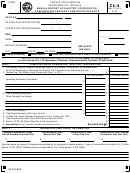

Form Bpt 2000 (Hj) - Computation Of Tax On Net Income And Gross Receipts Page 2

ADVERTISEMENT

BP

BP

BP

BP

BP T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

T 2000 (HJ)

PART I COMPUTATION OF TAX ON

NET INCOME.

Reminder—You must use the same method (METHOD I or METHOD II) that you elected on your first return.

SCHEDULE A. (METHOD I) To be used by taxpayers who elect to report net gain from the operation of a business IN ACCORDANCE WITH THEIR

ACCOUNTING SYSTEM rather than as reported to and ascertained by the Fed. Govt.

•

1

1. Net Income (loss) per Income Statement Attached .............................................................................................

•

2

2. PLUS: (a) Taxes based on net income (To the extent deducted in arriving at Line 1.) ........................................

3

3. ADJUSTED NET INCOME (loss) (Line 1 PLUS Line 2.) ...................................................................................

•

4

4. Total nonbusiness income (loss) ................................. ......................................................................................

5

5. Income (loss) to be apportioned (Line 3 minus Line 4.) ......................................................................................

6. Apportionment Percentage (From Schedule H-2, Line 12.)

6

•

%

If Entire Business Is Conducted Within Philadelphia, Enter 100% ....................................................................

•

7

7. Income (loss) apportioned to Philadelphia (Line 5 x Line 6.) ...............................................................................

•

8

8. Nonbusiness Income (loss) allocated to Philadelphia .........................................................................................

9

9. Current Year INCOME (loss) (Line 7 plus or minus Line 8) ..................................................................................

•

10

10. Loss Carry Forward (§411) from 1999 BPTNS (or 1999 BPT) Schedule A, Line 9, if any ....................................

11

11. Taxable Income (loss) (Line 9 less Line 10) .......................................................................................................

12

12. TAX DUE (6.5%) (.065 of Line (11)) If line 11 is a loss, enter zero .....................................................................

• TAXPAYERS REGISTERED UNDER THE PA SECURITIES ACT OF 1972. ENTER THE AMOUNT OF LINE 12, ONTO SCHED. H, LINE 13.

• "REGULATED INDUSTRY" TAXPAYERS, ENTER THE AMOUNT OF LINE 12 ONTO SCHEDULE J, LINE 1.

• ALL OTHER TAXPAYERS, ENTER THE AMOUNT OF LINE 12 ONTO LINE 1, PAGE 1, OF THE 2000 BPT RETURN. IN ADDITION,

UNINCORPORATED TAXPAYERS ALSO ENTER THE AMOUNT OF LINE 12 ONTO SCHEDULE K. (SUPPLEMENTAL), LINE 1 BELOW.

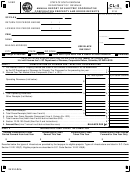

SCHEDULE K. (SUPPLEMENTAL) COMPUTATION OF THE 2000 BUSINESS PRIVILEGE TAX CREDIT FOR PERSONS SUBJECT TO THE

PHILADELPHIA NET PROFITS TAX. CORPORATIONS — DO NOT COMPLETE THIS SCHEDULE.

TAXPAYERS who are NOT Regulated Industries NOR registered under Penna. Securities Act of 1972:

1

•

1. Enter the amount of tax shown on Schedule A, Line 12 or Schedule B, Line 12 ............................................................

Taxpayers registered under the Pennsylvania Securities Act of 1972:

2. If the amount of tax shown on Schedule H, Line 23 is the SAME as the amount of tax shown on

Schedule H, Line 15; Enter the amount of tax shown on Schedule H, Line 13.

If the Amount of tax shown on Schedule H, Line 23 is the SAME as the amount of tax shown on

Schedule H, Line 22, PROVIDED THAT the amount of tax shown on Schedule H, Line 20 is the

SAME as the amount of tax shown on Schedule H, Line 21, then enter the amount of tax shown

•

2

on Schedule H, Line 20 OTHERWISE enter "zero" and do not complete the rest of this Schedule. ...............................

"Regulated Industry" Taxpayers:

3. If the amount of tax shown on Sched. J, Line 5 is the SAME as the amount of tax shown on Sched. J Line 1, enter

•

3

the amount of tax shown on Sched. J, Line 1. OTHERWISE enter "zero" and do not complete the rest of this Sched.

COMPUTATION OF THE TAX CREDIT

4. Enter 60% of the amount of tax shown on Line 1., 2. or 3., whichever is applicable, and read

4

•

instructions below. ..........................................................................................................................................................

• PARTNERSHIPS, JOINT VENTURES AND ASSOCIATIONS WHICH ARE COMPOSED OF ONE OR MORE CORPORATE PARTNERS,

CORPORATE JOINT VENTURES OR CORPORATE ASSOCIATES: REFER TO SCHEDULE D OF THE 1999 NET PROFITS TAX RETURN.

• OTHER PARTNERSHIPS, JOINT VENTURES, ASSOCIATIONS, AND INDIVIDUALS: REFER TO SCHEDULE E OF THE 1999 NET PROFITS

TAX RETURN AND SEE LINE 1c OR 1e (WHICHEVER IS APPLICABLE).

2

(HJ)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4