Form Bpt 2000 (Hj) - Computation Of Tax On Net Income And Gross Receipts

ADVERTISEMENT

BP

BP

BP

BP

BP T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

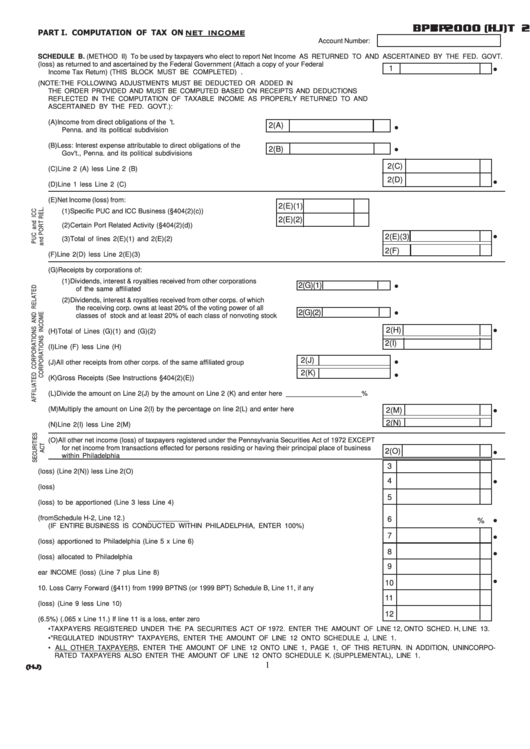

PART I. COMPUTATION OF TAX ON

NET INCOME

Account Number:

SCHEDULE B. (METHOD II) To be used by taxpayers who elect to report Net Income AS RETURNED TO AND ASCERTAINED BY THE FED. GOVT.

1. Net Income (loss) as returned to and ascertained by the Federal Government (Attach a copy of your Federal

•

1

Income Tax Return) (THIS BLOCK MUST BE COMPLETED) ..........................................................................

2. ADJUSTMENTS (NOTE: THE FOLLOWING ADJUSTMENTS MUST BE DEDUCTED OR ADDED IN

THE ORDER PROVIDED AND MUST BE COMPUTED BASED ON RECEIPTS AND DEDUCTIONS

REFLECTED IN THE COMPUTATION OF TAXABLE INCOME AS PROPERLY RETURNED TO AND

ASCERTAINED BY THE FED. GOVT.):

(A) Income from direct obligations of the U.S. Gov't.

2(A)

•

Penna. and its political subdivision ..................................................

(B) Less: Interest expense attributable to direct obligations of the U.S.

•

2(B)

Gov't., Penna. and its political subdivisions .....................................

2(C)

(C) Line 2 (A) less Line 2 (B) .............................................................................................................................

2(D)

•

(D) Line 1 less Line 2 (C) ..................................................................................................................................

(E) Net Income (loss) from:

2(E)(1)

(1) Specific PUC and ICC Business (§404(2)(c)) .................................

2(E)(2)

(2) Certain Port Related Activity (§404(2)(d)) .......................................

•

2(E)(3)

(3) Total of lines 2(E)(1) and 2(E)(2) ............................................................................................................

2(F)

(F) Line 2(D) less Line 2(E)(3) ................................................................................................ ............................

(G) Receipts by corporations of:

(1) Dividends, interest & royalties received from other corporations

2(G)(1)

•

of the same affiliated group......................................................................

(2) Dividends, interest & royalties received from other corps. of which

the receiving corp. owns at least 20% of the voting power of all

•

2(G)(2)

classes of stock and at least 20% of each class of nonvoting stock ........

•

2(H)

(H) Total of Lines (G)(1) and (G)(2) ....................................................................................................................

2(I)

(I)

Line (F) less Line (H) ..................................................................................................... ..............................

2(J)

•

(J) All other receipts from other corps. of the same affiliated group ......................

2(K)

•

(K) Gross Receipts (See Instructions §404(2)(E)) ..................................................

(L) Divide the amount on Line 2(J) by the amount on Line 2 (K) and enter here ____________________%

(M) Multiply the amount on Line 2(I) by the percentage on line 2(L) and enter here ..........................................

•

2(M)

2(N)

(N) Line 2(I) less Line 2(M) ...............................................................................................................................

(O) All other net income (loss) of taxpayers registered under the Pennsylvania Securities Act of 1972 EXCEPT

for net income from transactions effected for persons residing or having their principal place of business

2(O)

•

within Philadelphia ......................................................................................................................................

3

3. ADJUSTED NET INCOME (loss) (Line 2(N)) less Line 2(O) ................................................................................

4

•

4. Total nonbusiness income (loss) .................................. ......................................................................................

5

5. Income (loss) to be apportioned (Line 3 less Line 4) ...........................................................................................

6. Apportionment Percentage (from Schedule H-2, Line 12.)

6

•

%

(IF ENTIRE BUSINESS IS CONDUCTED WITHIN PHILADELPHIA, ENTER 100%) ......................................

7

•

7. Income (loss) apportioned to Philadelphia (Line 5 x Line 6) ................................................................................

8

•

8. Nonbusiness income (loss) allocated to Philadelphia ..........................................................................................

9

9. Current Year INCOME (loss) (Line 7 plus Line 8) .................................................................................................

•

10

10. Loss Carry Forward (§411) from 1999 BPTNS (or 1999 BPT) Schedule B, Line 11, if any ...............................

11

11.Taxable Income (loss) (Line 9 less Line 10) ........................................................................................................

12

12. TAX DUE (6.5%) (.065 x Line 11.) If line 11 is a loss, enter zero .....................................................................

• TAXPAYERS REGISTERED UNDER THE PA SECURITIES ACT OF 1972. ENTER THE AMOUNT OF LINE 12, ONTO SCHED. H, LINE 13.

• "REGULATED INDUSTRY" TAXPAYERS, ENTER THE AMOUNT OF LINE 12 ONTO SCHEDULE J, LINE 1.

• ALL OTHER TAXPAYERS, ENTER THE AMOUNT OF LINE 12 ONTO LINE 1, PAGE 1, OF THIS RETURN. IN ADDITION, UNINCORPO-

RATED TAXPAYERS ALSO ENTER THE AMOUNT OF LINE 12 ONTO SCHEDULE K. (SUPPLEMENTAL), LINE 1.

1

(HJ)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4