Form Bpt 2000 (Hj) - Computation Of Tax On Net Income And Gross Receipts Page 4

ADVERTISEMENT

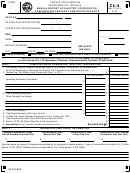

PART II. COMPUTATION OF TAX ON

BP

BP

BP

BP

BP T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

GROSS RECEIPTS

Account Number:

SCHEDULE H-1.

ALTERNATIVE COMPUTATION OF NET INCOME FOR TAXPAYERS REGISTERED UNDER THE PENNSYLVANIA SECURITIES

ACT OF 1972 WHO HAVE ELECTED TO USE METHOD II TO REPORT NET INCOME.

•

1

1. Enter the adjusted net income (loss) reported on Schedule B, Line 3 ...........................................................................

1

(a)

•

(a) Enter the amount shown on Schedule B, Line 2(o) ..................................................................................................

2

2. Line 1 plus Line 1(a) ......................................................................................................................................................

3

•

3. Total Nonbusiness Income (loss) .................................................................................................................................

4

4. Income (loss) To Be Apportioned (Line 2 Less Line 3) ...................................................................................................

%

•

5

5. Apportionment Percentage (From Schedule H-2, Line 12) ..............................................................................................

6

•

6. Income Apportioned To Philadelphia (Line 4 x Line 5) .................................................................................................

•

7

7. Nonbusiness Income (loss) Allocated To Philadelphia........................................................................................................

8

8. Current Year INCOME (loss) (Line 6 plus Line 7) ...........................................................................................................

9

9. Loss Carry Forward (§411) From 1999 BPTNS (or 1999 BPT) Schedule H-1, Line 10, if any .........................................

10

10. NET INCOME (loss) (Line 8 Less Line 9.) Enter here and on Schedule H, line 19(B) .....................................................

SCHEDULE H-2.

COMPUTATION OF APPORTIONMENT PERCENTAGE TO BE APPLIED TO NET INCOME.

LINE 8A

LINE 8B

Calculation of Average Values of Real & Tangible

WITHIN PHILADELPHIA

TOTAL EVERYWHERE

Personal Property Employed in Business:

1.

1. Inventories of Raw Materials. Works In Process and Finished Goods ......................................................................

2.

2. Land & Buildings Owned (At original cost) ................................................................................................................

3.

3. Machinery & Equipment Owned (At original cost) .....................................................................................................

4.

4. Other Tangible Assets Owned (At original cost) ........................................................................................................

5.

5. Rented Property (At 8 times the net annual rental) ...................................................................................................

6.

XXXXXXXXX

6. TOTAL AVERAGE VALUE OF PROPERTY USED WITHIN PHILADELPHIA .......................................................

7. XXXXXXXXXX

7. TOTAL AVERAGE VALUE OF PROPERTY USED EVERYWHERE .....................................................................

Computation of Apportionment Factors:

8A. Total Average of Philadelphia Property From Line 6 above ...........................................................................8A.

8B. Total Average Value of Property Everywhere From Line 7 above ..................................................................8B

8C. Philadelphia Property % (Line 8A divided by 8B) ..........................................................................................8C.

9A. Philadelphia Payroll .....................................................................................................................................9A.

.

9B. Payroll Everywhere ......................................................................................................................................9B.

9C. Philadelphia Payroll % (Line 9A divided by 9B) ............................................................................................9C.

10A. Philadelphia Receipts .................................................................................................................................10A.

.

10B. Gross Receipts Everywhere ........................................................................................................................10B.

10C. Double-Weight Philadelphia Receipts % [(Line 10A divided by 10B) x 2] ......................................................10C.

.

11.

TOTAL PERCENTAGES (Line 8C plus 9C plus 10C) ..............................................................................11.

12.

AVERAGE OF PERCENTAGES (Line 11 divided by applicable number of factors) .................................12.

(ENTER THIS PERCENTAGE ONTO SCHEDULE A OR SCHEDULE B, LINE 6)

Important Note: You must complete the Numerator and Denominator of all factors used. For taxpayers who apportion their net income in and out of Philadel-

phia the 2000 Business Privilege Tax has a double weighted receipts factor. This is accomplished by calculating the receipts apportionment percentage and

multiplying the resulting factors by 2. The total factors (payroll, property, and receipts) are then divided by the total factors used (always counting receipts as

2 factors) to obtain an average percentage.

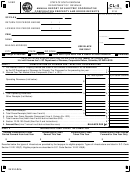

SCHEDULE J. COMPUTATION OF THE MAXIMUM BUSINESS PRIVILEGE TAX FOR "REGULATED INDUSTRY" TAXPAYERS.

•

1

1. Enter the amount of tax from Schedule A or Schedule B, Line 12 .........................................................................................

•

2

2. Enter the amount of tax from Schedule D, Line 8 of the 2000 BPT return ..........................

3

•

3. Enter the amount of tax from Schedule H, Line 9 ...............................................................

4

4. Total of Lines 2 & 3 ...........................................................................................................................................................

•

5

5. Enter here and on the 2000 BPT return Line 2, Page 1 the LESSER of the tax shown on Line 1 or Line 4 of this Sched..

UNINCORPORATED TAXPAYERS SEE SCHEDULE K (SUPPLEMENTAL) LINE 3 FOR ADDITIONAL INSTRUCTIONS.

(HJ)

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4