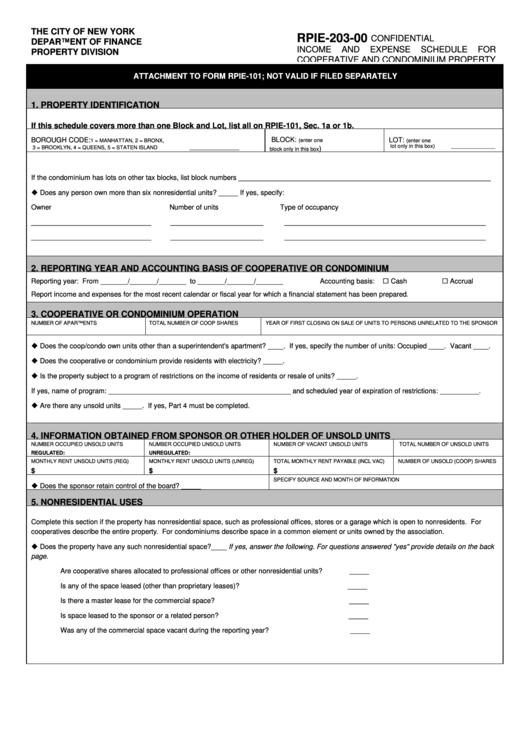

Form Rpie-203-00 - Confidential Income And Expense Schedule For Cooperative And Condominimum Property

ADVERTISEMENT

THE CITY OF NEW YORK

RPIE-203-00

CONFIDENTIAL

DEPARTMENT OF FINANCE

INCOME

AND

EXPENSE

SCHEDULE

FOR

PROPERTY DIVISION

COOPERATIVE AND CONDOMINIUM PROPERTY

ATTACHMENT TO FORM RPIE-101; NOT VALID IF FILED SEPARATELY

1. PROPERTY IDENTIFICATION

If this schedule covers more than one Block and Lot, list all on RPIE-101, Sec. 1a or 1b.

BOROUGH CODE:

BLOCK:

LOT:

1 = MANHATTAN, 2 = BRONX,

(enter one

(enter one

3 = BROOKLYN, 4 = QUEENS, 5 = STATEN ISLAND

_________________

)

____________

lot only in this box)

_______________

block only in this box

If the condominium has lots on other tax blocks, list block numbers _________________________________________________________________

u Does any person own more than six nonresidential units? _____ If yes, specify:

Owner

Number of units

Type of occupancy

_______________________________

________________________

____________________________________________________

_______________________________

________________________

____________________________________________________

2. REPORTING YEAR AND ACCOUNTING BASIS OF COOPERATIVE OR CONDOMINIUM

¨ Cash

¨ Accrual

Reporting year: From _______/_______/_______ to _______/_______/_______

Accounting basis:

Report income and expenses for the most recent calendar or fiscal year for which a financial statement has been prepared.

3. COOPERATIVE OR CONDOMINIUM OPERATION

NUMBER OF APARTMENTS

TOTAL NUMBER OF COOP SHARES

YEAR OF FIRST CLOSING ON SALE OF UNITS TO PERSONS UNRELATED TO THE SPONSOR

u Does the coop/condo own units other than a superintendent's apartment? ____. If yes, specify the number of units: Occupied ____. Vacant ____.

u Does the cooperative or condominium provide residents with electricity? _____.

u Is the property subject to a program of restrictions on the income of residents or resale of units? _____.

If yes, name of program: _______________________________________________ and scheduled year of expiration of restrictions: __________.

u Are there any unsold units _____. If yes, Part 4 must be completed.

4. INFORMATION OBTAINED FROM SPONSOR OR OTHER HOLDER OF UNSOLD UNITS

NUMBER OCCUPIED UNSOLD UNITS

NUMBER OCCUPIED UNSOLD UNITS

NUMBER OF VACANT UNSOLD UNITS

TOTAL NUMBER OF UNSOLD UNITS

REGULATED:

UNREGULATED:

MONTHLY RENT UNSOLD UNITS (REG)

MONTHLY RENT UNSOLD UNITS (UNREG)

TOTAL MONTHLY RENT PAYABLE (INCL VAC)

NUMBER OF UNSOLD (COOP) SHARES

$

$

$

SPECIFY SOURCE AND MONTH OF INFORMATION

u Does the sponsor retain control of the board? _____

5. NONRESIDENTIAL USES

Complete this section if the property has nonresidential space, such as professional offices, stores or a garage which is open to nonresidents. For

cooperatives describe the entire property. For condominiums describe space in a common element or units owned by the association.

u Does the property have any such nonresidential space?____ If yes, answer the following. For questions answered "yes" provide details on the back

page.

Are cooperative shares allocated to professional offices or other nonresidential units?

_____

Is any of the space leased (other than proprietary leases)?

_____

Is there a master lease for the commercial space?

_____

Is space leased to the sponsor or a related person?

_____

Was any of the commercial space vacant during the reporting year?

_____

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2