See instructions.)...........................................................

C. Income from estates, trusts, and partnerships .................................................................................................

D. Income from construction, repair, etc. (See instructions.) ................................................................................

E. Other allocable income .....................................................................................................................................

28. Net income subject to apportionment (Subtract Lines 27A through 27E from Line 26, Column 3.) ...................

29. Net income apportioned to Louisiana (See instructions.) .....................................................................................

30. Allocable income from Louisiana sources (See instructions.) Attach schedule supporting each amount.

A. Net rents and royalties from immovable or corporeal movable property .........................................................

B. Royalties from the use of patents, trademarks, etc. (See instructions.)...........................................................

C. Income from estates, trusts, and partnerships .................................................................................................

D. Income from construction, repair, etc. (See instructions.) ................................................................................

E. Other allocable income .....................................................................................................................................

31. Louisiana net income before loss adjustments and federal income tax deduction

(Add Line 29, Column 3 to Lines 30A through 30E, Column 2 or enter amount from Line 25,

whichever is applicable, here and on Page 1, Line 1A of Form CIFT- 620. Round to nearest dollar.) ..........................

Schedule Q - Computation of Income Tax Apportionment Percentage

1. Description of items used as ratios

2. Total amount

3. Louisiana amount 4. Percent (Col. 3 ÷ Col. 2)

For Manufacturers or Merchandisers.

1. Net sales of merchandise and/or charges for services

This is your apportionment ratio. Use this

A. Sales (See instructions.) .................................................................

result in determining income apportioned

B. Charges for services (See instructions.) .........................................

to Louisiana on Line 29, Sch. P above. Do

NOT proceed further.

C. Other gross apportionable income ..................................................

D. Total

(Enter total of Lines A, B, and C in Col. 2 and Col. 3.) (Enter ratio in Col. 4.)

IMPORTANT! For taxpayers in the business of manufacturing or merchandising,

.............................................

this is your apportionment ratio. See instructions.

2. Wages, salaries, and other personal service compensation paid during the year

.........................

(Enter amounts in Column 2 and Column 3, and ratio in Column 4.)

3. Income tax property ratio

............................................................................

(Enter percentage from Line 27, Schedule M.)

4. Total of percents in Column 4 .......................................................................................................................................

5. Average of percents

(Use this result in determining income apportioned to Louisiana on Line 29, Schedule P above.

) .........

WEB

2741

1

1 2

2