Schedule P - Partial Year Resident Pro-Ration Worksheet - Capital Tax Collection Bureau - 2003

ADVERTISEMENT

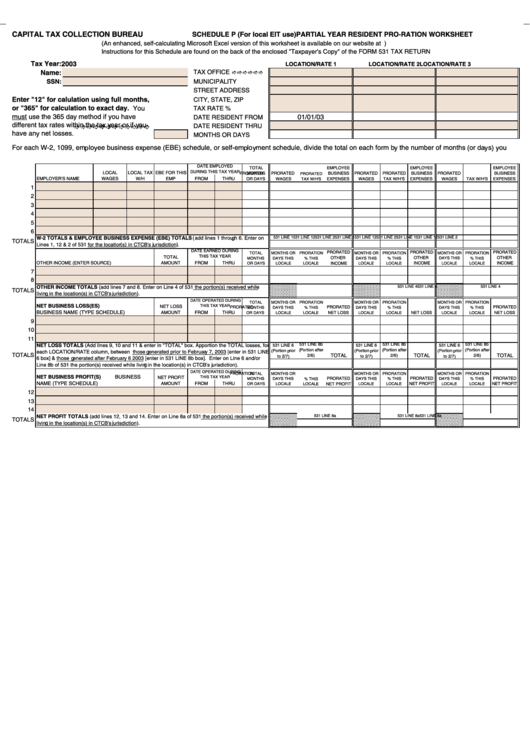

CAPITAL TAX COLLECTION BUREAU

SCHEDULE P (For local EIT use)

PARTIAL YEAR RESIDENT PRO-RATION WORKSHEET

(An enhanced, self-calculating Microsoft Excel version of this worksheet is available on our website at )

Instructions for this Schedule are found on the back of the enclosed "Taxpayer's Copy" of the FORM 531 TAX RETURN

Tax Year: 2003

LOCATION/RATE 1

LOCATION/RATE 2

LOCATION/RATE 3

((((((

Name:

TAX OFFICE

SSN:

MUNICIPALITY

STREET ADDRESS

Enter "12" for calulation using full months,

CITY, STATE, ZIP

or "365" for calculation to exact day. You

TAX RATE %

must use the 365 day method if you have

01/01/03

DATE RESIDENT FROM

((((((((((((

((((((((((((

different tax rates within the tax year or if you

DATE RESIDENT THRU

have any net losses.

MONTHS OR DAYS

For each W-2, 1099, employee business expense (EBE) schedule, or self-employment schedule, divide the total on each form by the number of months (or days) you

DATE EMPLOYED

TOTAL

EMPLOYEE

EMPLOYEE

EMPLOYEE

DURING THIS TAX YEAR

LOCAL

LOCAL TAX

EBE FOR THIS

MONTHS

PRORATED

BUSINESS

PRORATED

PRORATED

BUSINESS

PRORATED

PRORATED

BUSINESS

PRORATED

EMPLOYER'S NAME

WAGES

W/H

EMP

FROM

THRU

OR DAYS

WAGES

TAX W/H'S

EXPENSES

WAGES

TAX W/H'S

EXPENSES

WAGES

TAX W/H'S

EXPENSES

1

2

3

4

5

6

531 LINE 1

531 LINE 12

531 LINE 2

531 LINE 1

531 LINE 12

531 LINE 2

531 LINE 1

531 LINE 12

531 LINE 2

W-2 TOTALS & EMPLOYEE BUSINESS EXPENSE (EBE) TOTALS (add lines 1 through 6. Enter on

TOTALS

Lines 1, 12 & 2 of 531 for the location(s) in CTCB's jurisdiction).

DATE EARNED DURING

PRORATED

PRORATED

PRORATED

TOTAL

MONTHS OR

PRORATION

MONTHS OR

PRORATION

MONTHS OR

PRORATION

THIS TAX YEAR

TOTAL

OTHER

OTHER

OTHER

MONTHS

DAYS THIS

% THIS

DAYS THIS

% THIS

DAYS THIS

% THIS

OTHER INCOME (ENTER SOURCE)

AMOUNT

FROM

THRU

INCOME

INCOME

INCOME

OR DAYS

LOCALE

LOCALE

LOCALE

LOCALE

LOCALE

LOCALE

7

8

531 LINE 4

531 LINE 4

531 LINE 4

OTHER INCOME TOTALS (add lines 7 and 8. Enter on Line 4 of 531 the portion(s) received while

TOTALS

living in the location(s) in CTCB's jurisdiction).

DATE OPERATED DURING

TOTAL

MONTHS OR

PRORATION

MONTHS OR

PRORATION

MONTHS OR

PRORATION

NET BUSINESS LOSS(ES)

THIS TAX YEAR

NET LOSS

PRORATED

PRORATED

PRORATED

MONTHS

DAYS THIS

% THIS

DAYS THIS

% THIS

DAYS THIS

% THIS

BUSINESS NAME (TYPE SCHEDULE)

AMOUNT

FROM

THRU

NET LOSS

NET LOSS

NET LOSS

OR DAYS

LOCALE

LOCALE

LOCALE

LOCALE

LOCALE

LOCALE

9

10

11

531 LINE 8b

531 LINE 8b

531 LINE 8b

NET LOSS TOTALS (Add lines 9, 10 and 11 & enter in "TOTAL" box. Apportion the TOTAL losses, for

531 LINE 6

531 LINE 6

531 LINE 6

(Portion after

(Portion after

(Portion after

(Portion prior

(Portion prior

(Portion prior

each LOCATION/RATE column, between those generated prior to February 7, 2003 [enter in 531 LINE

TOTALS

2/6)

TOTAL

2/6)

TOTAL

2/6)

TOTAL

to 2/7)

to 2/7)

to 2/7)

6 box] & those generated after February 6 2003 [enter in 531 LINE 8b box]. Enter on Line 6 and/or

Line 8b of 531 the portion(s) received while living in the location(s) in CTCB's jurisdiction).

DATE OPERATED DURING

TOTAL

MONTHS OR

MONTHS OR

PRORATION

MONTHS OR

PRORATION

PRORATION

NET BUSINESS PROFIT(S)

BUSINESS

THIS TAX YEAR

NET PROFIT

PRORATED

PRORATED

PRORATED

MONTHS

DAYS THIS

% THIS

DAYS THIS

% THIS

DAYS THIS

% THIS

NAME (TYPE SCHEDULE)

AMOUNT

FROM

THRU

OR DAYS

LOCALE

LOCALE

NET PROFIT

LOCALE

LOCALE

NET PROFIT

LOCALE

LOCALE

NET PROFIT

12

13

14

531 LINE 8a

531 LINE 8a

531 LINE 8a

NET PROFIT TOTALS (add lines 12, 13 and 14. Enter on Line 8a of 531 the portion(s) received while

TOTALS

living in the location(s) in CTCB's jurisdiction).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1